3 Major Credit Rating Agencies Begin Regular Evaluation... Petrochemical and Memory Semiconductor Sectors Slump

Lotte Chemical, LG Display, SK Hynix at a Crossroads of Rating Downgrade

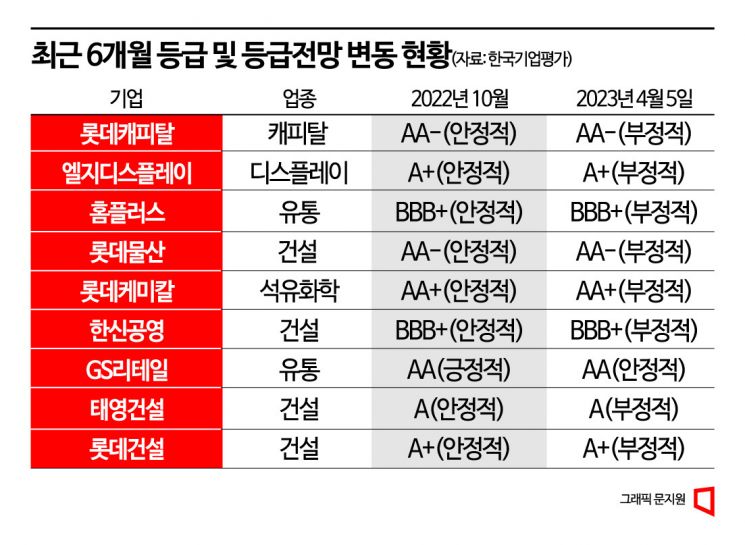

Due to weak global demand and the impact of the economic downturn, credit rating agencies are highly likely to downgrade the rating outlooks of companies in the petrochemical, memory semiconductor, display, and construction sectors in their regular April evaluations. Large conglomerate affiliates with relatively solid financial structures are also in a precarious position. Since the second half of last year, credit rating agencies have downgraded the rating outlooks of related affiliates of Lotte and LG groups and warned that rating adjustments could be made depending on performance.

Operating Environment Expected to Worsen for Memory Semiconductors, Displays, and Petrochemicals

According to a synthesis of opinions from the three major credit rating agencies (Korea Ratings, Korea Investors Service, and NICE Investors Service) on the 11th, the operating environments for major industries this year, including memory semiconductors, displays, petrochemicals, apparel, construction, securities, credit cards, and savings banks, are expected to deteriorate compared to the current situation. In particular, the construction, display, and securities sectors have been given negative credit rating outlooks for the evaluated companies. A year ago, the only sector with an unfavorable outlook was the credit card industry. The business conditions for memory semiconductors, steel, and banking sectors were expected to be favorable, but the current economic outlook is not easy.

The rating outlook for Lotte Chemical (AA+), a petrochemical company and a key affiliate of Lotte Group, remains 'negative.' A negative rating outlook means there is a high possibility of a downgrade within the next one to two years. Meanwhile, Lotte Chemical's stock price has risen more than 4% since the beginning of the year, buoyed by expectations of increased demand due to China's reopening of economic activities. However, credit rating agencies assessed that the positive factors from China are not sufficient to offset the downward pressure on ratings.

In the oil sector, the upstream segment producing basic feedstocks such as ethylene and propylene is expected to face oversupply, leading to a negative market outlook. Conversely, the downstream segment producing and selling final petrochemical products is expected to see market improvements. Lotte Chemical's naphtha cracking center (NCC), which is focused on upstream processes, accounts for 75% of total sales. Given the negative outlook for the upstream market, short-term performance improvement is unlikely. Oh Yoon-jae, a senior analyst at Korea Ratings, said, "From the second quarter, the performance of Iljin Materials will be additionally reflected, which may improve profitability, but overall profit generation improvement will not be significant," adding, "Even if the market improves, competitors' operating rates will also increase, which could increase supply pressure."

Lotte Construction (A+), which faces increased contingent liability risks due to the real estate market downturn, also carries a negative rating outlook. The contingent liability risk from project financing (PF) increased following the Legoland incident in October last year. As of November last year, Lotte Construction's PF contingent liabilities amounted to 5.8 trillion KRW. Although the recent trend of interest rate hikes has somewhat eased, the consensus is that housing demand recovery will not happen quickly. Kim Hyun, a senior researcher at Korea Investors Service, explained, "Lotte Construction has secured liquidity through affiliate loans, paid-in capital increases, and joint fund formation with Meritz Securities, but it will not be easy to reduce refinancing risk in the long term," adding, "Since sales decline is expected in the construction sector until the second half of the year, we will conduct regular evaluations by reviewing selective project commencements for unstarted projects and market response capabilities."

