"Cutting One's Own Flesh... Sometimes Even Resulting in Losses"

As competition in the MVNO (Mobile Virtual Network Operator) market intensifies, zero-won plans have emerged mainly among small and medium-sized companies, leading to cutthroat competition. This situation has arisen due to competition among telecom companies and the entry of banks into the market. While consumers benefit in the short term, there are concerns about negative side effects in the long term.

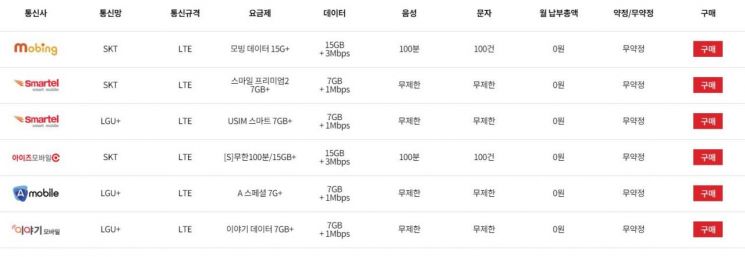

According to the 'Altteul Phone Hub,' a product information site operated by the Korea Information and Communication Promotion Association, there are currently as many as 31 zero-won plan products on sale. Many plans offer up to 65GB of data for zero won without a contract for as long as seven months. The plan offering the most data is T Plus's 'The Data Ma-eumkkeot 15G+ (300 minutes).' This plan, which normally costs 33,000 KRW per month, is offered for free for seven months, and customers who activate their service in April receive an additional 50GB of data. The most popular zero-won plan is Mobing's 'Mobing Data 15G+' plan, which provides 15GB of data for a monthly fee of 32,300 KRW but is free for seven months. At one point, there was even a 12-month zero-won plan, all of which are contract-free. Additionally, companies such as Iyagi Mobile, Eyes Mobile, Smartel, and Pretty are running zero-won plan promotions. The surge in subscriptions has been so great that notices about activation delays have been posted due to popularity.

It is not uncommon for small and medium-sized operators in the MVNO market to compete with low-priced plans. Since their service development and marketing capabilities lag behind those of subsidiaries of the three major telecom companies, they attract subscribers by selling plans cheaper than cost.

However, it is unusual for companies to rush to offer contract-free free plans like this. One analysis is that the entry of banks into the MVNO market has opened the door, prompting small and medium-sized companies facing crises to proactively secure subscribers. The Financial Services Commission approved KB Kookmin Bank's Livem MVNO service as an ancillary business the day before. There is also an analysis that this is a proxy war among the three major telecom companies. In the past, the three major telecom companies guarded against losing subscribers to MVNOs, but recently they have changed their strategy to increase their own network share in the MVNO market and have started supporting MVNOs, intensifying competition. In fact, SK Telecom, which was the most passive in the MVNO market, recently established an MVNO sales team to support MVNO operators using its own network.

From the consumer's perspective, this competition can be welcome. Since there is no contract, there is no penalty, so consumers can use the service for free during the promotion period and cancel afterward. Increasingly, people are using this to activate second numbers with unlocked devices or eSIMs (embedded Subscriber Identity Modules). However, in the long term, this negatively affects the entire market. Cutthroat competition cannot be sustained, and only phantom subscribers rather than actual users may increase. Also, a minimum usage fee of 1,500 KRW per MVNO subscriber is imposed, and if users consume less than this, the operator must bear the cost. A telecom industry official said, "Excessive marketing that cuts into their own profits will eventually lead to a return to original subscriber numbers over time," adding, "If cutthroat competition continues, small and medium-sized operators will collapse, and the market will be reorganized around large companies, causing side effects such as a decline in consumer benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)