Monthly Increasing Average Daily Personal Trading Volume Shows First Decline This Month

Tenfold Difference in One-Month Net Personal Buying Before and After Crash Crisis

Since the beginning of this month, the average daily trading value in the domestic stock market has dropped by more than 30%. In particular, the decline in trading value among individual investors was relatively large. This is attributed to the fact that May is typically considered a seasonal low period for the stock market each year, and the investment sentiment of retail investors sharply froze following the crash caused by the stock price manipulation by Ra Deok-yeon and his group in late last month.

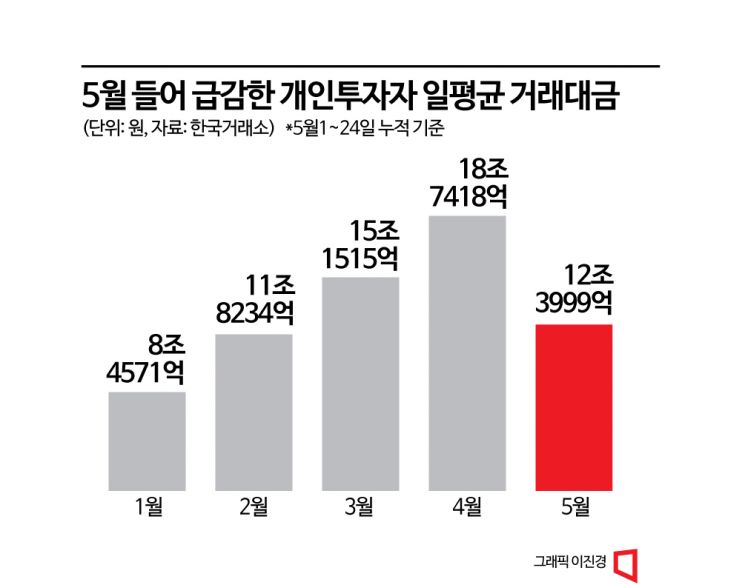

According to the Korea Exchange Information Data System on the 25th, the average daily trading value of individual investors this month was 12.3999 trillion KRW (based on May 1?24, total for KOSPI and KOSDAQ), which is about 34% less than last month. Since the beginning of this year, the average daily trading value of individual investors had steadily increased from 8.4571 trillion KRW in January → 11.8234 trillion KRW in February → 15.1515 trillion KRW in March → 18.7418 trillion KRW in April, but this month saw the first significant decline.

Especially when looking at net buying volume, individual investors who had maintained net buying for three consecutive months from February sold off 3.4364 trillion KRW worth of stocks (accumulated from May 1?24) this month. Notably, during the price manipulation process by Ra Deok-yeon’s group, eight stocks including Samchully and Seoul City Gas hit the lower limit price for three consecutive days, triggering the crash on the 24th of last month. Examining the net buying volume for the one month (20 trading days) before and after this date reveals a more distinct trend change. In the month before May 21, individual investors net bought 229.6 billion KRW, but in the month after the crash, they net sold 2.225 trillion KRW, which is about ten times the previous net buying volume.

The total trading value combining individual, institutional, and foreign investors also sharply decreased this month. The average daily trading value of the entire domestic stock market in May was 17.738 trillion KRW, about 33% less than last month’s 26.4099 trillion KRW. The decrease was largest among individual investors at 34%, followed by institutions at -32%, and foreigners at -29%. Despite the overall contraction in trading, foreign investors concentrated their purchases on semiconductor stocks such as Samsung Electronics and SK Hynix. This is interpreted as a reason why the index volatility was relatively low.

With the KOSPI unable to surpass the 2600 mark and remaining in a box range for some time, it is pointed out that recovering the trading value is crucial for market revitalization. Choi Yoo-jun, a researcher at Shinhan Investment Corp., said, "There are about 15 points left to reach the previous KOSPI high," adding, "Generally, breaking through the previous high is accompanied by an increase in trading volume (value)." He continued, "Although the KOSPI has been rising recently, mainly driven by semiconductor stocks, the buying value of foreign investors has decreased to the level of late March, and that of individual investors to the level of February," adding, "If the trading value increases, it will enhance the credibility of breaking through the previous high."

However, despite the recent decline in trading value, the securities industry offers a positive outlook that a 'bull market' will unfold in the second half of the year. Lee Jin-woo, a researcher at Meritz Securities, said, "Although macro variables such as interest rate hikes still pose noise, the possibility of them turning into disruptive risks is low," adding, "As AI technologies like ChatGPT accelerate development, industrial changes such as earnings turnarounds in sectors like semiconductors, IT software, and servers are expected to come faster than anticipated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)