EcoPro Stock Soars 385% in Q1

Successful Bet on KOSDAQ Growth Stocks... Only KT Faces Negative Returns Amid Regulatory Controversy

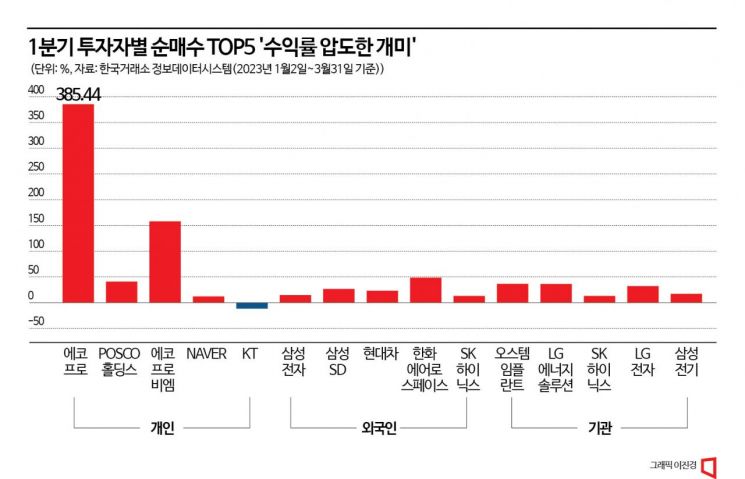

In the stock market during the first quarter, individual investors recorded overwhelming returns, surpassing institutions and foreigners.

On the 6th, an analysis of the top stocks by net purchases (based on transaction value) by investor type from January 2 to March 31 through the Korea Exchange Information Data System revealed that the stock most purchased by individual investors was Ecopro. They net purchased a total of 1 trillion KRW worth. During this period, Ecopro's stock price soared from 103,000 KRW to 500,000 KRW, a remarkable 385% increase. This means it rose nearly fivefold compared to the beginning of the year.

Besides this, individual investors net purchased POSCO Holdings (41.05%, hereafter rate of change), Ecopro BM (157.87%), NAVER (12.17%), and KT (-11.39%) in that order. KT, which faced management vacuum issues amid government intervention controversies, was the only stock among the top five net purchases to record a negative return. Excluding KT, the top net purchased stocks all showed solid returns.

The stock most sold by individual investors in the first quarter was Samsung Electronics. They net sold a total of 3.6732 trillion KRW worth. Samsung Electronics' stock price plunged from the 80,000 KRW range at the end of 2021 to the 50,000 KRW range by the end of last year. This is interpreted as individual investors liquidating Samsung Electronics shares and shifting their interest to growth stocks in the KOSDAQ market.

Kim Hak-gyun, head of the research center at Shin Young Securities, said, "Although the KOSPI showed a decent trend this year, overall it was a box range market that failed to surpass the 2,500 level," adding, "In a generally sluggish stock market, investor interest concentrated intensively on KOSDAQ growth stocks, especially in the specific sector of 'secondary batteries,' causing related stocks' prices to surge."

The Samsung Electronics shares sold by individual investors were mostly purchased by foreign investors. In the first quarter, foreign investors net purchased Samsung Electronics alone worth 4.7028 trillion KRW, ranking first overwhelmingly in terms of net purchase transaction value for a single stock. Samsung Electronics is expected to have recorded an operating profit of less than 1 trillion KRW in the first quarter due to the semiconductor industry downturn, marking its worst performance in 14 years. The preliminary earnings announcement is scheduled for the 7th.

Despite the expected poor performance, Samsung Electronics' stock price rose 14.65% from 55,300 KRW to 63,400 KRW. This is interpreted as the market preemptively pricing in expectations that the semiconductor industry has bottomed out and will enter a recovery phase in the second half of the year. Following Samsung Electronics, foreign investors also heavily purchased Samsung SDI (26.57%), Hyundai Motor (23.31%), Hanwha Aerospace (48.64%), and SK Hynix (13.07%). All top five net purchased companies are listed on the KOSPI market. Although all showed double-digit returns, their profitability was not as high compared to the top net purchased stocks by individual investors.

The returns for institutional investors were similar. Institutions net purchased about 710 billion KRW worth of Osstem Implant in the first quarter, with a quarterly rate of change of 36.57%. This was followed by LG Energy Solution (36.39%), SK Hynix (13.07%), LG Electronics (32.14%), and Samsung Electro-Mechanics (17.32%).