Concerns Over Downgrade of Lotte Group’s Integrated Credit Rating

As the downgrade pressure on the ratings of key affiliates in Lotte Group increases, the rating outlooks of other affiliates have also been lowered. Korea Investors Service has downgraded the ratings or rating outlooks of 14 companies over the past six months (October 7, 2022 ? April 5, 2023), including eight affiliates of Lotte Group. The rating outlooks of Lotte Chemical, Lotte Construction, Lotte Rental (AA-), Lotte Property & Development (AA-), Lotte Auto Lease (A), Lotte Holdings (AA), Lotte Capital (AA-), and Lotte Himart (AA-) have been lowered from stable to negative. However, the performance of other affiliates is not outstanding either. The combined operating profit of major listed companies in Lotte Group?Lotte Confectionery, Lotte Chilsung, Lotte Rental, Lotte Shopping, Lotte Chemical, and Lotte Refining & Chemical?for the first quarter is estimated to decrease by more than 53% year-on-year to 187.1 billion KRW.

Yeom Jae-hwa, a researcher at Korea Investors Service, said, "If the creditworthiness of key affiliates declines, the integrated credit rating of Lotte Group will also fall," adding, "Although demand recovery in China is expected after the second quarter for Lotte Chemical, the pace of demand recovery in countries outside China is expected to be slow due to the full-scale economic downturn, making it difficult to quickly restore financial stability."

LG Display (A+, negative), an affiliate of LG Group, is also at a crossroads for a rating downgrade. This is because losses that began in the second quarter of last year are expected to continue into the first half of this year. Due to weak IT demand, domestic display companies' shipments have decreased, and the expansion of organic light-emitting diode (OLED) production capacity and market penetration by Chinese companies have increased uncertainty about profit generation. LG Display recorded an operating loss of 904.3 billion KRW in the first quarter, expected to turn to a loss compared to the same period last year. Sales are estimated to be around 5 trillion KRW, down more than 20% year-on-year. A loss of 623.1 billion KRW is also expected in the second quarter.

Another negative factor is the increased financial burden due to a rise in the company's net borrowings. Recently, LG Display borrowed 1 trillion KRW from LG Electronics at an interest rate of 6.1%. The company also plans to raise additional funds from financial institutions. As a result, the company's net borrowings are expected to increase from 11.4 trillion KRW at the end of last year to 13.4 trillion KRW this year. Previously, Korea Ratings mentioned that if LG Display's net debt ratio (net borrowings/assets minus cash equivalents) continues to exceed 35% and profitability declines due to intensified industry competition, the possibility of a rating downgrade will inevitably increase.

Due to continued weak IT demand, the credit rating outlook for memory semiconductor companies has also been lowered to negative. SK Hynix is expected to record an operating loss of 3.6 trillion KRW in the first quarter and is projected to remain in the red throughout the year. However, thanks to recent news of Samsung Electronics' production cuts, the memory semiconductor market is expected to improve in the second half of the year, so the downgrade pressure is estimated to be less severe compared to other sectors.

Improving Performance Expected for Kia and Korean Air with Upgraded Rating Outlooks

Unlike last year, some sectors have seen improvements in their credit rating outlooks. Korean Air (BBB+), included in the airline, hotel, and leisure sectors that were hit hard by COVID-19, and its largest shareholder Hanjin KAL (BBB) have had their rating outlooks upgraded from stable to positive. Korean Air maintained stable performance through cargo transportation during the COVID-19 period, and it is analyzed that it will sustain good profit generation in the passenger segment in the mid to short term due to the easing of travel restrictions between countries. Moon Ah-young, a researcher at NICE Investors Service, said, "Even assuming the resumption of dividends and investments that were halted during COVID-19, the financial structure remains stable," adding, "However, negative factors such as route relinquishment during the acquisition of Asiana Airlines require monitoring."

The automobile sector is expected to see rating upgrades due to solid performance and stable financial structures. Kia's credit rating was upgraded from AA (positive) to AA+ (stable) at the end of last month. Although concerns about performance declines arose due to demand contraction from the economic downturn and intensified competition among finished car manufacturers following the easing of semiconductor supply shortages, the outlook remains positive. This is because accumulated backlog demand and product mix improvements are expected to continue driving performance improvements. The securities industry expects Hyundai Motor's operating profit in the first quarter to approach 3 trillion KRW, showing a growth rate of about 50% compared to the same period last year. Kia is also expected to record operating profits in the 2 trillion KRW range.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)