National Pension Financial Projection Committee, Financial Projection Results

National Pension Depletion by 2050

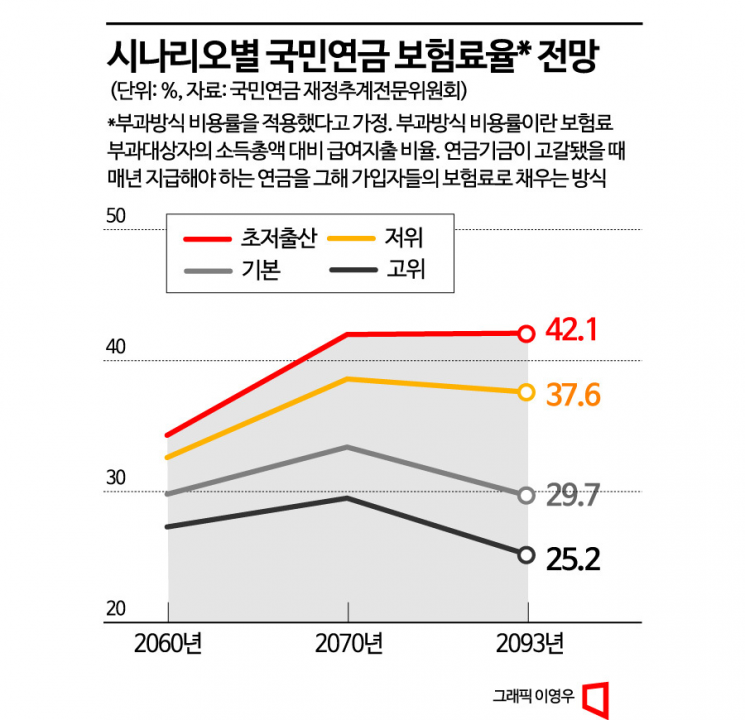

If Collected Funds Are Paid Immediately, Contribution Rate at 42% of Monthly Salary (Individual 21%)

In Ultra-Low Birthrate Families, Elderly Support Ratio 129.1% in 2070

Pension Benefit Expenditure as % of GDP 11.2% by 2093

Increasing Investment Return Rate by 1%P Delays Fund Depletion by 5 Years

If the worst-ever low birthrate trend continues, the National Pension Fund is projected to be depleted by 2050. Without government financial support, the 'pay-as-you-go' system, which requires immediate payment of collected premiums, will have to be applied. Under the current ultra-low birthrate conditions, the pay-as-you-go premium rate that citizens must pay is expected to reach 42% of wages (employee + employer) by 2070. It was also analyzed that preventing this situation requires not only improvements in demographic structure and economic conditions but also an increase in fund investment returns.

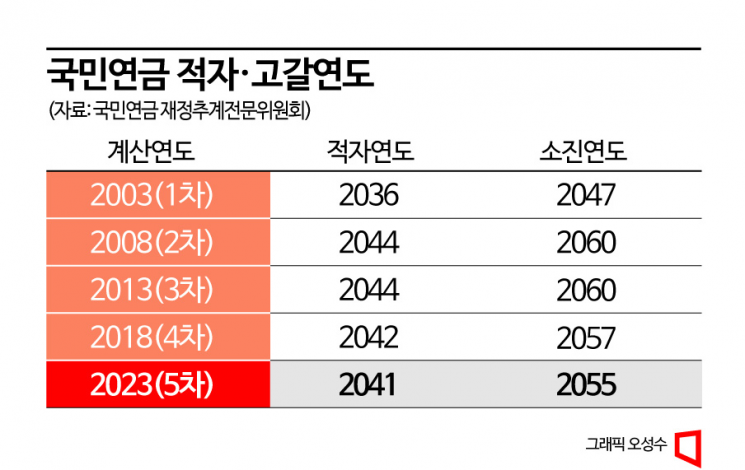

On the 31st, the National Pension Financial Projection Expert Committee announced the results of the '5th National Pension Financial Projection.' The projection results included basic assumptions and various scenarios reflecting different future situations. These scenarios covered pension conditions ranging from 'high' (assuming favorable birthrate and life expectancy) to 'low' (pessimistic birthrate and life expectancy), 'ultra-low birthrate' (long-term impact of COVID-19), and 'OECD average.' A forecast mixing optimistic and pessimistic economic conditions with the median scenario was also disclosed. Considering that last year's total fertility rate recorded an all-time low of 0.78, the 'ultra-low birthrate' scenario is highly likely to materialize.

