Focused on Memory Semiconductors, More Vulnerable to Economic Downturn

Expansion of Investment in System Semiconductors Needed

As memory semiconductor prices are expected to fall further in the second quarter compared to the first quarter this year, there is an assessment that our semiconductor market is approaching its bottom.

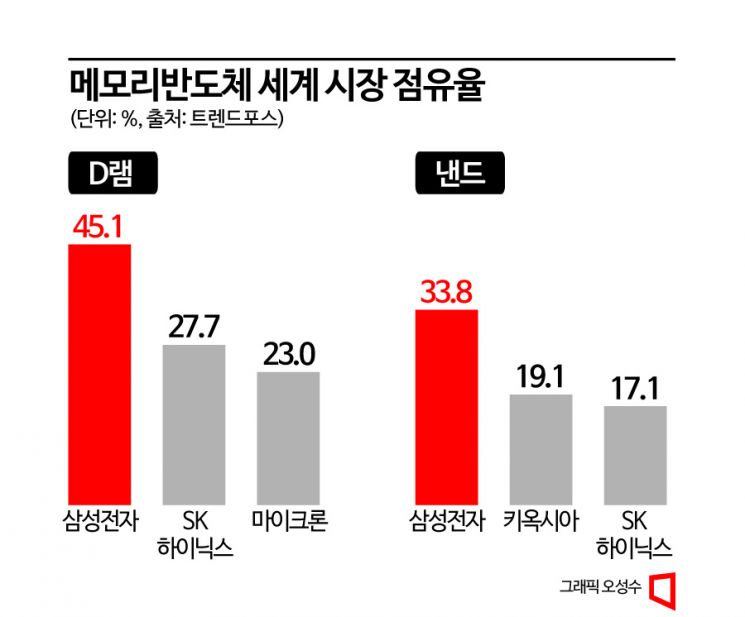

On the 10th, market research firm TrendForce announced that the average selling price (ASP) of DRAM in the second quarter could drop by up to 18% compared to the first quarter. Previously, the maximum decline was projected at 15%, but due to still high DRAM inventory, prices could fall as much as 18%. Although memory semiconductor companies have started production cuts, the effect has not been sufficient yet, leading to the judgment that supply still exceeds demand.

By product category, PC DRAM prices are expected to fall 15-20% from the previous quarter. Both the upper and lower bounds of the previously suggested decline of 10-15% have been lowered by 5 percentage points. Server DRAM is also expected to drop 15-20% in the second quarter, which is a steeper decline than the previous forecast of 13-18%. Mobile DRAM is also expected to see a decline of 13-18%, down further from the previously suggested 10-15%.

The NAND price decline in the second quarter is projected at 8-13%, lowered from the previous 5-10%. In particular, for enterprise SSDs, order volumes have not significantly increased even after China's reopening, resulting in considerable inventory pressure.

Memory prices have been on a downward trend since last year. Since the second half of last year, a chain reaction of ‘decreased IT demand → oversupply → increased inventory → semiconductor price decline → reduced corporate earnings’ has been occurring due to the prolonged industry downturn.

The market expects that the production cut effects by memory semiconductor companies will become more apparent in the second half of the year.

Especially with Samsung Electronics, the world's number one memory semiconductor company, joining the production reduction efforts, there is growing anticipation that the oversupply situation in memory semiconductors will soon be resolved. However, considering that it takes about three months from wafer input to memory chip production, the actual effects of production cuts will appear 3 to 6 months later. This means the production cut effects will only fully materialize in the second half of the year.

The Korea Development Institute (KDI), in its report titled ‘Recent Semiconductor Market Trends and Macroeconomic Impact,’ stated that considering the demand cycles for semiconductor-related products, the semiconductor market could hit its bottom within the second to third quarters.

Joram Cho, a research fellow at KDI’s Economic Outlook Office, analyzed, "The simultaneous decline in demand for computers and mobile devices, whose replacement cycles overlapped recently, has been a major factor in the sharp drop in the semiconductor market," adding, "Considering the replacement cycles, the recent semiconductor market is close to its bottom." Typically, the replacement cycle for computers is 4-5 years, and for mobile devices, 2-3 years. Considering that the recent low point in computer demand was in 2019 and mobile device demand rapidly increased from the third quarter of 2020, there is a possibility that the market will bottom out and rebound within this year.

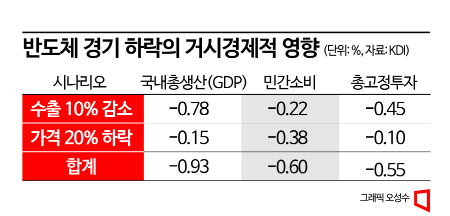

There is also a diagnosis that due to the semiconductor market downturn, the Gross Domestic Product (GDP) of South Korea is likely to shrink by 0.93%. This is based on the assumption that semiconductor export volume falls by 10% and prices by 20%. Even if only export volume decreases without a price drop, GDP is projected to decline by 0.78%. KDI advised that since South Korea is heavily dependent on memory semiconductors and thus more vulnerable to economic downturns, investment expansion in system semiconductors is necessary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)