Credit spreads have risen about 20bp this month

Concerns over interest rate fluctuations and banking sector liquidity crisis coincide

If investor sentiment improves, long-term credit bond yields will become more attractive

Concerns over the "Bankdemic" (Bank + Pandemic) are shaking the domestic credit market. The chain of crises involving Silicon Valley Bank (SVB), Credit Suisse (CS), and Deutsche Bank has cooled investor sentiment toward credit. As companies preparing to submit their March financial reports sharply reduce their bond issuance, institutional investors participating in bond issuance are also showing more cautious sentiment compared to the beginning of the year.

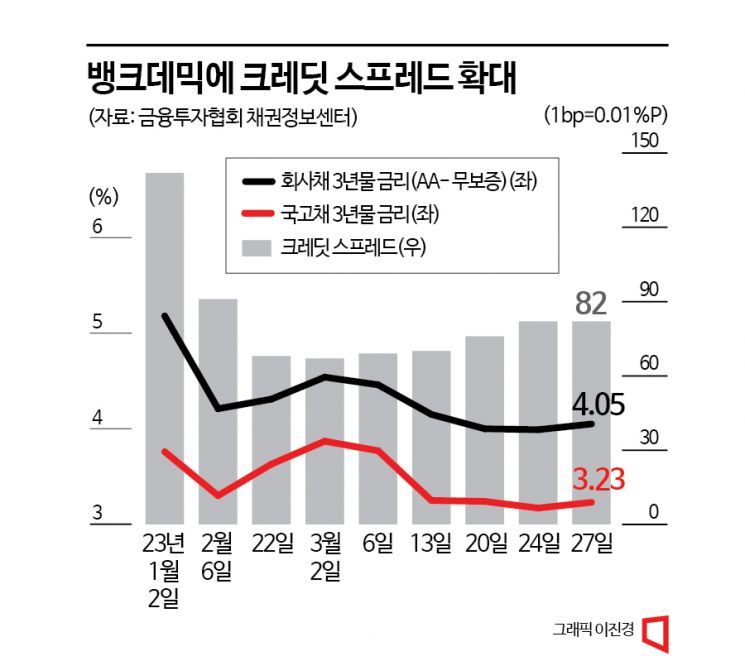

According to the bond industry, the credit spread (the difference between the 3-year corporate bond yield with a credit rating of 'AA-' and the 3-year government bond yield), which reflects bond issuance investor sentiment, stood at 82 basis points (bp) as of the 27th (1bp = 0.01 percentage point). Although it dropped by more than half from 140bp in January to below 67bp earlier this month, it is now on the rise again. Looking at the absolute interest rate levels, the 3-year government bond yield fell by about 65bp to 3.23% compared to early this month, but the 3-year corporate bond yield only decreased by about 50bp from 4.54% to 4.05%. This is attributed to the dampened corporate bond investor sentiment following reports that liquidity crises have affected not only small and medium-sized U.S. banks but also major global banks. In particular, during UBS's acquisition of CS, the exclusion of the value of hybrid capital securities caused individual investors' appetite for bonds to freeze.

Additionally, with increased interest rate volatility this month, bond demand aiming to secure liquidity smoothly seems to have shifted from corporate bonds to government bonds. Eun-ki Kim, a researcher at Samsung Securities, explained, "To respond to interest rate market conditions, investments are inevitably focused on government bonds, which have better liquidity than corporate bonds," adding, "The end of the short-term company bond and commercial paper (CP) demand shifting to government bonds was also influenced by the expiration of the money market fund (MMF) market valuation system waiver in April."

The issuance market is also quiet. The strong issuance market seen at the beginning of the year has cooled off as companies face the issue of submitting their March financial reports. Looking at net corporate bond issuance this year, January saw 3.768 trillion KRW, February 4.308 trillion KRW, but this month is expected to fall short of 2 trillion KRW.

The results of companies that conducted demand forecasts have not been very favorable. Samcheok Blue Power (A+) attempted to raise 225 billion KRW in 3-year bonds but failed to meet the target with a zero effective competition rate. Hyundai Motor Securities also conducted demand forecasts for 2-year and 3-year bonds totaling 100 billion KRW, but the final coupon rate was set at the top of the public offering rate band (0.4%p), with effective competition rates of only 1.2 times and 0.5 times, respectively. Only Hyundai Infracore (A-), whose credit rating was strengthened after joining the HD Hyundai Group, successfully raised 50 billion KRW in 1.5-year and 2-year bonds with effective competition rates of 10.6 times and 8.7 times, respectively, resulting in an undersubscribed issuance. Korea Asset Valuation explained, "Issuance market performance varied depending on the company's fundamentals and industry conditions," adding, "In the case of Samcheok Blue Power, investor sentiment toward the coal and thermal power generation industry turned negative as ESG interest expanded."

Credit Spread Expected to Rise Further

Bond experts predict that credit spreads will rise further as institutional investors' risk aversion increases for the time being. Especially for lower-rated bonds, considering the strong issuance market and the sharp decline in credit spreads at the beginning of the year, the increase is expected to be more significant. However, they do not expect credit spreads to widen as much as during the Legoland incident in October last year. This is because, amid declining earnings of domestic companies and downward revisions of stock market earnings per share (EPS), government bond yields are rapidly falling, making it necessary to include corporate bonds in investment portfolios to enhance returns.

Researcher Eun-ki Kim stated, "Even long-term government bonds are trading well below the base interest rate, making it impossible to expect capital gains from further interest rate declines," adding, "To achieve returns above the funding cost, credit investment (raising funds privately to invest in corporate bonds, loans, structured products, etc.) is necessary, and with the widening of long-term credit spreads, long-term credit bonds will attract attention going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)