Domestic Battery Inventory Doubles in One Year

Rising Inventory in China Raises Concerns Over Price Cuts

Margins Likely to Shrink If High Purchase Costs Are Not Reflected

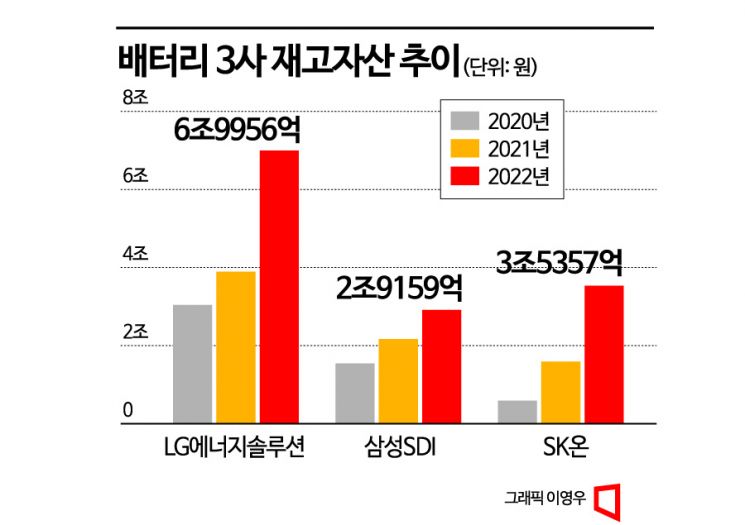

Inventory is piling up in the battery industry. The combined inventory held by three domestic battery companies, which have made large-scale investments in the US and Europe at a rapid pace, amounts to 14 trillion KRW. As electric vehicle sales slow down, there are concerns that the industry may fall into an overproduction state similar to that of China. The batteries were made using raw materials purchased during a period of soaring prices last year, but with recent price declines, profit margins are also expected to shrink.

As of the end of last year, LG Energy Solution's inventory assets stood at 6.9956 trillion KRW, a 79.5% increase from 3.8958 trillion KRW the previous year. The book value of inventory reached 7.1738 trillion KRW, resulting in an impairment loss of 178.1 billion KRW. SK On and Samsung SDI have also accumulated inventory assets worth 3.5357 trillion KRW and 2.9159 trillion KRW respectively, representing increases of 122.0% and 34.4% compared to the previous year.

Despite global expectations for rapid electrification of internal combustion engines, concerns have been raised that electric vehicle demand may slow due to economic recession and worsening inflation. This inevitably leads to sluggish sales and increased inventory in the battery industry, which is central to electric vehicles.

Most of the inventory held by battery companies consists of finished or semi-finished products, which could translate into sales if electric vehicle demand recovers. However, due to the high cost of raw materials purchased, profit margins are expected to shrink, making losses unavoidable.

LG Energy Solution purchased key raw materials such as cathode and anode materials worth 14.7348 trillion KRW last year, a 52.3% increase from 9.6723 trillion KRW the previous year. The price of cathode materials rose from $16.4 per kg in 2020 to $21.8 in 2021, and reached a staggering $43.9 last year. This means material costs more than doubled in two years.

Chinese companies, which produce more batteries than our domestic firms, have already lowered sales prices due to excess inventory.

CATL, the world's number one battery manufacturer, recently announced a lithium profit return plan that reflects only half the market price of lithium carbonate, a key raw material for electric vehicle batteries. This is expected to put pressure on other battery companies in China to reduce prices.

While the US and Europe are expanding sales incentives to promote the transition to electric vehicles, the Chinese government has stopped supporting electric vehicles since the end of last year, raising concerns that battery inventory will continue to increase. The accumulated inventory of power batteries (lithium-ion and nickel-metal hydride batteries) in China surged from 13.6 GWh in 2018 to 19.8 GWh in 2020, 65.2 GWh in 2021, and 251 GWh in 2022. Battery inventory nearly quadrupled compared to the previous year just last year.

As battery inventory accumulates, raw material prices for batteries have also been falling together this year. Lithium carbonate was priced at 474.5 yuan per kg early this year but dropped 54% to 216.5 yuan as of the 28th. Nickel (-26.9%) and cobalt (-34.4%) have also followed downward trends during the same period.

The problem is that raw material prices are directly reflected in battery prices. The battery industry is closely watching whether automakers will demand lower supply prices reflecting the decline in raw material costs. A battery industry official explained, "Since prices were linked during the period of raw material price increases, prices must be lowered as prices fall," but added, "A temporary surge in inventory due to production facility expansion is unavoidable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)