Ecopro, Ecopro BM, and L&F Concentration Phenomenon

Impact on Index Due to Economic Slowdown and High Interest Rates

80 Trillion Won in Short Selling Waiting Funds Raises 'Time Bomb' Concerns

This year, the KOSDAQ market, which has surged more than 30% and shown the highest growth rate among major global stock markets, is raising concerns of overheating. In particular, a concentration phenomenon is severe, with just three stocks?Ecopro, Ecopro BM, and L&F?accounting for one-third of the total increase. Without support from other stocks, if these fall, the entire market could be shaken. Additionally, factors such as economic recession, sustained high interest rates, and a sharp increase in short-selling transaction amounts are major variables threatening the KOSDAQ market.

According to the Korea Exchange on the 18th, the KOSDAQ index has been rising for four consecutive months, staying above the 900-point level. This is the highest level since April last year. It closed at 909.47 points the previous day. Kim Seok-hwan, a researcher at Mirae Asset Securities, said, "The continued strength of secondary battery material stocks has attracted buying momentum, leading to the KOSDAQ's strong performance," but also expressed concern, saying, "However, there is severe supply-demand concentration and excessive valuation assessments."

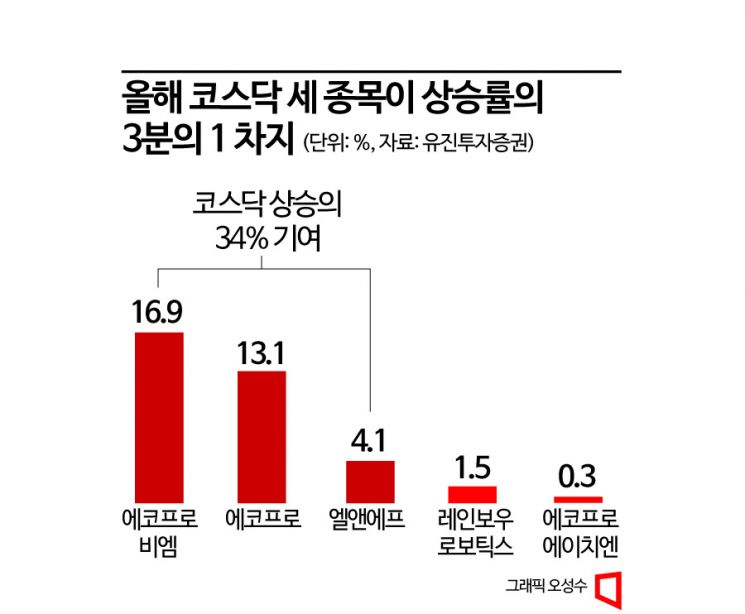

The reclaiming and maintenance of the 900-point level in KOSDAQ is attributed to the concentration on a few stocks, and concerns about this are growing. Analysis has even emerged that about 34% of this year's KOSDAQ rise is contributed by just three stocks. Heo Jae-hwan, a researcher at Eugene Investment & Securities, diagnosed, "Three stocks?Ecopro, Ecopro BM, and L&F?account for one-third of the KOSDAQ's rise, and behind the dazzling run of KOSDAQ lies the shadow of concentration on a few stocks."

This year, the contribution rates to KOSDAQ's rise are 16.9% for Ecopro BM, 13.1% for Ecopro, and 4.1% for L&F, respectively. Researcher Heo analyzed, "The power of these stocks becomes clearer when comparing the market capitalization excluding them. Recently, the KOSDAQ market capitalization is about 425 trillion won, approaching the level of January last year, but excluding the five stocks with high contribution rates (Ecopro BM, Ecopro, L&F, Rainbow Robotics, Ecopro HN), there is little difference from the level of June last year."

Researcher Heo stated, "The concentration on a few KOSDAQ stocks is analyzed as a result of increased idle funds in the late phase of the economic and interest rate hike cycle," and emphasized, "When real interest rates rise, the concentration phenomenon is likely to reverse, so attention should be paid to the possibility that inflation slowdown could raise real interest rates." He added, "Ultimately, the concentration in KOSDAQ will either lead to a spread of stock price gains to other industrial companies as the economy improves, or to a sharp decline in stock prices again due to price burdens and rising real interest rates."

There is also a possibility that the hard-won 900-point level could collapse again, falling back to the 800s. As the earnings season fully opens, companies' earnings announcements are scheduled one after another. Amid concerns over declining corporate profits due to recession forecasts, the possibility of additional interest rate hikes or sustained high interest rates is a burdensome factor.

Short selling is also expected to weigh down the KOSDAQ. Recently, the balance of securities lending transactions, classified as short-selling standby funds, has exceeded 80 trillion won. According to the Korea Financial Investment Association, as of the latest available date (the 14th), the balance of securities lending transactions was 80.8434 trillion won. The balance exceeded 80 trillion won on the 10th and has remained above that level for five consecutive trading days. This is the first time in one year and five months since November 16, 2021 (80.243 trillion won) that it has surpassed 80 trillion won.

Securities lending transactions refer to borrowers borrowing securities from lenders for a fee and returning the same stocks and quantities after the contract period ends. The balance of securities lending transactions is the quantity of stocks borrowed but not yet returned. Since naked short selling is not allowed domestically, securities lending transactions must be conducted to short sell. This is why the scale of securities lending balances is used to gauge short-selling demand. Recently, short-selling transactions have increased significantly. The monthly average short-selling transaction volume in the KOSDAQ market surged from 83.47 billion won in January to 376.87 billion won this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)