February Seoul Sales Price Index Negative for 6 Consecutive Months

Real Estate Slump Lowers Sales Prices, Increasing Yield

Concerns Over Negative Margins When Considering High-Interest Loan Interest

While the officetel market is sinking into a recession, paradoxically, the yield in February reached an all-time high. Due to the impact of high interest rates causing a sharp drop in transaction prices, investors can receive the same monthly rent with a smaller investment amount. However, it is unwise to easily judge officetels as a 'good investment' based solely on the yield. Considering the increased interest burden, there is a risk of negative returns, so careful decision-making is necessary.

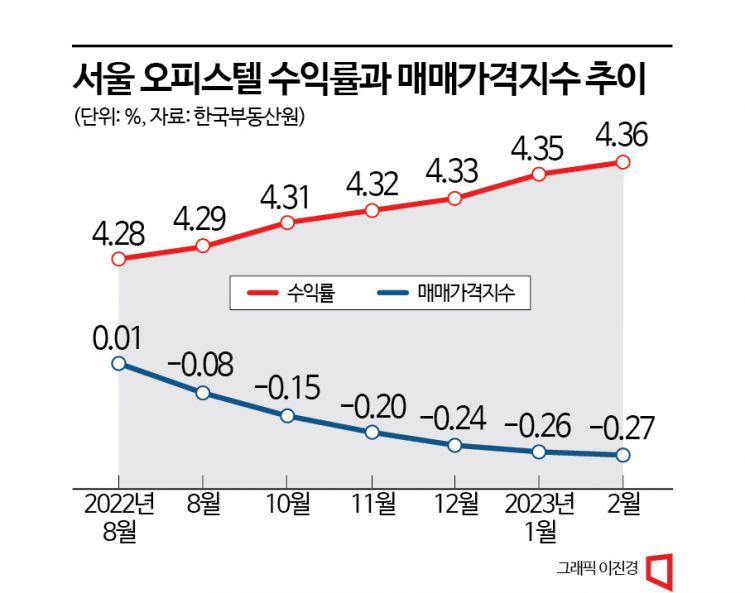

According to the Korea Real Estate Board on the 4th, the nationwide officetel yield in February was 4.88%, the highest since the statistics began in July 2020. The yield for Seoul officetels also rose for six consecutive months from August last year, reaching a record high of 4.36% in February.

The Korea Real Estate Board publishes officetel yield statistics as one of the investment decision indicators for landlords aiming for rental income. In other words, a high yield indicates a favorable environment for investment.

However, there are criticisms that the current high yield is just a 'glittering but sour fruit.' The yield is calculated by using transaction price, deposit, and monthly rent to determine the annual income (numerator) relative to the actual investment amount (denominator), and the recent rise in yield is due to the sharp drop in transaction prices.

Since the second half of last year, the real estate market has been sluggish due to rising interest rates, causing officetel transaction prices to fall rapidly. The government's strong regulatory easing aimed at reviving the apartment market has also dealt a fatal blow to officetels.

In fact, the Seoul officetel transaction price index has recorded negative values for six consecutive months, with the decline gradually deepening to -0.27% in February. The transaction freeze is also severe. According to the Seoul Real Estate Information Plaza, the number of officetel transactions in Seoul in February was 903, an increase from 449 in the previous month, but still far from the 1,300 to 1,900 range seen in the first half of last year.

There are many large brand officetels with 'negative premiums' due to lack of buyers. The pre-sale right for the 68A unit (29㎡ exclusive area) of the officetel 'Hillstate Sindorim Station Central' in Guro-gu, scheduled for occupancy in September, is currently listed at 349.42 million KRW, 30 million KRW cheaper than the pre-sale price.

The prevalence of negative premiums indicates that officetels are not attractive as income-generating real estate. No matter how high the yield has risen, unless there is almost no debt, investors must bear higher loan interest than this, and when considering additional costs such as brokerage fees and depreciation, losses may occur. Even if it is not difficult to find tenants due to the recent strong preference for monthly rent, there is a risk of negative returns.

A real estate industry official said, "With interest rates much higher now than at the time of subscription several years ago, there are many cases where people give up their deposits and put their pre-sale rights on the market," adding, "For officetels to function as income-generating real estate, the yield needs to rise to 6-7%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)