May 12 MSCI Regular Review Announcement Scheduled

EcoPro, KT, Cosmo Advanced Materials, Hanwha Aerospace, Geumyang Inclusion Candidates

Comprehensive Survey of Price Fluctuations for 61 Stocks Included or Excluded Over 3 Years

Increase in Stocks Reaching Short-Term Highs Before Index Inclusion Announcement

Market interest is high ahead of the regular review announcement of the Morgan Stanley Capital International (MSCI) index scheduled for May 12 (rebalancing that excludes and includes stocks will take place on May 31). In this May review, there is a possibility that five stocks?Ecopro, KT, Cosmo Advanced Materials, Hanwha Aerospace, and Geumyang?will be newly included. When a stock is included in the MSCI index, which is based on market capitalization and free float market capitalization, the stock price has often risen. However, there are also concerns that stocks that have recently surged sharply in the short term may be excluded from the index, so caution is advised when investing.

Comprehensive Survey of 61 Stocks Included and Excluded from the MSCI Index Over 3 Years

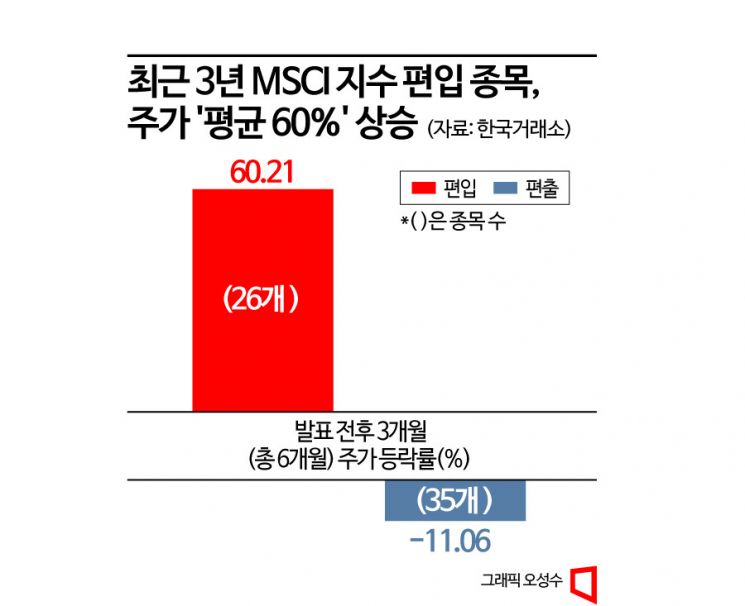

On the 19th, Asia Economy conducted a comprehensive survey of 61 stocks that were included or excluded from the MSCI index over the past three years, analyzing stock price changes (price fluctuations over a total of six months, three months before and after the inclusion/exclusion announcement). The 26 stocks that succeeded in being included in the index recorded an average stock price increase of 60.21%. The MSCI index announcements are made four times a year (February, May, August, and November). The survey covers stocks included or excluded from February 2020 to February 2023. The most recent inclusion, Kakao Pay, was analyzed based on the closing price of the previous day since three months had not yet passed from the inclusion date.

The MSCI index is a global market index published by the American investment bank Morgan Stanley and serves as a reference for foreign investors' investment decisions. It is known to have the largest amount of funds tracking it among major global indices. Stocks are selected for inclusion based on market capitalization and free float market capitalization. Samsung Securities estimates the effective tracking fund size of MSCI at $400 billion (approximately 527 trillion KRW). Inclusion in the index can lead to significant foreign investment inflows through passive funds such as exchange-traded funds (ETFs) that track the index. Conversely, exclusion from the index often results in foreign capital outflows.