Individuals Buy KOSDAQ Growth Stocks, Institutions and Foreigners Buy Large KOSPI Stocks

The widening gap in returns between individual investors and foreigners/institutions is also related to the difference in their main purchased stocks. While foreigners and institutions focused their investments on large-cap listed companies in the KOSPI market, individual investors concentrated on KOSDAQ growth stocks. The KOSPI rose 10.75% in the first quarter, whereas the KOSDAQ index surged 24.77%, overwhelmingly outperforming the KOSPI. In particular, the stocks known as the "Ecopro Trio" ? Ecopro, Ecopro BM, and Ecopro HN ? experienced explosive price increases. Selvas Healthcare (411.48%) ranked first in stock price increase among all KOSDAQ-listed companies, followed by secondary battery material company ZIGL (342.10%) and logistics software company MRO (320.53%), acquired by Samsung SDS, all showing remarkable gains.

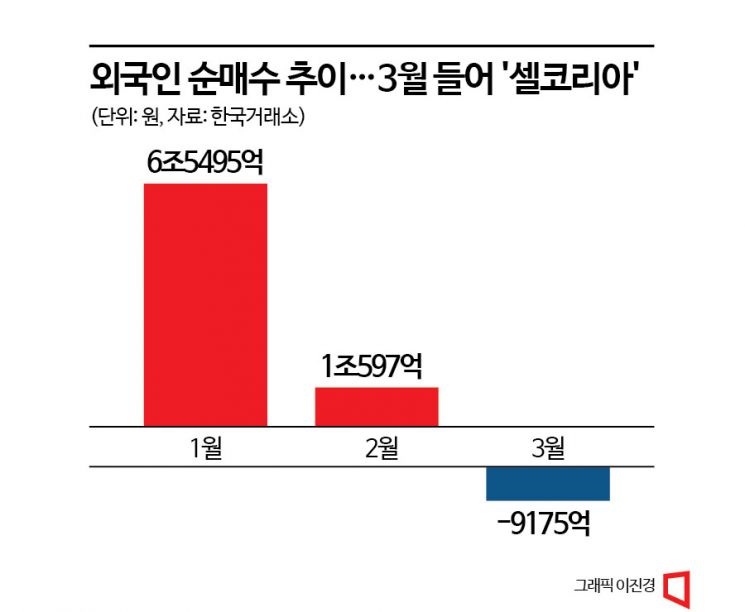

Thanks to the storm of purchases by so-called Donghak Ants (individual investors), KOSDAQ trading volume surpassed KOSPI trading volume in February. In January, foreign buying concentrated on KOSPI, with KOSPI trading volume at about 139 trillion KRW, 16 trillion KRW more than KOSDAQ's approximately 123 trillion KRW. However, in February, KOSDAQ trading volume reached about 192 trillion KRW, exceeding KOSPI's 160 trillion KRW by about 32 trillion KRW, and the gap widened further in March. Notably, in March, there was not a single trading day when KOSPI trading volume surpassed KOSDAQ's. Considering the size of companies listed on both markets, this is a very unusual phenomenon.

This is also related to the supply and demand trends of foreign investors. Foreign investors, who showed a record-breaking "Buy Korea" movement at the beginning of the year, purchased 6.55 trillion KRW worth in January alone, but their net purchase volume dropped to 1.06 trillion KRW in February. Then, in March, they turned to net selling with 920 billion KRW, shifting to "Sell Korea."

Stock Market Outlook After Q2 Remains Uncertain

The stock market outlook after the second quarter is a series of uncertainties. Initially, with the expectation that the US interest rate hike cycle was ending, the market was optimistic about a stock market rebound. Cha Hyun-gi, a researcher at Heungkuk Securities, said, "Assuming that the instability in the US banking sector does not lead to systemic risk, the financial market is expected to raise expectations for the end of the Federal Reserve's tightening cycle," adding, "Considering the disinflation phase and inflation levels significantly exceeding the target, it is highly likely that after an additional 25 basis points (bp) rate hike in May, the Fed will maintain a pause policy."

However, the mood sharply reversed recently as the Organization of the Petroleum Exporting Countries (OPEC), led by Middle Eastern oil-producing countries, and the non-OPEC oil-producing alliance including Russia, known as OPEC Plus (+), announced a surprise oil production cut. International oil prices, which had fallen to around 80 dollars per barrel, coinciding with China's economic reopening, are expected to surge back to 100 dollars per barrel, raising inflation concerns again. Choi Yoo-jun, a researcher at Shinhan Investment Corp., explained, "The OPEC+ production cut decision will act as a burden on the stock market," adding, "It is necessary to monitor the impact of the oil production cut and the responses of major countries including the US, and factors such as some countries' indirect imports of Russian oil will also be variables."

However, there are also views that despite this production cut announcement, international oil prices will not sharply rise back to the 100-dollar level. Shim Soo-bin, a researcher at Kiwoom Securities, said, "Given that banking sector instability and the possibility of a US recession have not been completely resolved, the OPEC+ production cut is likely to be an issue that provides downside rigidity," maintaining the existing forecast for international oil price fluctuations at 65 to 95 dollars per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)