35% Increase in Number of Stores at 3 Major Convenience Store Chains Over 5 Years

Store Sales Per Location Rise by Only 0.9%

"Franchise Headquarters Must Comply with Voluntary Regulations"

Park (43), who operates a franchise convenience store in Dongjak-gu, Seoul, has been discussing closing the store with his wife since the beginning of this year. Fixed expenses have significantly increased due to rising labor costs and electricity bills, and at the end of last year, a new store opened nearby, which took away many customers. After paying about 40 percent of the gross monthly sales profit to the headquarters and spending around 7 to 8 million won on labor costs, rent, and electricity bills, Park is left with just about 2 million won. Park said, "Since last year, my wife and I have been working together to reduce labor costs, but we are barely breaking even. Considering the hours I worked, I basically earned just the minimum wage," adding, "Recently, my wife's health has deteriorated, so we are seriously considering closing the store."

Although the domestic convenience store industry has achieved significant external growth over the past five years, earning the nickname 'Convenience Store Kingdom,' the reality for store owners has not improved. While fixed expenses such as labor costs and electricity bills have increased due to inflation, sales per store have actually decreased due to indiscriminate store openings.

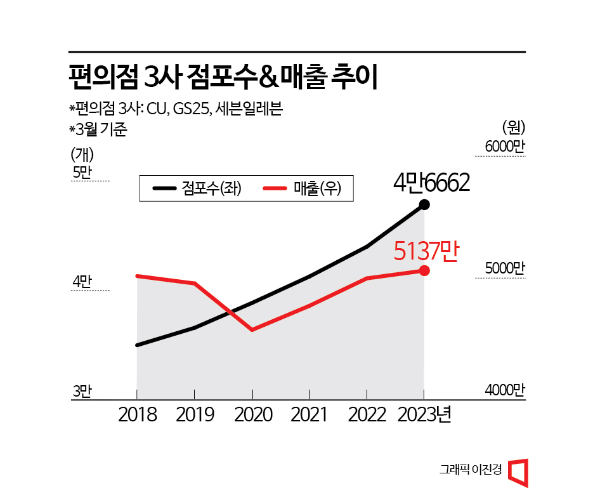

According to the 'Major Retailers Sales Status' released by the Ministry of Trade, Industry and Energy on the 11th, the number of major convenience stores (CU, GS25, 7-Eleven) in Korea was counted at 46,662 in March this year. This is an increase of nearly 35% compared to 34,664 stores five years ago in 2018. However, sales per store only saw a slight increase.

The average sales per store in March were 51.37 million won, which is about 0.9% higher than 50.89 million won in 2018. Considering inflation rates, while the headquarters have experienced a record boom recently, the situation for store owners has actually worsened.

Convenience store franchise owners point to 'overcrowded store openings' as the cause of this phenomenon. They argue that with new stores popping up every block, it inevitably deals a severe blow to their sales. Currently, convenience store openings must maintain a minimum distance of 50 meters according to the voluntary regulations of the Korea Convenience Store Industry Association, which includes six companies such as CU, GS25, 7-Eleven, and Emart24. However, since these regulations lack legal binding power, there are no practical penalties for violations, and the method of measuring distance is ambiguous, rendering the rules ineffective. Accordingly, franchise owners are calling for the minimum distance between stores to be increased from 50 meters to 100 meters. Three years ago, Gyeonggi-do recommended revising ordinances to increase the distance to 100 meters to prevent overheated competition and sent this recommendation to various cities and counties, but it failed due to low participation.

Experts point out that at least the currently applied voluntary regulations should be strictly enforced by the franchisors. Attorney Jinwook Lee of Palma Law Firm said, "We understand the difficulties franchise owners face due to overcrowded convenience store openings, but legally regulating the distance between stores is practically difficult," adding, "Instead of continuously strengthening regulations, it is important to encourage franchisors to strictly comply with the current voluntary regulations by giving incentives to exemplary franchisors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)