Continuous Net Selling for 9 Trading Days in KOSDAQ This Month...Longest Record in 11 Years

KOSPI Net Buying of 1.2563 Trillion KRW...Focused Buying on Semiconductor, Automobile, and IT Stocks

The long-standing stock market adage ‘Sell in May’ is becoming a reality in the KOSDAQ market. This is due to foreign investors beginning to exit the KOSDAQ, which had outperformed the KOSPI so far this year. It appears that foreign investors’ sentiment is shifting away from secondary batteries toward large-cap stocks on the KOSPI.

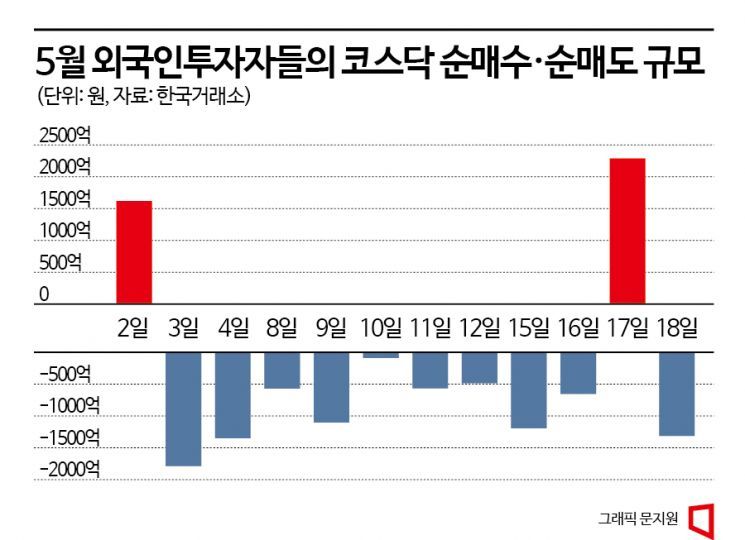

According to the Korea Exchange, foreign investors have taken net selling positions in the KOSDAQ for 11 trading days this month, except for the first trading day on the 2nd and the 17th. From the 3rd to the 16th, they showed continuous net selling for 9 trading days. This is the longest streak in about 11 years since the 9 consecutive net selling days from June 27 to July 9, 2012. The net selling amount by foreigners in the KOSDAQ market this month has reached 528.4 billion KRW.

Looking at the top 10 stocks that foreigners net sold (KOSPI + KOSDAQ) this month, secondary battery and financial stocks dominated. The most sold stock was undoubtedly Ecopro, with 380.1 billion KRW sold just this month. Next were POSCO Holdings (176.2 billion KRW) and Ecopro BM (134.9 billion KRW). Other stocks in the top 10 included Shinhan Financial Group (104.6 billion KRW), Meritz Financial Group (76.9 billion KRW), and LG Energy Solution (66.0 billion KRW). Most of the top net sold stocks by foreigners were bought by individual investors.

In contrast, foreigners net bought over 1 trillion KRW in the KOSPI during the same period. It seems that investment sentiment has shifted mainly to large-cap stocks on the KOSPI. From the 2nd to the 18th, over 13 trading days, foreigners net bought 1.2563 trillion KRW in the KOSPI. Among the top 10 net bought stocks by foreigners during this period, except for YG Entertainment (98.8 billion KRW) and JYP Ent. (59.4 billion KRW), the remaining eight were all large-cap stocks on the KOSPI.

The stock most bought by foreigners was undoubtedly Samsung Electronics. Foreigners net bought 767 billion KRW worth of Samsung Electronics just this month. Next was SK Hynix, with 333.3 billion KRW purchased. The expectation of a bottom in the semiconductor sector is believed to have improved investor sentiment. Yeom Dong-chan, a researcher at Korea Investment & Securities, analyzed, “Although both Samsung Electronics and SK Hynix’s operating profits in Q1 fell short of expectations, the anticipation of having passed the bottom in earnings has actually strengthened.” Kim Dong-won, a researcher at KB Securities, also forecasted, “From the second half of the year, the semiconductor sector will show excess returns compared to the market due to improved supply and demand, easing price declines, and inventory reduction. As the second half progresses, Samsung Electronics’ earnings improvement is expected to accelerate, raising the stock’s low points toward the end of the year.”

Other top net bought stocks by foreigners included NAVER (231.2 billion KRW), Hyundai Motor (206.2 billion KRW), Kia (143.0 billion KRW), and LG Electronics (99.9 billion KRW), indicating that foreigners mainly focused on large-cap KOSPI stocks in semiconductors, automobiles, and IT sectors.

Choi Yoo-jun, a researcher at Shinhan Investment Corp., analyzed, “With growing expectations that the global semiconductor industry has passed its bottom, foreigners have continued net buying for three consecutive trading days through the 18th. Next week, events such as the visit of Intel’s CEO to Korea and Microsoft’s developer conference, which will act as momentum for semiconductors, are scheduled. Additionally, undervaluation appeal is emerging mainly in auto parts stocks, attracting foreign capital inflows.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)