Electric Bus Market Share from January to April This Year: Chinese Companies Hold 43%

Chinese Market Share Maintained Despite Subsidy Reforms

Small Price Difference Between Domestic and Chinese Models

Chinese Market Share Expected to Continue Rising

Four out of ten electric buses sold domestically this year were of Chinese origin. Although the government changed its subsidy policy this year to favor domestic manufacturers, Chinese electric buses still maintained an overwhelming market share.

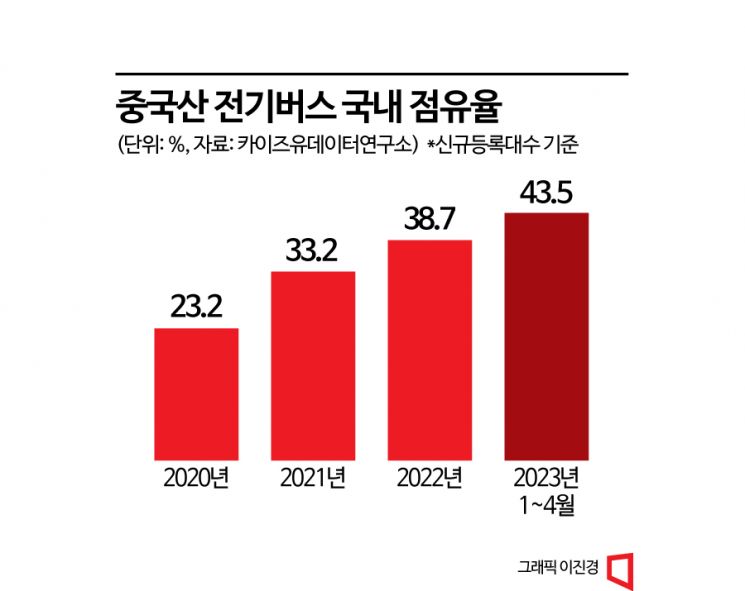

According to data commissioned by this publication from Kaizyu on the 31st, 43.5% of newly registered large electric buses in Korea from January to April this year were Chinese-made. Out of a total of 451 registered units, 196 were Chinese. The market share of Chinese electric buses in Korea has steadily increased from 23.2% in 2020 to 33.2% in 2021, 38.7% in 2022, and 43.5% in the first four months of this year.

The government changed its policy this year to provide higher subsidies for electric buses equipped with batteries that have higher energy density. Chinese electric buses mainly use lithium iron phosphate (LFP) batteries, which have lower energy density but are cheaper. As a result, subsidies for Chinese electric buses equipped with LFP batteries were reduced by about 30 to 40 million KRW compared to last year. However, despite this policy revision, the trend of increasing market share for Chinese electric buses has not been reversed.

There are three main reasons for this. First, Chinese electric buses equipped with batteries that meet domestic policy standards receive government subsidies similar to those for domestic buses. This means that some models among various Chinese electric buses maintain their price competitiveness. Additionally, Hyundai Motor raised the price of its electric buses this year, narrowing the actual purchase price gap that had widened due to the government subsidy policy. While subsidies for Chinese electric buses with LFP batteries were reduced by about 30 to 40 million KRW, Hyundai also increased the price of its Elec City electric bus by 25 million KRW.

Second, vehicles contracted last year were delivered late in the first quarter of this year. Some Chinese electric bus importers faced liquidity crises, causing delays in vehicle deliveries. As a result, Chinese electric buses subject to last year's subsidy policy were still imported domestically through the first quarter of this year.

Lastly, it is also evaluated that the legal administration of Edison Motors, which accounted for a significant portion of the domestic electric bus market share, had an impact. Edison Motors held a 20% share of the domestic electric bus market as of the first half of last year. The company has halted operations amid aggressive business acquisitions and stock manipulation scandals. As the market share of major domestic companies declined, the relative share of Chinese companies increased.

Industry insiders expect the market share of Chinese companies in the domestic electric bus market to continue rising. Chinese companies are expected to respond to changes in domestic subsidy policies by launching electric buses equipped with ternary batteries. It is reported that many companies are preparing certification work aiming for sales in the second half of this year.

It is also pointed out that the limited production capacity of Hyundai Motor's Jeonju plant for electric buses is an obstacle to expanding domestic market share. The Hyundai Motor Jeonju plant, which handles most domestic electric bus production, switched to a two-shift bus production line in March this year to cope with the surge in orders. However, the plant's production capacity for electric buses is about 1,500 units annually, far below the government's target of 3,000 electric vans for this year. Ultimately, the remaining supply target must be filled with Chinese-made buses.

A representative of a Chinese electric bus importer said, "Unless Hyundai Motor increases production capacity or Edison Motors fully recovers, the market share of Chinese companies will continue to rise." He also pointed out, "If Chinese companies use ternary batteries, which have higher costs, the actual purchase price of electric buses will inevitably increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)