Kiwoom Securities Records Q1 Net Profit of 292.4 Billion KRW, Earnings Surprise

Stock Price Declines Amid CFD Loss Concerns...Foreigners Focused on Buying NH, Kiwoom, Samsung, and Others

The securities industry is unable to smile despite recording an earnings surprise in the first quarter. This is due to encountering an unexpected obstacle called Contract for Difference (CFD) during the crash triggered by Soci?t? G?n?rale (SG) Securities. While pessimism is spreading that the 'surprise earnings' in the securities sector will end with the first quarter due to concerns over CFD losses, foreign investors are sending love calls to securities stocks, drawing significant attention.

According to the Financial Supervisory Service's electronic disclosure system (DART) on the 12th, most securities firms that announced their first-quarter earnings this year recorded earnings surprises exceeding market expectations. Among the major securities firms that have disclosed their first-quarter results so far, Kiwoom Securities stands out with the largest net profit of 292.4 billion KRW. Following are Korea Investment & Securities (262.1 billion KRW), Mirae Asset Securities (252.6 billion KRW), NH Investment & Securities (184.1 billion KRW), KB Securities (140.6 billion KRW), Shinhan Investment Corp. (119.4 billion KRW), and Hana Securities (83.4 billion KRW). The securities industry’s performance had deteriorated last year due to concerns over the Legoland-related real estate project financing (PF) defaults and sluggish stock markets, but most rebounded successfully in the first quarter of this year.

The earnings surprise in the securities industry is due to a significant increase in brokerage revenue amid a booming stock market, including the KOSPI breaking through the 2,500-point mark and the KOSDAQ surpassing 800 points this year. In fact, the average daily trading volume in April was 26.4 trillion KRW, up 21.8% from the previous month. This is the highest level since August 2021. The proportion of individual trading in April also rose continuously to 71.2% this year. The size of customer deposits, which gauges the investment enthusiasm in the stock market, reached 53.4 trillion KRW, marking the highest level in about eight months since September last year. Seunggeon Kang, a researcher at KB Securities, analyzed, “The individual stock market centered on KOSDAQ that appeared from February extended to KOSPI, significantly improving brokerage revenue.”

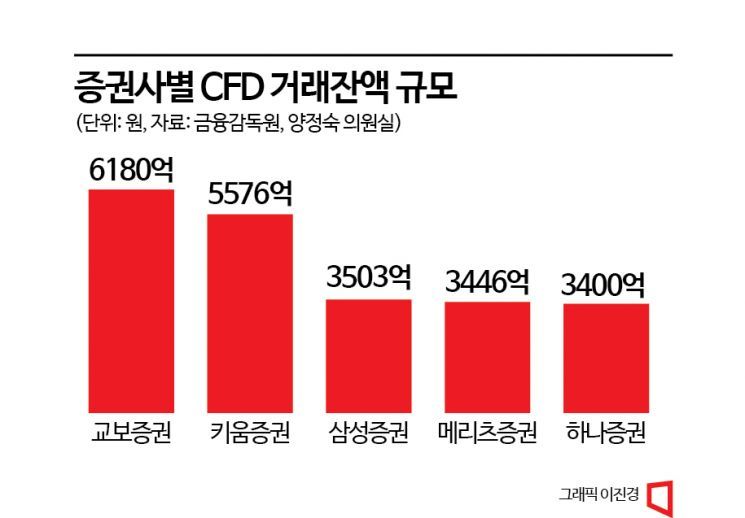

However, pessimism is spreading that the securities sector’s surprise earnings will end with the first quarter. This is due to the possibility of large-scale unpaid receivables arising from the CFD incident, which is considered the epicenter of the recent SG-triggered stock price crash. According to data submitted by the Financial Supervisory Service to the office of National Assembly member Yang Jeongsuk of the Political Affairs Committee, as of the end of March, the outstanding CFD trading balance of 13 domestic securities firms was 2.7697 trillion KRW. Among them, Kyobo Securities had the largest amount at 613.1 billion KRW, followed by Kiwoom Securities at 557.6 billion KRW. Accordingly, the stock prices of Kyobo Securities and Kiwoom Securities fell by 2.91% and 10.89%, respectively, after the SG-triggered stock price crash incident (April 24 to May 11).

In particular, the securities industry is lowering target prices for Kiwoom Securities despite its surprise earnings. This is based on the forecast that second-quarter earnings will be sluggish due to concerns over CFD-related losses. Shinhan Investment Corp. lowered Kiwoom Securities’ target price from 135,000 KRW to 120,000 KRW, and Samsung Securities lowered it from 137,000 KRW to 125,000 KRW. Heeyeon Lim, a researcher at Shinhan Investment Corp., said, “Kiwoom Securities recorded an earnings surprise far exceeding market consensus, but provisioning for unpaid receivables is inevitable with their increase,” adding, “There is also a high possibility that CFD-related profits and losses will shrink due to the suspension of new CFD subscriptions and the Financial Services Commission’s CFD system improvements.”

Meanwhile, foreign investors appear to be buying securities stocks despite the CFD headwinds. Foreign investors have been net buyers of NH Investment & Securities for 20 consecutive days from April 10 to May 9, purchasing a total of 18.5 billion KRW worth of shares during this period. Additionally, they have been net buyers of Samsung Securities and Kiwoom Securities for 17 consecutive days from April 12 to May 9. The amounts purchased by foreign investors during this period were 59.6 billion KRW and 45 billion KRW for Samsung Securities and Kiwoom Securities, respectively.

The reason foreign investors are sending love calls to securities stocks is interpreted as the expectation that the loss scale from the CFD incident will not be as large as anticipated and the creation of a business environment favorable to securities firms. According to financial information provider FnGuide, the combined operating profit forecast for the second quarter of this year for the five major securities firms (NH, Korea Investment & Securities, Samsung, Mirae Asset, and Kiwoom) was revised upward by 24% from a month ago to 1.0513 trillion KRW. Although CFD losses have not yet been reflected, it is analyzed that there is no factor that would shake the overall fundamentals. Taejun Jeong, a researcher at Yuanta Securities, analyzed, “The strong performance of the securities industry is expected to continue for a considerable period,” adding, “If interest rates decline, deposits increase, and monetary policy responds favorably, mid- to long-term recovery in trading and brokerage could also follow.”

※This SG Securities-triggered stock price crash incident has sounded an alarm for the capital market order. Readers’ reports will be a great help in uncovering the truth. We welcome any reports regarding investment damage cases, suspicions of stock price manipulation and asset concealment by the Radukyeon group, insider details related to the mass sale by major shareholders of Dow Data and Seoul Gas, or any other information (jebo1@asiae.co.kr). Asia Economy will do its best to establish a transparent capital market order.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)