As China eases quarantine measures and the reopening (resumption of economic activities) gains momentum, domestic beauty medical companies are actively targeting the market. It appears they are aiming to secure market dominance as the growth of beauty medical devices and cosmetic procedures in China is expected to be significant.

At the 10th China Minimally Invasive Cosmetic Surgery Conference, Tian Fengfei, director of Chongqing Tongzhuetai Plastic Surgery Hospital, is giving a lecture on facial dermal toxin procedures using Hugel's 'Letibo'.

At the 10th China Minimally Invasive Cosmetic Surgery Conference, Tian Fengfei, director of Chongqing Tongzhuetai Plastic Surgery Hospital, is giving a lecture on facial dermal toxin procedures using Hugel's 'Letibo'. [Photo by Hugel]

According to the industry on the 18th, LG Chem's Aesthetic Business Division recently held a local academic forum in China themed around the hyaluronic acid filler 'Y Solution.' About 60 people attended the forum, including beauty medical experts, medical staff, figures from the fashion and art sectors, and wanghong (influencers).

Earlier this month, Hugel also participated in the Minimally Invasive Aesthetic Surgery Conference held in Chongqing, China, hosted by the Chinese Society of Plastic Surgery and Aesthetics. At this conference, Hugel, together with its partner Sahuan Pharmaceutical, held an exclusive academic symposium on the botulinum toxin preparation 'Retivo' (Korean product name Botulex). It is reported that discussions were held on the product strength of Retivo as well as the development direction of the Chinese botulinum toxin market. Hugel is the only domestic toxin company to have entered the Chinese market, having received product approval for Retivo from Chinese authorities in October 2020.

The reason domestic companies are putting considerable effort into entering the Chinese market is that China is the largest market in Asia and shows a bright outlook with significant annual growth. The recent easing of quarantine policies by Chinese authorities and the full-scale reopening are also expected to positively impact market growth.

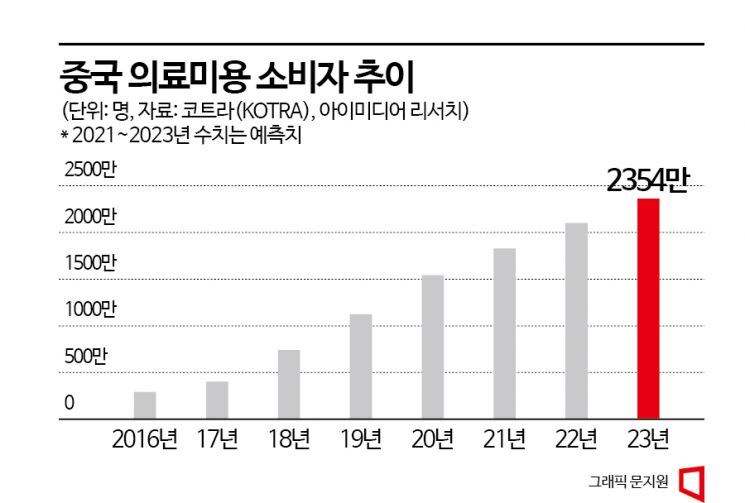

According to KOTRA, as personal income rises in China, consumers investing in skincare and beauty are increasing. Among them, demand for beauty medical procedures that do not require surgery or long recovery times is growing, with cosmetic procedures accounting for 69% of the total medical beauty market as of 2020. The growth trend is also remarkable. According to the China Industry Outlook Institute, the size of the Chinese cosmetic procedure market grew at an average annual rate of 26% from 2015 to 2020. The number of consumers in the Chinese cosmetic procedure market is also expected to increase from 20.93 million last year to 23.54 million this year. Compared to 2.8 million in 2016, this represents nearly an eightfold increase.

The market size for beauty medical devices is also expanding annually. KOTRA predicted that the Chinese beauty medical device market reached 10.9 billion yuan (approximately 2.0897 trillion KRW) last year, surpassing the 10 billion yuan mark. It is expected to grow to 15.3 billion yuan (approximately 2.9333 trillion KRW) by 2025. Currently, over 80% of China's beauty medical device market relies on imports, and with the medical beauty penetration rate being less than 20% compared to South Korea, there is significant potential for development.

Accordingly, there are forecasts that beauty medical companies will benefit from entering the Chinese market this year. Park Jong-hyun, a researcher at Daol Investment & Securities, analyzed, "2023 is expected to be a year confirming the benefits for domestic medical device companies due to China's reopening," adding, "These companies can be categorized into those that have obtained formal product approval to sell in the Chinese domestic market and those benefiting from medical tourism due to the influx of Chinese inbound tourists."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)