Decline in REIT Stocks Amid Worsening Commercial Real Estate Slump

Undervalued Food and Beverage Companies Show Clear Earnings Improvement

As the bankruptcy of the US Silicon Valley Bank (SVB) has spread to the acquisition of Credit Suisse (CS) and the crisis at Deutsche Bank, the aftermath of the 'Bankdemic (Bank + Pandemic)' continues, drawing attention to food and beverage stocks, which have a strong defensive nature in the economy. In contrast, REITs (Real Estate Investment Trusts) stocks, which had risen earlier this year on expectations of a peak in interest rates, are freezing as forecasts spread that the Bankdemic will deepen the commercial real estate slump.

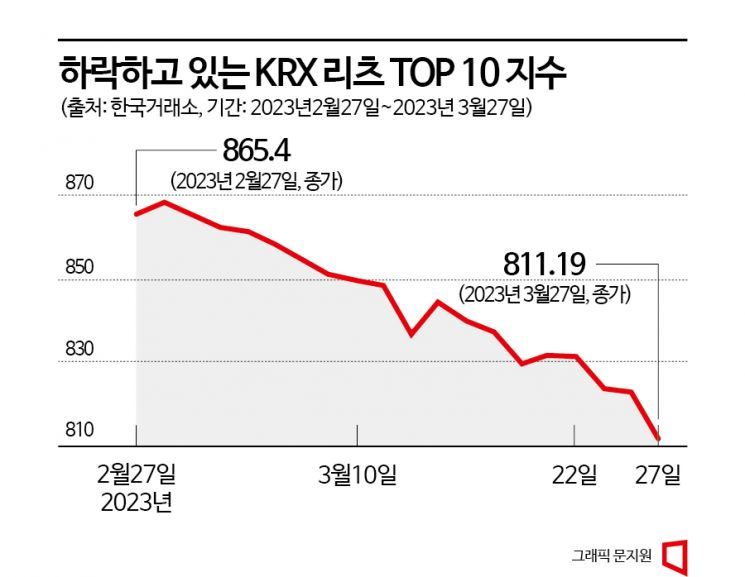

According to the Korea Exchange on the 28th, the KRX REITs TOP 10 index closed at 811.19, down 1.38% from the previous trading day. The KRX REITs TOP 10 index is calculated by weighting the top 10 REIT stocks listed on the KOSPI market by market capitalization with free float market capitalization. The current components of the KRX REITs TOP 10 index include SK REITs, Lotte REITs, JR Global REITs, ESR Kendall Square REITs, Koramco Energy REITs, KB Star REITs, Shinhan Alpha REITs, iREITs Co-KREP, D&D Platform REITs, and Shinhan West T&D REITs.

This represents a 6.26% decrease over the past month (February 27 to March 27). Although the decline is not as steep as the approximately 16% plunge during the Legoland incident in October last year, the atmosphere has clearly changed compared to earlier this year when REITs stocks were highlighted amid growing expectations of a peak in interest rates.

The cooling sentiment toward REITs stocks is due to the Bankdemic triggered by the SVB incident. The global banking crisis has negatively impacted commercial real estate loans and financing, spreading pessimistic forecasts that the real estate slump will deepen.

In fact, Hanwha REITs, which holds major group real estate assets including the Hanwha General Insurance headquarters, recorded poor performance on its first day of listing on the 27th. On that day, Hanwha REITs closed down 7.96% at 4,510 won, due to simultaneous selling by foreign and institutional investors.

In the securities industry, there are forecasts that food and beverage stocks, which have a strong defensive nature in the economy, could be an alternative even amid the Bankdemic. This is because their earnings improvement trend is clear while their stock prices remain undervalued. Additionally, the decline in raw material grain prices is reducing cost burdens, which is another attractive factor.

According to financial information provider FnGuide, Lotte Confectionery's operating profit in the first quarter of this year is expected to increase by 106.01% year-on-year to 22.2 billion won. Nongshim is expected to increase by 29.01% to 44.3 billion won. This earnings improvement trend is expected to continue into the second quarter.

Yang Hae-jung, a researcher at DS Investment & Securities, analyzed, "Since cash cannot be the most important asset, it is recommended to focus on companies with stable cash flow when selecting investment companies. In particular, food and beverage sectors have traditionally had high profit stability." Park So-yeon, a researcher at Shin Young Securities, also advised, "Food and beverage stocks, which have a strong defensive nature during economic recessions, can be an alternative for investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)