Gasoline down 25%, Diesel down 37%

Proactive Response to China-Originated International Oil Price Surge

Concerns Over Public Burden Due to Oil Price Increase

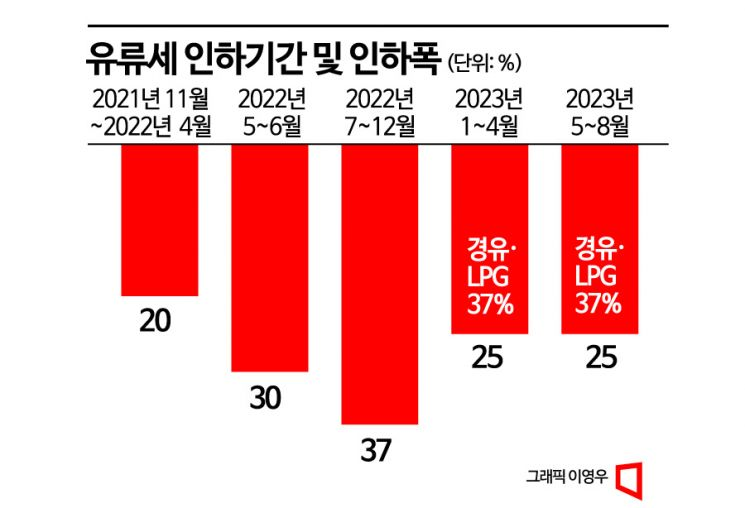

The government has extended the scheduled end date of the fuel tax reduction by four months, which was originally set for the end of next month. As a result, the current reduction rates of 25% for gasoline and 37% for diesel and LPG butane will be maintained until the end of August. Previously, the government had considered gradually normalizing the temporarily implemented fuel tax reduction measures, but decided on this extension to minimize the burden on the public amid rising prices.

According to the Ministry of Economy and Finance on the 18th, the government decided to extend the fuel tax reduction measures, which were set to end next month, by four months. The fuel tax reductions for gasoline and diesel will remain at the current rates of 25% and 37%, respectively. This measure is expected to lower prices by 205 KRW per liter for gasoline, 212 KRW for diesel, and 73 KRW for LPG butane compared to the pre-reduction tax rates. The government estimates that extending the fuel tax reduction for four months will reduce fuel costs by approximately 25,000 KRW per month for a passenger car with a fuel efficiency of 10 km per liter driving 40 km daily (based on gasoline).

Domestic gasoline prices at gas stations have fallen for five consecutive weeks due to the expanded reduction rate of the fuel tax and the decline in international oil prices. According to Opinet, the oil price information service of the Korea National Oil Corporation, the average retail price of gasoline nationwide in the first week of August was 1,881.9 KRW per liter, down 55.8 KRW from the previous week. This is the first time in five months since the second week of March that the average gasoline price has dropped to the 1,800 KRW per liter range. Photo by Mun Ho-nam munonam@

Domestic gasoline prices at gas stations have fallen for five consecutive weeks due to the expanded reduction rate of the fuel tax and the decline in international oil prices. According to Opinet, the oil price information service of the Korea National Oil Corporation, the average retail price of gasoline nationwide in the first week of August was 1,881.9 KRW per liter, down 55.8 KRW from the previous week. This is the first time in five months since the second week of March that the average gasoline price has dropped to the 1,800 KRW per liter range. Photo by Mun Ho-nam munonam@

Burden of Prolonged High International Oil Prices and Inflation

The background for the government’s decision to extend the fuel tax reduction is growing concern that the public’s burden could increase due to the recent sharp rise in international oil prices. According to the Korea National Oil Corporation’s oil price information system, Opinet, the retail price of gasoline in the second week of this month rose by 30.2 KRW from the previous week to 1,631.1 KRW per liter, increasing the burden. If the fuel tax reduction ends as scheduled at the end of this month, there are concerns that gasoline prices could surge above 1,800 KRW per liter. Experts and the government warn that if gasoline prices spike, the inflation rate, which has recently been suppressed in the 4% range, could again face upward pressure and rise to the 5% range.

This decision also reflects an intention to proactively respond to uncertainties in future international oil prices. There are forecasts that if China’s reopening (resumption of economic activities) effect is fully reflected, the rise in international oil prices could further accelerate. Recently, international oil prices surpassed $80 per barrel following news that the Organization of the Petroleum Exporting Countries (OPEC) and the OPEC Plus (+) group, which includes Russia and other major non-OPEC oil-producing countries, will begin production cuts starting in May. As of the 17th (local time), West Texas Intermediate (WTI) crude oil was trading in the $83 per barrel range, a 25.7% increase from mid-last month’s $66. Hwang Yuseon, a researcher at the International Finance Center, explained, “China is the world’s largest crude oil importer, and the strength of China’s crude oil demand recovery will serve as a gauge for the future direction and magnitude of international oil price increases.”

The government is expected to first focus on stabilizing prices by extending the fuel tax reduction measures, then gradually ease the reductions to create a buffer. The Ministry of Economy and Finance stated, “This measure prioritizes alleviating the burden on the low-income economy despite the recent difficult fiscal conditions. Considering that domestic fuel prices have continued to rise following OPEC+’s announcement of production cuts, it was decided after comprehensively taking into account the ongoing need to reduce the public’s fuel cost burden.”

Concerns Over Tax Revenue Decline Due to Extension of Fuel Tax Reduction

With the fuel tax reduction extended by three months, additional tax revenue losses are inevitable. Last year, transportation tax revenue amounted to 11.1164 trillion KRW as the fuel tax reduction rate increased from 20% in the first half to 37% in the second half. This was a 33% (5.482 trillion KRW) decrease compared to the previous year’s performance. Although this year the reduction rate for gasoline was scaled back to 25%, the 37% reduction rate for diesel and LPG remains, so tax revenue is expected to decline.

Overall tax revenue conditions are also expected to remain challenging. As of February, national tax revenue was 106.1 trillion KRW, which is 15.7 trillion KRW less than a year earlier. Even if the same amount as last year is collected from March onward, a deficit of about 20 trillion KRW is expected. The managed fiscal balance, which reflects the country’s finances, recorded a deficit of 30.9 trillion KRW, expanding by 10.9 trillion KRW compared to the same period last year. This has raised concerns that tax revenue shortages may become a reality this year.

However, the Ministry of Economy and Finance maintains that extending the fuel tax reduction does not necessarily worsen fiscal management difficulties. The ministry explained, “When preparing the revenue budget, we assumed that the flexible tax rates for the first and second halves of the year would be largely maintained, and based on this, we made projections. We believe the impact of this extension on fiscal management will be limited.” They added, “Regarding the decrease in tax revenue, it is difficult to judge at this point because it depends on how much consumption occurs.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)