In the 'ultra-low birthrate' scenario, where the total fertility rate is the lowest at 0.98, the pay-as-you-go premium rate surged to 34.3% in 2060, 42.0% in 2070, and 42.1% in 2093. Currently, the National Pension is paid by operating the accumulated fund, but once depleted, the annual pension payments must be covered by the premiums of that year's subscribers. The premium applied at this time is called the 'pay-as-you-go cost rate.' For a salaried worker earning 3 million KRW, this means paying 630,000 KRW (21%) in premiums by 2070. The total premium of 1.26 million KRW (42%) is split equally between the employee and the employer.

However, the pay-as-you-go cost rate is a figure determined by wages and subscriber income and assumes the government neglects the depletion of the National Pension Fund, so it may differ from the actual premium rate. The government also stated that the premium rate could change if pension reforms delay the fund's deficit and depletion timing.

The problem becomes clearer when comparing with other scenarios under the same conditions. Assuming median (basic) birthrate, life expectancy, and economic conditions, the pay-as-you-go premium rates are 29.8% in 2060, 33.4% in 2070, and 29.7% in 2093. The difference in premium rates between the ultra-low birthrate and median scenarios is only 4.5 percentage points in 2060 but widens significantly to 12.4 percentage points by 2093. In the high scenario, the pay-as-you-go premium rate in 2093 is 25.2%, showing a 16.9 percentage point difference from the ultra-low birthrate scenario. This highlights how severe the current low birthrate situation is.

Raising Investment Returns by 1% Point Delays Fund Depletion by 5 Years

The ultra-low birthrate also severely impacts the 'old-age dependency ratio' (the ratio of population aged 65 and over to those aged 18-64). In 2060, Korea's old-age dependency ratio is projected to reach 108.5%, meaning there will be more elderly people than the working-age population. This is much more severe than the basic assumption (94.2%), low (99.9%), and high (89.0%) scenarios. By 2070, it is expected to soar to 129.1%. However, the committee did not separately disclose the old-age dependency ratio forecast for 2093.

If the ultra-low birthrate is not overcome, pension benefit expenditures relative to Gross Domestic Product (GDP) are projected to approach 11.2% by 2093. During the same period, the basic assumption scenario shows 8.8%, the low scenario 10.6%, and the high scenario 7.7%.

The committee also revealed how pension conditions improve when fund investment returns are enhanced beyond the basic assumption. Increasing the fund investment return rate by 0.5 percentage points from the basic 4.5% delayed the deficit from 2041 to 2043 and postponed fund depletion from 2055 to 2057. Raising it by 1 percentage point is expected to extend the depletion timing by 5 years, equivalent to the effect of increasing the premium rate by 2 percentage points.

The Ministry of Health and Welfare plans to prepare a 'Comprehensive National Pension Operation Plan' based on these results. Since the current financial projection is based on 2021 data, it will be supplemented and reviewed by external institutions. Lee Seuran, Director of the Pension Policy Bureau at the Ministry of Health and Welfare, emphasized, "As raising fund investment returns alleviates the burden of premium increases, we plan to establish measures to improve returns soon through expert forums."

Jeon Byungmok, Chair of the Financial Projection Expert Committee, stressed, "Improving the demographic structure through increased birthrates and better economic conditions can play a crucial role in long-term fiscal stabilization," adding, "Strengthening the role of the fund is also necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.