KT with Stopped Business Clock, Q1 Profit Expected to Decrease by 11%

The combined operating profit of the three mobile carriers in the first quarter of this year is expected to comfortably surpass 1 trillion won. However, profits are anticipated to slightly decrease compared to the same period last year. While SK Telecom and LG Uplus continued their performance growth, KT's profits declined due to changes in both domestic and international environments.

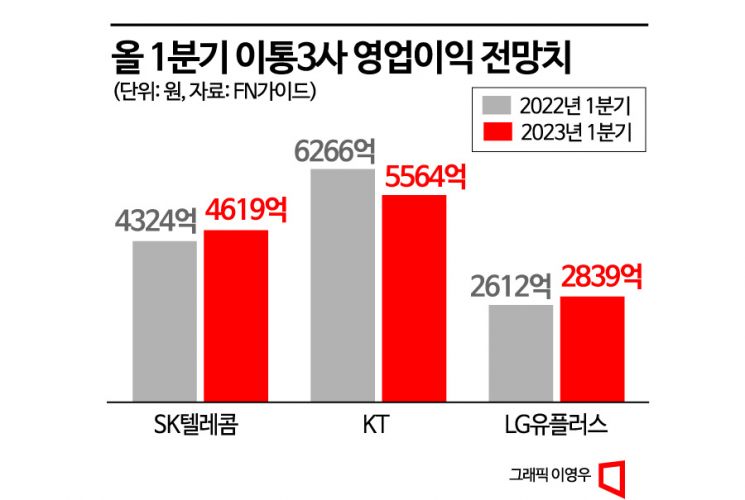

According to the consensus (average estimate by securities firms) from financial information provider FN Guide on the 4th, the combined revenue of the three mobile carriers?SK Telecom, KT, and LG Uplus?was 14.3933 trillion won, a 2.2% increase from the same period last year. Operating profit during this period was estimated at 1.3022 trillion won, down from 1.3202 trillion won in the previous year. SK Telecom and LG Uplus recorded operating profits of 461.9 billion won and 283.9 billion won, respectively, marking increases of 6.8% and 8.6%. The stable growth of the wireless communication business, driven by the expansion of 5th generation (5G) service subscriber penetration, is cited as a major factor for the strong performance. The stabilization of marketing expenses also contributed to profits. Kim Jang-won, a researcher at IBK Investment & Securities, explained, "In the first year of service in 2019, the penetration rate was 8.3% based only on mobile phone subscribers, and in four years, the penetration rate has exceeded half." He added, "Following last year, the 5G penetration rate continues to increase this year, and telecom companies are suppressing consumptive expenses including marketing costs, so profitability is expected to improve." He further projected, "Marketing expenses decreased by 2.6% from 8.2 trillion won in 2021 to 8 trillion won last year, and are expected to remain at 8 trillion won this year."

KT's operating profit is estimated to have decreased by 11.2% to 556.4 billion won. This is largely attributed to the halt in management momentum this year due to leadership absence. Ahn Jae-min, a researcher at NH Investment & Securities, analyzed, "With all attempts at the CEO’s reappointment and reelection failing, a management vacuum in the first half of this year is inevitable." He added, "Uncertainties surrounding KT are becoming more prominent, and it is uncertain whether KT can continue the capabilities it has built." Additionally, the base effect from last year's record-high quarterly profit in the first quarter, which included a one-time gain of 74.6 billion won from asset sales, appears to have been factored in. An industry insider commented, "KT recorded an all-time high operating profit in the first quarter of last year due to strong core business performance plus one-time gains, so profits in the first quarter of this year may decrease somewhat."

However, with the business environment likely to change significantly this year due to the diversification of 5G plans and the selection of a fourth mobile carrier, the stock price outlook for the three mobile carriers remains uncertain. As part of measures to stabilize people’s livelihoods, the government has introduced a card to reduce communication fees. Starting with SK Telecom, KT and LG Uplus are also expected to announce revised rate plans. On the 23rd of last month, SK Telecom launched mid-tier plans allowing consumers to choose data ranges between 37 and 99GB, as well as age-specific plans for youth and seniors. The government is also promoting market competition through the fourth mobile carrier license, which had repeatedly failed in the past due to business feasibility and economic reasons. The activation of the MVNO (Mobile Virtual Network Operator) market is also being actively pursued. KT’s stock price, which was 37,400 won as of December 1 last year, fell 20.3% to 29,800 won as of the closing price on the 3rd. During the same period, SK Telecom and LG Uplus stock prices also dropped by 5.9% and 10.1%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.