Interview with Neil Warma, CEO of Genexine

Expect GX-E4 Launch Within 1-2 Years and GX-H9 in 2025

Careful Decision on Conditional Approval Application for GX-188E

Recent Stock Situation Seen as 'Undervalued'... "It Will Be an Opportunity"

"Among Genexine's various pipelines, we selected four with the highest potential for market launch. The first commercialization is expected within 1 to 2 years, and the next pipeline launch is also anticipated in 2025."

"A company without a commercialized new drug for 24 years." This is the stigma attached to the bio-venture Genexine. In response, Neil Warma, CEO of Genexine, who met with Asia Economy, stated, "The commercialization of the long-acting anemia treatment for chronic kidney disease, 'GX-E4,' is expected within 1 to 2 years," adding, "We will lead changes to quickly bring products to market through urgent measures."

Warma, who has work experience at various overseas pharmaceutical and bio companies such as Novartis, Opexa in the U.S., and iMap in China, joined Genexine as CEO in May 2022. He explained his reason for joining, saying, "I was attracted by the solid scientific foundation, management team, and the many late-stage pipelines under development."

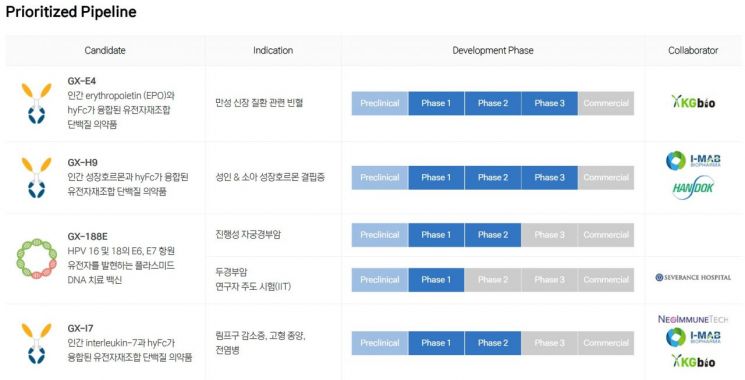

Warma cited 'focus' as the biggest change and achievement at Genexine since his appointment. He narrowed down the broad range of Genexine's pipelines to the four with the highest potential that require immediate focus. These are GX-E4, the cancer treatment DNA vaccine 'GX-188E,' the long-acting growth hormone 'GX-H9,' and the lymphopenia treatment 'GX-I7.' Except for GX-188E, the others apply Genexine's long-acting protein therapeutic platform, Hybrid Fc (hyFC). Warma explained, "We based this on development stage and marketability," adding, "These pipelines have entered clinical phases 2 to 3, with risk factors offset or overcome, and can be differentiated compared to competing products."

The pipeline closest to commercialization is GX-E4. It combines erythropoietin (EPO) with the hyFc platform. The technology was transferred to KG Bio, a local joint venture in Indonesia, and since 2020, a multinational Phase 3 clinical trial has been underway in seven countries, including Korea and Indonesia. Warma said, "The biological license application (BLA) process is already underway in Indonesia," adding, "Commercialization through KG Bio is expected within 1 to 2 years." Especially as the EPO market continues to grow steadily, with the proportion of long-acting EPO expected to rise to 63% by 2028, capturing just 10% market share in Asia and Europe could achieve sales targets of $130 million (approximately 169.4 billion KRW).

The next in line is the long-acting growth hormone GX-H9. Research and development (R&D) are underway in cooperation with Handok in Korea and iMap, Warma's former company, in China. Patient recruitment for Phase 3 clinical trials in China was completed last year. Warma said, "We expect to receive results around June," adding, "We plan to submit a BLA in the first quarter of next year and anticipate a 2025 launch." The long-acting growth hormone market in China is expected to grow from $1 million in 2020 to $3 billion by 2030, with an average annual growth rate of 43%. Even securing about 20% of this market share, which Genexine targets, could generate annual sales of $600 million.

The cancer treatment vaccine GX-188E, targeting cervical cancer and head and neck cancer caused by human papillomavirus (HPV), is also a high-growth market with expected annual growth rates of 23% for cervical cancer and 10% for head and neck cancer. In a Phase 2 clinical trial combining GX-188E with Keytruda for cervical cancer, overall survival (OS) increased nearly twofold to 16.7 months compared to 9 months with Keytruda monotherapy, with an objective response rate (ORR) of 35% and complete remission of 10%, showing positive results.

However, Warma took a cautious stance regarding the conditional approval application in Korea, which was expected within the year. He said, "Conditional approval in Korea is important, but we are considering the market size," adding, "Rather than clinging to conditional approval, it is necessary to align it with the framework of a global strategy." He implied that focusing too much on conditional approval domestically could delay global Phase 3 trials and miss the optimal timing for overseas expansion, so various considerations will be made.

The new headquarters of Genexine, 'Genexine Progen Bio Innovation Park' (left building), located in Magok, Gangseo-gu, Seoul. On the right is the research institute of its affiliate Handok, 'Handok Future Complex.'

The new headquarters of Genexine, 'Genexine Progen Bio Innovation Park' (left building), located in Magok, Gangseo-gu, Seoul. On the right is the research institute of its affiliate Handok, 'Handok Future Complex.' [Photo by Lee Chunhee]

Genexine's next step is global expansion. Accordingly, a local office will be established in San Diego, USA, in the second half of this year. This is also know-how derived from Warma's experience leading iMap's Nasdaq listing. He said, "Entering the U.S. increases access to excellent research personnel and large investment capital," adding, "At iMap, we introduced the company to the U.S. through the San Diego office, attracting investors' attention and successfully listing." Regarding dual listing on Nasdaq, he said, "It is a mid- to long-term goal," adding, "We will make plans and review the market situation."

On the financial front, Warma said that the funds secured through a paid-in capital increase of 85.2 billion KRW at the end of last year are being concentrated on research and development (R&D), while maximum efforts are being made to reduce costs. He said, "Raising capital in the current market situation can be a sensitive move, so we delayed it as much as possible, but with R&D funds nearly depleted, we made a decision," adding, "We will use the funds effectively for clinical trials and commercialization." He also said, "We have been improving work efficiency and reducing costs by integrating internal operational support tasks," and "We are also implementing strict management in business development (BD) and partnership management."

Regarding the recent stock price situation, he viewed it as 'undervalued.' Genexine's stock price closed at 11,790 KRW the previous day, down 64.6% compared to a year ago and 17.4% since the beginning of the year. Warma said, "The undervaluation situation can be an opportunity from another perspective," adding, "If we complete various global commercialization plans one by one, it will definitely be a good opportunity for the stock price, and we will do our best to deliver this opportunity to shareholders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)