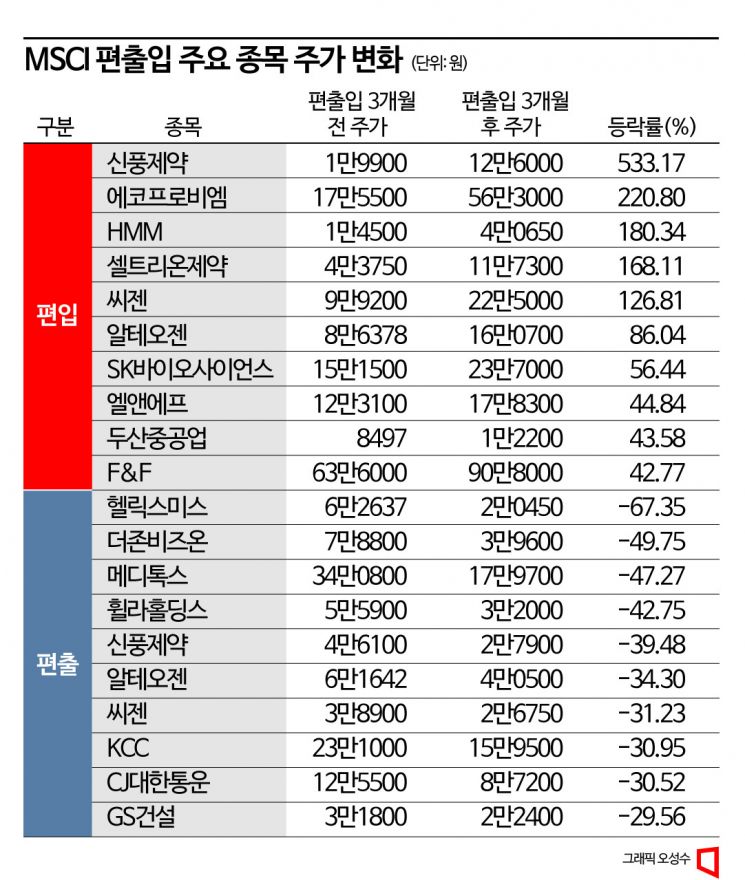

The stock that experienced the largest price increase following MSCI index inclusion was Shinpung Pharmaceutical. Based on the inclusion announcement on August 13, 2020, Shinpung Pharmaceutical’s stock price rose from 19,900 KRW to 126,000 KRW over six months (May 13 to November 13), a 533% increase. However, it was excluded from the index about a year and a half later, on February 10 last year. At the time of exclusion, the stock price dropped nearly 40%, from 46,100 KRW to 27,900 KRW over six months.

Ecopro BM, included in the MSCI index on August 12, 2021, recorded a 220.80% increase over six months before and after inclusion, the second-highest increase after Shinpung Pharmaceutical. Following were HMM (included May 12, 2021, 180.34%) and Celltrion Pharm (included May 13, 2020, 168.11%).

On the other hand, 35 stocks that were included and later excluded from the MSCI index experienced an average stock price decline of 11.06% over six months based on the same criteria. Bio company Helixmith, excluded on August 13, 2020, saw its stock price fall from 62,637 KRW to 20,450 KRW, a 67.35% drop. Other large declines were seen in Duzon Bizon (excluded February 10, 2022, -49.75%), Medytox (excluded May 13, 2020, -47.27%), and Fila Holdings (excluded November 12, 2021, -42.75%).

The Pattern of Rising Before New Inclusion Remains Valid

Of course, inclusion in the MSCI index does not guarantee a stock price increase, nor does exclusion guarantee a decrease. Some investors exploit the positive news of inclusion and the negative news of exclusion to realize profits and exit, or distort stock prices by preemptively reflecting these events to secure gains.

Kang Song-cheol, a researcher at Eugene Investment & Securities, explained the recent trend, saying, "The pattern where stocks expected to be newly included in the MSCI index outperform the market (exceeding average market returns) before inclusion remains valid. However, the timing of the price increase is being brought forward." For example, stocks such as Meritz Financial Group, Meritz Fire & Marine Insurance, Hyundai Heavy Industries, and Hyundai Mipo Dockyard, which were included in the MSCI index last year, recorded short-term peaks before the index inclusion announcement.

Looking at historical cases, the possibility of stock price increases after MSCI index inclusion is relatively high. However, the key factor is foreign investor demand. Examining foreign trading trends of stocks included in the MSCI index over the past three years, 22 out of 26 stocks (excluding HMM, L&F, Meritz Financial Group, and Meritz Fire & Marine Insurance) recorded net foreign buying for three months after the inclusion announcement. Conversely, among the 35 excluded stocks, 33 (excluding Shinsegae and Meritz Financial Group) suffered net foreign selling immediately after exclusion.

Many Variables Including High Price Volatility and Foreign Ownership Limits

The market identifies Ecopro, KT, Cosmo Advanced Materials, Hanwha Aerospace, and Geumyang as stocks likely to be included in May. However, experts point out that there are many variables such as high price volatility, short-term sharp price increases, and foreign ownership limit ratios, so premature pre-betting should be approached with caution.

Nam Aran, a researcher at Daol Investment & Securities, explained, "Since 2021, MSCI has introduced a rule excluding stocks with short-term sharp price increases from inclusion to ensure the continuity and stability of the index. Stocks with excessively large short-term price increases may find it difficult to be included in the MSCI index." He added, "Until recently, no stocks failed inclusion due to this rule, so the market did not pay much attention. However, in this review, stocks like Ecopro and Cosmo Advanced Materials, which surged sharply in a short period, are mentioned as inclusion candidates, so it is necessary to closely monitor the impact of this rule."

In particular, a report lowering the possibility of Ecopro’s inclusion in the MSCI index was released. Kyungbeom Ko, a researcher at Yuanta Securities, issued a related report yesterday, stating, "Ecopro is subject to the 'extreme price increase rule.' If the inclusion/exclusion reference date is set between April 17 and 18 while maintaining the current stock price, inclusion may fail." He adjusted the inclusion possibility from 'High' to 'Mid.'

The condition that additional foreign ownership must be at least 15% is also a variable. KT’s telecommunications business is a national key industry, so foreign ownership limits are set. In 2019, KT failed to meet this criterion and was excluded from the index. However, recently, KT meets this criterion, increasing the likelihood of inclusion. Yuanta Securities raised KT’s inclusion possibility from 'Mid' to 'High.'

Meanwhile, multiple securities firms expect S-1, SD Biosensor, Cheil Worldwide, and Lotte Shopping to be excluded in the upcoming May MSCI review. The MSCI index conducts rebalancing by periodically adding major stocks with increased market capitalization and deleting stocks with decreased market capitalization to accurately reflect each country’s stock market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)