Former Ourhome Chairman Koo Bon-sung Demands 300 Billion Won Dividend

Cash Assets of 224 Billion Won... Over 10,000 Employees Strongly Oppose

Eldest Daughter Koo Mi-hyun Holds Casting Vote at Shareholders' Meeting on 4th Next Month

The management dispute among the four siblings of Ourhome, the second-largest catering company in South Korea, has deteriorated into a battle over dividends. Criticism is mounting that the eldest son, who was sidelined in the management dispute, is threatening management stability by demanding dividends worth 300 billion KRW, an amount comparable to Ourhome's cash assets. As a member of the owner family holding a large stake demands an unreasonably high dividend, the financial stability of Ourhome?which handles group catering at about 900 locations nationwide, including corporate cafeterias of large companies?could be severely shaken. The approximately 10,000 employees of Ourhome have also strongly opposed this.

Ourhome Siblings’ Management Dispute Escalates into Dividend War

According to the financial investment industry on the 29th, at the Ourhome shareholders' meeting scheduled for the 4th of next month, the three owner siblings each proposed different dividend plans.

The eldest son, former Ourhome Chairman Koo Bon-sung, demanded dividends of 300 billion KRW, followed by eldest daughter Koo Mi-hyun and Vice Chairman and CEO Koo Ji-eun, who proposed 45.6 billion KRW and 3 billion KRW respectively.

The dividend amount proposed by former Vice Chairman Koo Bon-sung exceeds Ourhome’s cash assets of 224 billion KRW as of the end of 2021, according to the consolidated audit report. This is a large dividend demand that could cause liquidity problems amid the unstable economic situation dubbed the global 'Bankdemic' (bank + pandemic). Despite being an excessive demand, as a non-listed company, Ourhome must put shareholder proposals from shareholders holding more than 3% of shares on the agenda unless they fall under legal or exceptional reasons. If this agenda passes, Koo, who holds 38.6% of shares, would receive over 100 billion KRW. Last year, Koo attempted to sell his shares but, failing to do so, is interpreted as demanding a large dividend to receive all the retained cash assets within the company. It is also interpreted as an attempt to gain negotiating power in board composition changes by using the dividend demand as leverage.

An Ourhome official said, "Shareholder proposals can be withdrawn before the shareholders' meeting, so we hope for reconsideration." The Ourhome labor union stated in a press release, "The absurd dividend demand of 296.6 billion KRW by former Vice Chairman Koo Bon-sung goes beyond personal moral hazard and is an act to ruin the company," adding, "If the company’s image deteriorates and it falls back into management difficulties, the survival of employees will also be threatened."

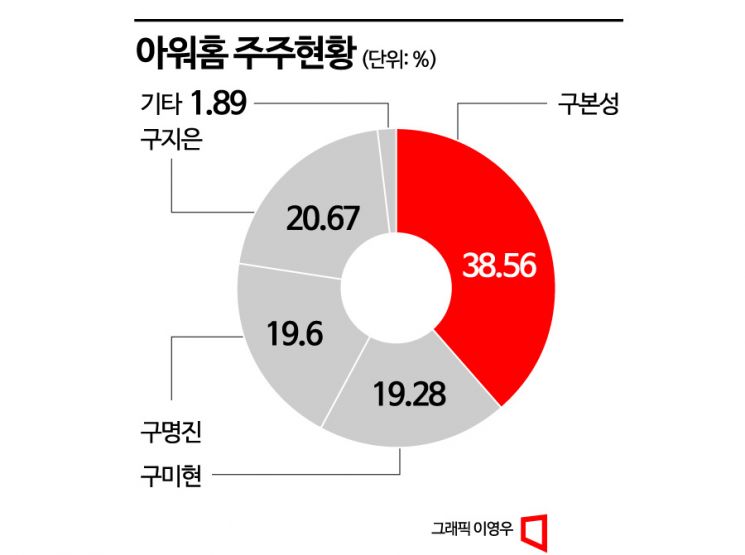

At present, it is difficult to predict which agenda will be adopted. Currently, Ourhome’s one brother and three sisters hold more than 98% of the total shares. The eldest son, former Vice Chairman Koo, holds 38.6%, the youngest sister and Ourhome Vice Chairman Koo Ji-eun holds 20.7%, and eldest daughter Koo Mi-hyun and second daughter Koo Myung-jin hold 19.28% and 19.6% respectively.

Combining the shares of Vice Chairman Koo and second daughter Koo Myung-jin, who have formed a 'sisters' alliance' against former Vice Chairman Koo, amounts to 40.3%, slightly surpassing their brother’s stake, but it falls short of the majority consent of attending shareholders required to pass the dividend resolution. According to Ourhome, former Vice Chairman Koo also demanded 100 billion KRW in dividends at the shareholders' meeting in March last year. However, the side of Vice Chairman Koo responded with no dividends. Subsequently, former Vice Chairman Koo and Koo Mi-hyun requested an extraordinary shareholders' meeting and board reorganization from Ourhome, but these efforts failed.

Management Dispute Continuing Since 2015

The choice of eldest daughter Koo Mi-hyun is the biggest variable at this shareholders' meeting. Although she has currently proposed an independent dividend plan, Koo Mi-hyun has previously allied with her brother and also formed alliances with her sisters. She has played a casting vote role, such as by not attending the extraordinary shareholders' meeting convened by former Vice Chairman Koo to reorganize the board for management rights sale. In 2017, when her brother (former Vice Chairman Koo) and youngest sister (Vice Chairman Koo Ji-eun) fought over management rights, she sided with her brother, but in 2021, when former Vice Chairman Koo was prosecuted for 'retaliatory driving' and received a suspended prison sentence, she joined the other two sisters to dismiss him. Last year, she allied with former Vice Chairman Koo to push for share sales. The plan was to put the combined 57.84% stake?38.56% held by former Vice Chairman Koo and 19.28% held by Koo Mi-hyun?on the market, including a management rights premium. However, a 'joint share sale agreement' previously made among the three sisters became an obstacle.

Meanwhile, Ourhome was founded in 2000 by the late Koo Ja-hak, the third son of Koo In-hoe, the founder of LG Group. It was created by separating LG Distribution’s food service division. Its main businesses are food material distribution and group catering. Until 2015, Ourhome was led by the late Koo Ja-hak and youngest daughter Koo Ji-eun. Among the children, only youngest daughter Koo Ji-eun had been involved in management. Until then, there was no disagreement that Koo Ji-eun would succeed the chairman’s management rights.

However, in 2015, Koo Ji-eun was suddenly removed from her position. The eldest son and brother, former Vice Chairman Koo Bon-sung, took over management of Ourhome. Koo Ji-eun stepped down to become CEO of Calisco, which operates the tonkatsu specialty restaurant Saboten. Then, in 2021, former Vice Chairman Koo was dismissed from his CEO position after causing social controversy due to retaliatory driving. Koo Ji-eun joined forces with her two elder sisters to return to Ourhome’s management. Since then, she has focused on management and succeeded in turning the company profitable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)