Increased Revenue from Subscription Fee Hike in Korea

Large Content Costs Remitted to Headquarters

On the 18th, Byeon Jae-il, a member of the National Assembly's Science, Technology, Information, Broadcasting and Communications Committee from the Democratic Party of Korea, pointed out that Netflix is transferring a significant portion of its domestic revenue overseas and evading taxes.

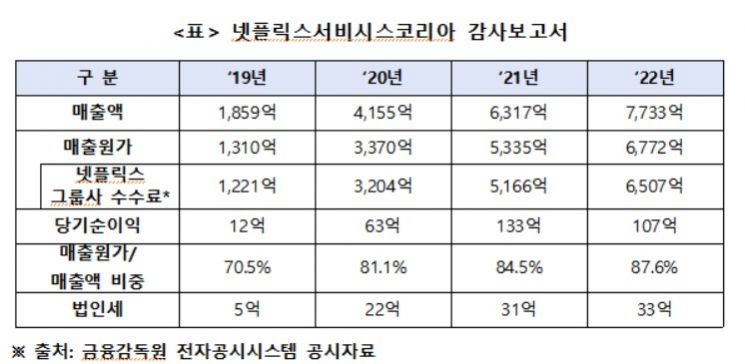

According to an analysis by Byeon Jae-il's office of Netflix's overseas financial statements and domestic audit reports, Netflix's domestic sales last year amounted to 773.3 billion KRW, a 22% increase compared to the previous year. Despite a 30.5% decrease in the average daily number of Netflix users in Korea in the fourth quarter of last year compared to the same period the previous year, sales increased, which is understood to be due to the effect of monthly subscription fee hikes.

Byeon said, "Domestically, along with increased sales due to subscription fee hikes, Netflix has been increasing the proportion of cost of sales relative to sales each year, setting it at over 87% last year, thereby transferring profits earned in Korea overseas and even reducing the proportion of corporate tax relative to sales."

The proportion of cost of sales to revenue at Netflix's headquarters has been steadily decreasing, standing at around 60% last year. Domestically, the cost of sales ratio was raised to 70.5% in 2019, 81.1% in 2020, 84.5% in 2021, and 87.6% in 2022. Despite ongoing concerns about overseas profit transfers and corporate tax evasion, no improvements have been made. According to the office, out of the 773.3 billion KRW in domestic revenue Netflix earned last year, 677.2 billion KRW was remitted to overseas group companies.

Meanwhile, Netflix was required to take corrective measures last year in Italy and Japan for tax evasion practices involving the use of cost of sales to reduce corporate tax payments. Netflix paid a settlement in Italy and a penalty in Japan. However, domestically, although the National Tax Service conducted a tax audit on Netflix in 2021 and imposed an additional tax of 80 billion KRW on allegations of tax evasion, Netflix is currently appealing this decision to the Tax Tribunal.

Netflix has sparked controversy by causing massive internet traffic using domestic internet networks without paying any costs for it. In this context, Netflix applies a double standard regarding costs to increase profits taken from Korea, such as setting content costs (cost of sales) high to transfer sales to its overseas headquarters.

Byeon stated, "Netflix's actions of transferring most of its sales overseas and evading corporate taxes while earning huge profits domestically cannot be seen as contributing to the Korean economy as they claim, but rather as viewing Korea as a target for exploitation," adding, "It is urgent to establish measures to prevent Netflix's unilateral subscription fee hikes, free-riding on domestic networks, and corporate tax evasion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)