Police Mutual Aid Association, 7 Consecutive Years of Surplus with 5% Yield

Military Mutual Aid Association Expected to Achieve Overall Yield of 5.7%

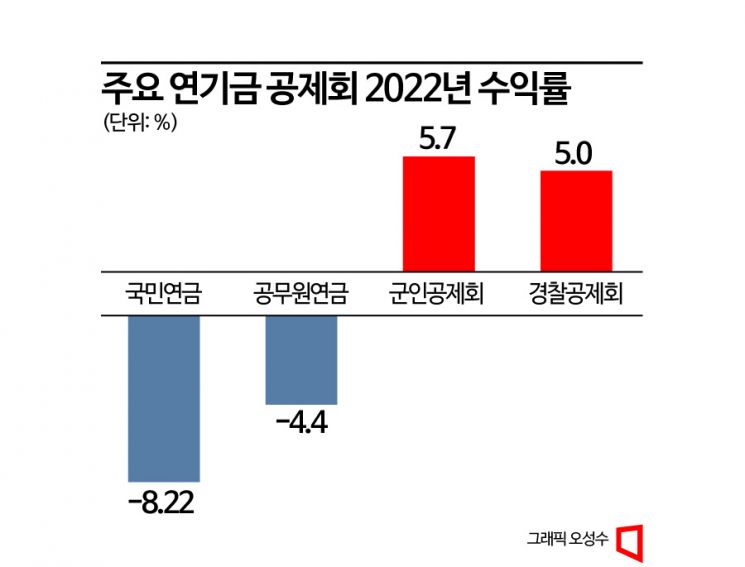

Last year, despite a challenging investment environment, major mutual aid associations such as the Korean National Police Mutual Aid Association and the Military Mutual Aid Association recorded returns in the 5% range.

According to the investment banking (IB) industry on the 31st, the Korean National Police Mutual Aid Association held a delegates' meeting on the 29th and completed its financial report for the previous year. It recorded a net profit of 58.2 billion KRW and a return rate of 5%. This marks the seventh consecutive year of profitability. Specifically, returns were approximately 5% in stocks, 4.1% in bonds, 3.7% in corporate finance, and 7% in real estate.

Managing about 4.0894 trillion KRW (as of the end of 2021), the Korean National Police Mutual Aid Association achieved returns of 5.5% in 2019, 5.2% in 2020, 5.6% in 2021, and maintained returns in the 5% range in 2022. It is analyzed that an active investment strategy, including participation in the LG Energy Solution IPO subscription last year, was effective.

The Military Mutual Aid Association, although not yet publicly disclosed, is also reported to have recorded an overall return of 5.7%. Managing approximately 14.3673 trillion KRW (as of the end of 2021), the Military Mutual Aid Association posted returns of 4.9% in 2019, 5.1% in 2020, and 6.6% in 2021.

These figures are quite encouraging compared to the National Pension Service’s return of -8.22% and the Government Employees Pension Service’s -4.4% last year.

With rising domestic and international market interest rates, major mutual aid associations found it difficult to devise investment plans last year. Although the amount to be returned to members increased due to interest rate hikes, it was not easy to find profitable investment opportunities in a tough market environment.

Meanwhile, as market interest rates rose, the salary rate also increased, adding to the operational burden of the mutual aid associations. The salary rate is the interest rate applied on a compound basis to the savings paid by members. Given the nature of mutual aid associations, responding to members’ loan demands is a priority, so raising investment funds was postponed.

Many mutual aid associations also requested asset management firms not to make capital calls for the time being. Since it is uncertain when members will request funds, mutual aid associations are believed to have adopted a strategy of concentrated investment with small amounts. A senior official from the IB industry said, "In an environment like last year’s, an active response involving concentrated investment combined with systematic risk management was effective rather than diversified investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)