China's Consumer and Manufacturing Slowdown Raises Recovery Concerns

People's Bank Expands Liquidity Supply... Authorities Show Strong Resolve

South Korea's Exchange Rate and Exports Influenced by China's Growth and Yuan Trends

China's Situation Key Variable Ahead of Next Month's Monetary Policy Meeting

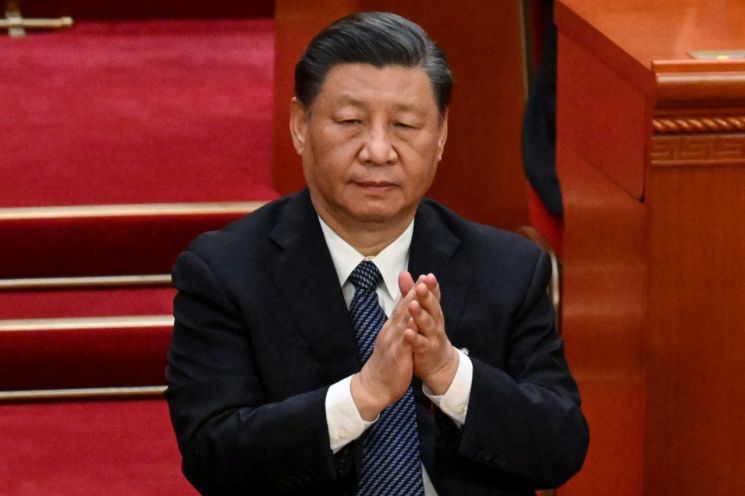

Chinese President Xi Jinping is clapping at the 5th plenary session of the 1st meeting of the 14th National People's Congress (NPC) held at the Great Hall of the People in Beijing on the 12th. [Image source=Yonhap News]

Chinese President Xi Jinping is clapping at the 5th plenary session of the 1st meeting of the 14th National People's Congress (NPC) held at the Great Hall of the People in Beijing on the 12th. [Image source=Yonhap News]

As analyses emerge suggesting that China's economic recovery is slower than expected, attention is focused on how China's anticipated accommodative monetary and fiscal policies this year will impact our economy. If the People's Bank of China, the central bank, injects liquidity to boost domestic demand and the real estate market, it could help stabilize our exports and exchange rates. However, if China's economic recovery does not meet expectations, it could add further burden to an already negative economic outlook.

Hesitation Despite Reopening... Concerns Over China's Recovery

According to major foreign media and experts on the 29th, China has declared a reopening (resumption of economic activities) this year and is focusing on promoting domestic consumption and economic openness. However, recent consecutive sluggish performances in manufacturing and consumption have raised concerns about slowing growth. Although global financial instability eased somewhat the previous day, leading to gains in Asian stock markets, the Shanghai Composite Index and the Shenzhen Composite Index closed down by 0.19% and 0.70%, respectively, highlighting the issue of slowing growth.

Recently, KB Financial Group's Management Research Institute pointed out that the excess savings accumulated by Chinese households during the COVID-19 pandemic are unlikely to be converted into consumption immediately. They even noted that "there is a forecast that China's consumption recovery will peak in the second quarter and then enter a slowdown phase again." Chinese manufacturing also remains weak, with corporate profits in January and February this year down 22.9% compared to the same period last year. This is analyzed as a result of a larger decline in sales amid a lack of market demand recovery.

Meanwhile, China is strongly expressing its determination to recover the economy this year. In a report released on the 27th by the Bank of Korea's Beijing office, it was stated, "The Chinese government is expected to focus on promoting domestic demand, stabilizing employment, reform and innovation, and risk management to respond to downward pressures on the domestic and external economy and to sustain a stable economic recovery." It also forecasted that "the People's Bank of China will appropriately utilize selective liquidity supply measures in supporting the real economy."

On the 10th, President Xi Jinping took the constitutional oath at the Great Hall of the People in Beijing, where the 3rd plenary session of the 14th National People's Congress (NPC) was held. [Image source=Yonhap News]

On the 10th, President Xi Jinping took the constitutional oath at the Great Hall of the People in Beijing, where the 3rd plenary session of the 14th National People's Congress (NPC) was held. [Image source=Yonhap News]

People's Bank Injects Liquidity... Expanding Influence of the Yuan

The People's Bank of China has been operating since the 27th of this month with a 0.25 percentage point cut in the bank reserve requirement ratio (RRR). This is expected to supply about 500 billion yuan (approximately 95 trillion won) in liquidity to the market. While the U.S. Federal Reserve (Fed) continues its stance of raising benchmark interest rates, China's move to lower the RRR is interpreted as a sign of its strong focus on economic recovery.

The People's Bank of China is also continuing liquidity supply through reverse repurchase agreements (reverse RPs). The Bank of Korea explained, "From the perspective of supplying long-term liquidity to the real economy, there is a possibility of an additional RRR cut of around 0.25 percentage points once more in the second half of this year." It added, "The People's Bank of China is also expected to lower the 5-year loan prime rate (LPR), which directly affects mortgage loan interest rates, at an appropriate time to ease financial costs for homebuyers."

In particular, China is enhancing the status of the yuan through the development of the offshore yuan market and international trade openness. The New York Times (NYT) reported the previous day that China has lent $240 billion (approximately 312 trillion won) to 22 highly indebted countries worldwide, stating that "China is emerging as a new heavyweight in the international financial market." This has led to analyses suggesting that the long-standing dollar hegemony is being challenged and the yuan's international influence is strengthening.

On the afternoon of the 28th, the closing price of the KOSPI is displayed on the screen in the Hana Bank dealing room in Jung-gu, Seoul. [Image source=Yonhap News]

On the afternoon of the 28th, the closing price of the KOSPI is displayed on the screen in the Hana Bank dealing room in Jung-gu, Seoul. [Image source=Yonhap News]

Focus on China's Recovery... Impact on Korea's Exchange Rate, Interest Rates, and Exports

If China's economy recovers its growth rate and the yuan continues to strengthen, it could benefit our exports, growth, and exchange rate stability. Due to the high economic interdependence between Korea and China, when the yuan appreciates, the won tends to follow, showing strong synchronization. Therefore, China's economic trend is expected to significantly influence the Bank of Korea's benchmark interest rate decision, which is just two weeks away. Lee Chang-yong, Governor of the Bank of Korea, said earlier this month in a press meeting, "Given the uncertainties such as China's economic recovery and the real estate market situation, the consensus among Monetary Policy Committee members is to observe how these developments unfold before deciding on interest rates."

With China becoming Korea's largest trade deficit country this year, China's recovery will inevitably play a crucial role in future exports to China. According to the Korea International Trade Association, the cumulative trade deficit with China for January and February this year reached about 6.6 trillion won, with the main cause being a decline in imports due to China's economic slowdown. Sung Yeon-ju, a researcher at Shin Young Securities, explained, "There is still significant skepticism in the market about China's economic recovery," but added, "From the second quarter, China's fiscal policy is expected to strengthen, and expectations for a recovery in the real estate market will also increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)