Samsung Securities Surveys 10,964 MTS·HTS Customers

Desire Fast Investment Information and Immediate Consultation Channels

Mirae Asset, SK, KB Expand AI-Based Services

High-net-worth individuals who invest at least 100 million KRW using only their thumbs, known as the 'digital affluent class (high-net-worth individuals + thumb users),' are emerging as a new key customer segment in the securities industry. Accordingly, efforts to strengthen digital capabilities to meet their demands are ongoing. Unlike past online trading customers, they do not simply seek low fees. They are highly interested in digital premium asset management services such as rapid investment information and immediate consultations with private bankers (PBs).

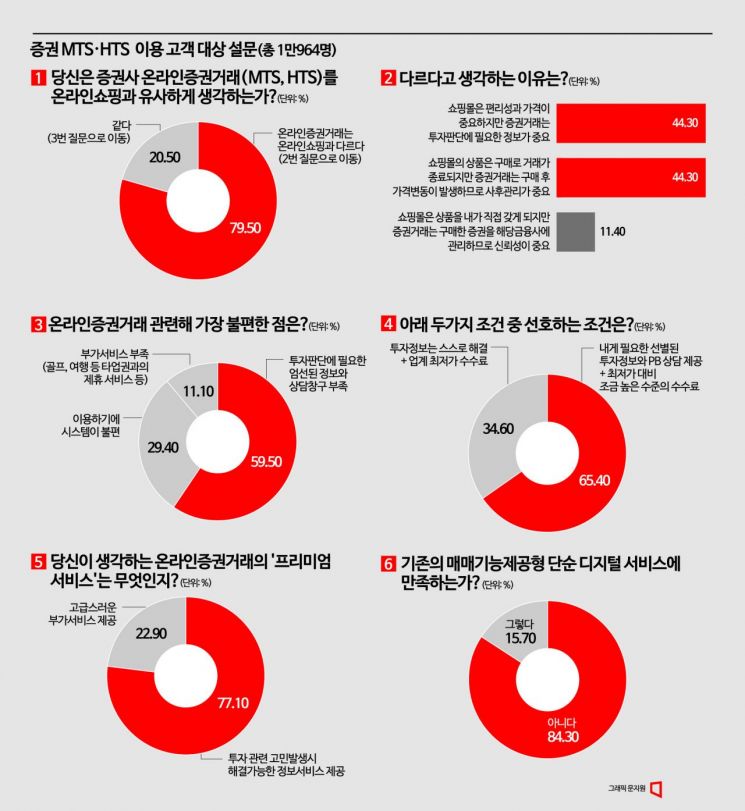

A survey conducted by Asia Economy on 10,964 customers using Samsung Securities' Mobile Trading System (MTS) and Home Trading System (HTS) clearly revealed these characteristics.

Among the survey participants, 84.3% responded that they are not satisfied with simple digital services that only provide trading functions. Of these, 44.3% said that information necessary for investment decisions is important. Another 44.3% answered that post-purchase management is crucial due to price fluctuations after buying. They want timely and continuous information related to the assets they have invested in.

They currently feel a lack of information consultation. 59.5% cited the lack of carefully selected information and consultation channels necessary for investment decisions as the most inconvenient aspect of online securities trading. System deficiencies were also noted as inconvenient by 29.4%. The most needed conditions identified were provision of tailored investment information and PB consultation (65.4%). As the most important premium service, 77.1% chose information services that can resolve investment-related concerns when they arise.

Oh Hyun-seok, Head of Digital Asset Management at Samsung Securities, explained, "The digital affluent class has done a lot of self-learning related to investments, so they often check a large amount of information in a short time through non-face-to-face consulting." He added, "We are expanding efforts to enhance the expertise of digital PBs." Lee Chan-woo, Head of Digital Division at Samsung Securities, said, "Unlike past thumb investors who made investment decisions alone with only low fees, demand for investment information provided through consulting using human touch and automated systems is expected to gradually increase."

The securities industry is also intensifying efforts to capture this new generation of investors. Last year, Samsung Securities launched the S.Lounge service for digital affluent customers. It offers a hybrid service centered around three main menus: ▲Investment Information Lounge ▲Seminar Lounge ▲Consulting Lounge, providing both human touch and automated investment information. Lee Chan-woo said, "We will leverage our experience and know-how in providing the industry's largest ultra-high-net-worth services to further develop services tailored to the needs of digital affluent customers."

Mirae Asset Securities opened a night investment consultation service called 'Global Night Desk' for overseas stock investments. It operates from 6 PM to 1 AM, before the U.S. regular market opens. Dedicated PBs provide professional investment consultation via phone. As the number of overseas stock trading customers increases, demand for overseas stock investment consultation at night has also grown. An In-sung, Head of Digital Division at Mirae Asset Securities, said, "Along with the Total View service that shows all U.S. stock order book volumes and AI-based real-time overseas stock news service, we expect increased convenience in overseas stock trading."

There is also a trend toward strengthening AI-integrated services. SK Securities recently launched an AI Contact Center (AICC) based on cloud AI technology. It provides customer experience innovation services such as AI voice consultation and plans to expand AI-related financial services to become a specialized AI securities firm. KB Securities also opened an AI technology-applied Future Contact Center (FCC) chatbot service, embarking on systematic customer management and personalized consultation services. They also established a WM Tech Solutions department to enhance capabilities in providing asset management solutions such as portfolio algorithm development and AI-based investment strategy development.

An industry insider said, "Since anyone can easily access vast amounts of information, providing customized information that investors want will soon become a key competitive advantage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)