An investment advisory firm established in 2013 specializing in cultural content and pre-IPO investments

Invested in films such as "Parasite," "Hero," and "The Spy"... Also involved with Yanadoo, Kakao Games, and Bithumb

Mr. A stepped down as CEO in March 2021

"I have heard the name of the investment firm, but I have never met them. Even within the cultural content investment industry, it is not a well-known place to the extent that people ask each other about it."

A veteran cultural content investment reviewer said that C Investment Advisory is known only by name in the industry, and not many people know its true nature. Other reviewers showed similar reactions. C Investment Advisory was a veiled player that people knew of but did not really understand.

The venture capital (VC) industry is paying attention to C Investment Advisory. The former CEO of C Investment Advisory, Mr. A, is suspected of embezzling large sums of investment funds from entrepreneurs and others through a real estate-related company, P, while claiming to invest in unlisted companies. The Seoul Metropolitan Police Agency's Financial Crime Investigation Unit is investigating Mr. A, who is suspected of deliberately embezzling tens of millions to over 10 billion KRW from investors. The current estimated damage is about 100 billion KRW.

C Investment Advisory is an investment advisory firm established in 2013. It is based in Yeouido, Seoul, and operates investment businesses. According to the corporate registry, its business purposes include ▲financial investment advisory services under the Capital Markets and Financial Investment Business Act ▲financial businesses permitted under other financial-related laws besides the Capital Markets Act ▲ancillary businesses allowed for financial investment firms under the Capital Markets Act, among other general descriptions.

Seeking New Paths in Unlisted Investments Without Passing Through the 'Investment Advisory → Asset Management' Course

C Investment Advisory's business areas are broadly divided into corporate finance investment, fundraising advisory, mergers and acquisitions investment and brokerage, pre-IPO investment, and cultural content investment. It is evaluated that unlike many investment advisory firms that secured asset management licenses after proving their capabilities, C Investment Advisory took a different path.

Mr. A, who was the CEO of C Investment Advisory, stepped down from the position in March 2021. Subsequently, CEO B and Executive Director D have been managing the company together. Both CEO B and Executive Director D joined C Investment Advisory in 2016 and have recently taken over company management. Both were born in February 1979. It appears as if twin brothers are leading the company.

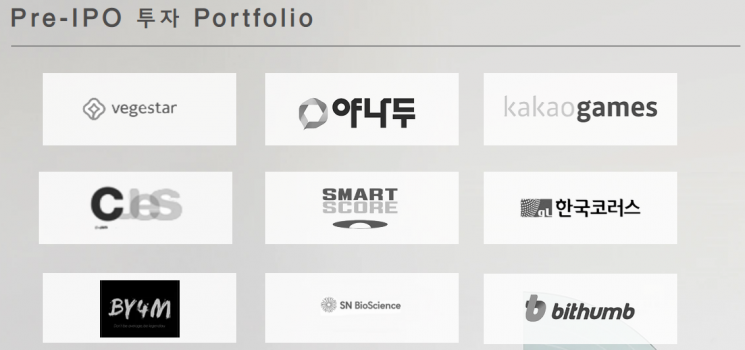

C Investment Advisory has focused heavily on investing in cultural content such as films. It has invested in movies including "Parasite," "Hero," "The Spy Gone North," "Exit," "Svaha: The Sixth Finger," and "Decision to Leave," as well as exhibitions like the "Pulitzer Prize Photo Exhibition" and "You, My Muse." In addition, it has concurrently engaged in pre-IPO equity investments. Representative investments include the education startup "Yanadoo," game company "Kakao Games," cryptocurrency exchange "Bithumb," and golf startup "SmartScore." It has also invested in bio companies such as J-BioLogics and BioBetter.

A bio investor said, "I have participated in deals alongside C Investment Advisory," adding, "There were more decent deals than expected, and CEO B is a well-regarded figure." He further stated, "You have to separate Mr. A from C Investment Advisory."

Joint Fund Operation with Hoban-affiliated VC... Active Formation of Project Funds

Even during Mr. A's tenure as CEO, C Investment Advisory achieved meaningful results through various investments. Mr. A built trust with investors during this process and, two years ago, began actively raising investment funds using company E, which he acquired. It is reported that wealthy individuals in Hannam-dong, Seoul, were the main targets. According to the investigation, Mr. A's address was confirmed to be Hannam The Hill, a luxury residence in Hannam-dong. It appears he raised funds through acquaintances nearby.

C Investment Advisory also partnered with venture capital firms. In April 2020, it established the "OO Cornerstone Unicorn Investment Association No. 1 (total commitment of 1.8 billion KRW)" as a Co-GP with Cornerstone Investment Partners, a VC affiliated with Hoban Group. At that time, C Investment Advisory expanded its business from the successful exit of Syntekabio to a new technology business investment association. This fund invested in Natural Way and Adrock Advertisement.

An industry insider said, "C Investment Advisory has consistently formed project funds and conducted investment activities," adding, "This was possible because there were always 'money providers' appearing." However, the insider also noted, "Those who have created and operated funds mainly with personal capital are essentially sitting on a bed of nails," and "There have been continuous complaint calls from individuals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)