Steel, Oil Refining, and Defense Industries' 'Chimney Industries' Companies

'Hidden Card' Products Perform Amid Internal and External Shocks

War, volatile raw material prices, and economic recession. These have been the external shocks faced by the global industrial sector over the past year. Among the struggling companies, our manufacturing firms’ ‘hidden cards,’ which were prepared early on, are now shining.

POSCO suffered severe setbacks last year due to Typhoon Hinnamnor and consecutive global economic downturns, but it is achieving results in the battery and automotive parts sectors. Originally used for food and beverage containers such as tuna cans and powdered milk cans, BP (tinplate) has recently been reborn as an electric vehicle battery case, with sales steadily increasing.

BP is a thin steel sheet made of low-carbon steel, 0.14 to 0.6 mm thick, that can be plated with tin, chromium, nickel, and other metals. When tin is plated on BP, it becomes the material commonly used for tuna cans. Heat-resistant tinplate is now plated with nickel and used for electric vehicle battery cases. When a battery catches fire, the internal temperature rises to 600 degrees Celsius. Nickel-plated BP withstands intense heat and is also resistant to cracks caused by external shocks. It is a steel material suitable for reducing the risk of battery fires. POSCO has been developing its technology since it first produced BP in 1977. It is manufactured at the Pohang Steelworks. An industry insider said, "With the rapid increase in electric vehicle and battery production, BP supply is tight."

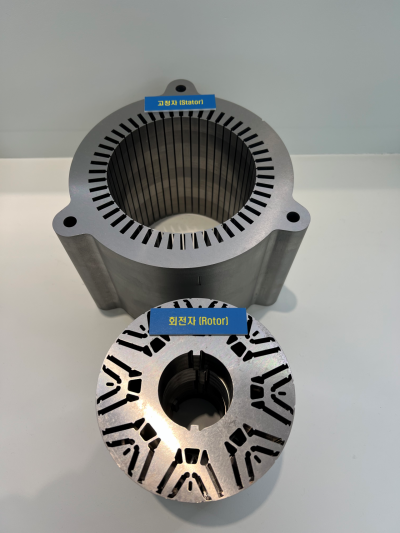

Since last year, POSCO has been investing 1 trillion won to build a new electric steel sheet factory for electric vehicle motors with an annual capacity of 300,000 tons. Electrical steel sheets are steel products used in devices that apply electricity and magnetism. In particular, POSCO’s non-oriented electrical steel sheets are used for the stator and rotor cores of electric vehicle drive motors, improving motor efficiency. This increases driving range and reduces power loss. POSCO currently has an annual production capacity of 100,000 tons of non-oriented electrical steel sheets for drive motors but plans to increase production to 400,000 tons by 2025 through facility investments.

Even amid the Russia-Ukraine war, the resilience of our manufacturing industry has been revealed. As the war prolongs, a global shortage of ammunition and shells has emerged, keeping Poongsan, the only domestic ammunition and shell manufacturer, busy. Poongsan recorded sales of 771.1 billion won and operating profit of 59 billion won in the first quarter of this year. Compared to the same period last year, sales increased by 0.4% and operating profit by 19.5%. The securities industry expects Poongsan to achieve record-high performance this year. It is analyzed that Poongsan is filling the gap created by the massive supply of ammunition and shells to Ukraine by the U.S. and the EU. The Ukrainian military fires 6,000 to 8,000 shells daily in the war against Russia, far exceeding the U.S. monthly shell production of 14,000.

As oil prices have stabilized and fallen, refining margins have sharply declined, making the lubricants business a ‘pillar’ for refiners. Although rising oil prices may seem like a burden on refiners due to increased raw material costs, in fact, price increases are beneficial. Refiners import crude oil, refine it, and sell it as gasoline, diesel, etc., so the value of crude oil they purchased in advance rises, increasing profits. When oil prices fall, the opposite effect occurs, becoming a negative factor.

Last year, when Russia’s invasion of Ukraine destabilized liquefied natural gas (LNG) supply, diesel demand increased as a substitute. As diesel prices rose, refiners reduced lubricant production, which uses the same production facilities as diesel, to increase diesel supply. Lubricants thus became scarcer. As supply shortages accumulated, prices rose.

SK Innovation recorded an operating profit of 259.2 billion won from its robust lubricants business in the first quarter of this year, turning a profit compared to the previous quarter. The refining industry is recently developing eco-friendly lubricants that reduce carbon emissions by recycling waste lubricants and lubricants for electric vehicles to keep pace with changes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)