Low-cost carriers (LCCs) that had been pushed to their limits are now stretching and preparing to take off. Until recently, they were in a dire situation, covering operating expenses through capital increases and perpetual bond issuances. This was because they could not generate revenue due to COVID-19. However, the situation has changed rapidly. There are even forecasts that LCCs achieved record-breaking performance in the first quarter of this year.

After the so-called endemic phase, they quickly secured medium- and short-haul routes, attracting passengers. As a result, they secured more passengers than before COVID-19. Thanks to this, they are expected to exceed market expectations in performance for the first quarter of this year.

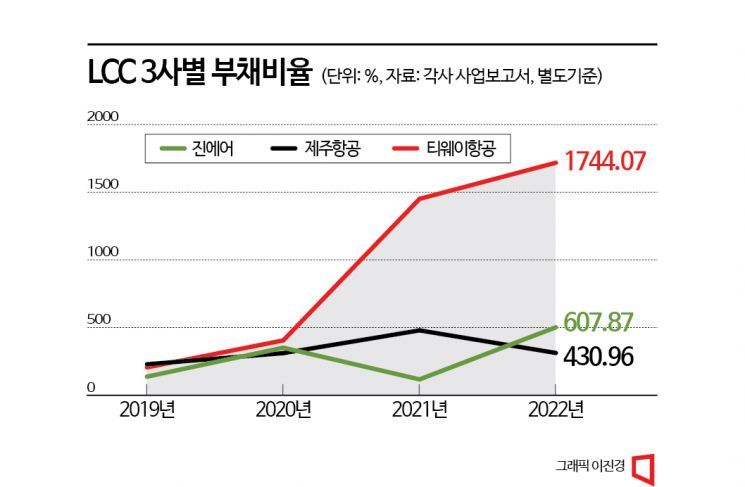

According to Jin Air's business report for last year on the 29th, its debt ratio stands at 607.87%. This is nearly a 340 percentage point increase from 267.37% in 2019. During the same period, Jeju Air's debt ratio rose from 352.74% to 430.96%, and T'way Air's soared from 331.15% to 1744.07%.

LCCs went through difficult times during the COVID period. While FSCs (Full-Service Carriers) achieved record-high performance through cargo and other means, LCCs, whose performance is determined primarily by passenger numbers, suffered from deteriorating financial structures due to poor performance. Many LCCs survived by securing operating funds through capital increases and perpetual bond issuances.

However, this year, as LCCs increased flights on medium- and short-haul routes, the pace of performance recovery has accelerated. In January and February, Jeju Air, Jin Air, and T'way Air recorded average passenger transports of 553,318, 434,873, and 416,090 respectively. In 2019, the averages were 702,317, 427,623, and 411,144 respectively. Jeju Air has recovered to 78.7%, while Jin Air (102.4%) and T'way Air (103.2%) have already surpassed 2019 levels.

Additionally, the environment is becoming more favorable for LCCs. While the number of travelers continues steadily, the shortage of aircraft has caused airfares to rise. Cho Gyo-woon, a researcher at Korea Investment & Securities, said, "Due to deferred overseas travel demand, slot shortages at overseas airports, and slow flight increases, international passenger supply is insufficient. In February, the number of passengers per flight reached an all-time high, and airfares rose more than 20% compared to pre-pandemic levels."

Thanks to this, LCCs are expected to post strong results in the first quarter of this year. According to securities firms (compiled by FnGuide), Jin Air's first-quarter sales and operating profit are projected to be 236.3 billion KRW and 36.9 billion KRW respectively. Jeju Air is expected to achieve 343.7 billion KRW in sales and 51.8 billion KRW in operating profit, while T'way Air is forecasted to record 233.3 billion KRW in sales and 28.6 billion KRW in operating profit. Researcher Cho explained, "LCCs are expected to achieve record-high operating profits in the first quarter immediately after turning profitable in December last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.