Adoption of Closed-End Tax Imposed on Ex-Factory Price

Growing Calls for Volume-Based Tax Introduction

Concerns Over Soju Price Increase Hinder Progress

"The price range I knew was quite different, so I wondered if I had been overestimating the brand all this time."

After visiting Fukuoka, Japan for his first overseas trip since the COVID-19 pandemic, Hyunjin Kang was quite surprised while browsing local liquor specialty stores. This was because there was a significant price difference compared to the whiskies sold domestically. Kang said, "I knew that whiskey prices were relatively high in Korea, but when I actually looked at the price tags, it didn't feel good," adding, "I thought I should be more cautious and carefully consider the price when purchasing whiskey in the future."

Sandy Hislop, Valentine Master Blender, is introducing the 'Valentine 40-Year Masterclass Collection.'

Sandy Hislop, Valentine Master Blender, is introducing the 'Valentine 40-Year Masterclass Collection.'

As the demand for whiskey rapidly increases, with whiskey import volumes in the first quarter of this year reaching the highest level for any first quarter since related statistics began in 2000, voices calling for changes to the liquor tax system?cited as a cause of rising whiskey prices?are growing louder again.

On the 24th, Pernod Ricard Korea unveiled the new collection of 'Ballantine's,' the 'Ballantine's 40-Year Masterclass Collection.' Of the 108 bottles worldwide, six were brought into Korea, and the domestic selling price is expected to be set at around 20 million KRW. While the ultra-high price is natural given the product's rarity, it is relatively expensive compared to the global selling price known to be $11,000 USD (about 14.7 million KRW), even considering the recent high exchange rate.

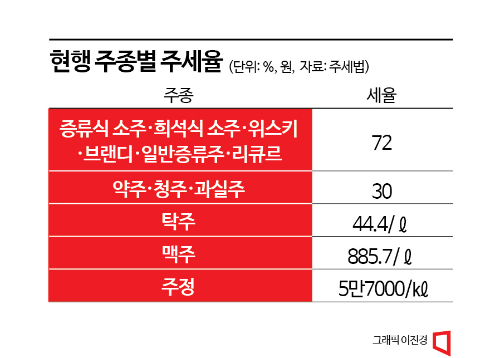

The reason why the domestic selling price is relatively high for the same whiskey is due to Korea's liquor tax law, which adopts an ad valorem tax system for distilled spirits such as whiskey and soju. The ad valorem tax imposes taxes based on the shipment price, meaning higher-priced alcohol is taxed more heavily. In particular, the tax rate for distilled spirits like whiskey is 72%, which is higher than that for light alcoholic beverages such as yakju, cheongju, and fruit wine (30%), making them more vulnerable to price increases.

Accordingly, applying the current tax system to a bottle of whiskey with a shipment price of 100,000 KRW results in a liquor tax of 72,000 KRW. On top of this, an education tax of 21,600 KRW (30% of the liquor tax) is added as an indirect tax, and a value-added tax of 10% (19,360 KRW) is also included, pushing the final price above 200,000 KRW. This means the consumer price more than doubles the tax base.

The tax system opposite to the ad valorem tax is the specific tax, which imposes taxes based on the volume of alcohol. Currently, among OECD member countries, all except five?including Korea?adopt the specific tax system. Domestically, since 2020, beer and takju have been taxed under the specific tax system, allowing annual adjustments according to inflation rates. The government accepted the industry's request to improve the structural problem where taxes rise as shipment prices increase due to the use of high-quality raw materials.

The current liquor tax system, which adopts the ad valorem tax, is also an obstacle to producing domestic whiskey. Considering the high tax rate and manufacturing costs, domestic production is not profitable. A representative example is Golden Blue, which promotes itself as K-Whiskey but imports raw whiskey from Scotland and bottles it in Australia despite having a whiskey production plant in Gijang, Busan. Recently, Kim Chang-su, CEO of 'Kim Chang-su Whiskey,' suggested to the 'K-Liqueur Export Support Council' that "to develop the domestic whiskey manufacturing industry, it is necessary to reduce the high liquor tax burden compared to imported whiskey or consider introducing a specific tax system suitable for our circumstances," and made this proposal to the National Tax Service.

Although calls for revising the liquor tax law are growing mainly within the whiskey industry, the industry believes that switching distilled spirits to a specific tax system will not be easy. This is due to concerns about price increases for diluted soju, which, along with whiskey, accounts for a significant portion of the domestic liquor market. If the tax system were changed to specific tax while whiskey and soju remain grouped as distilled spirits, whiskey prices would decrease, but soju prices could rise significantly. Separating soju from distilled spirits to create a separate tax system is also currently difficult. This is because in 1999, the World Trade Organization (WTO) judged Korea's liquor tax system?which applied a 35% tax rate on soju and 100% on whiskey?to be inconsistent with WTO agreements, leading to the current uniform 72% tax rate on distilled spirits.

Although the likelihood of including a revision of the distilled spirits tax system in next year's tax reform plan, to be announced in the second half of the year, is low, the industry insists that, just as specific tax was introduced for beer and takju, a gradual and serious review of switching other liquor categories to specific tax is necessary. An industry official said, "Different approaches are needed for each liquor category," adding, "Revising the liquor tax law could not only lower whiskey prices but also lead to the return of liquor factories that had moved overseas back to Korea, contributing to consumer welfare and job creation."

Professor Woochul Kim of the Taxation Department at the University of Seoul pointed out, "Now that whiskey and wine have become major consumer items, the time has passed when excessively high taxes were imposed," and said, "Introducing a specific tax system for soju and whiskey is an unavoidable task." He further explained, "Through a second reform of the specific tax system, it would be desirable for consumers and considering social costs such as health insurance that the excessively low price of soju is raised and the excessively high price of whiskey is lowered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.