"Health Insurance Premiums Must Be Paid" Emphasized

0.017% (3,326 People) Pay 4 Million Won

40% of Median Income Exempt from Payment

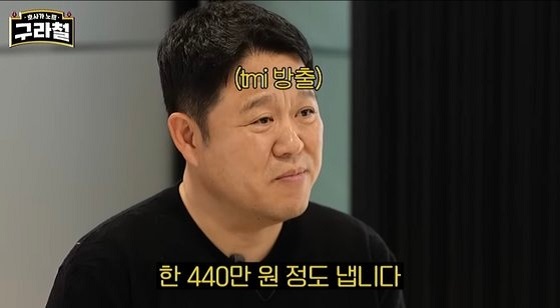

Broadcaster Kim Gura is known to pay 4.4 million KRW monthly for health insurance premiums, drawing attention to the premium cap and taxpayer ratios.

On the 27th, a video titled "I Earned Money, So Why Do I Pay Taxes?! The Story of a Tax Officer from the National Tax Service Who Got Angry" was posted on Kim Gura's YouTube channel 'GuraCheol,' featuring Kim visiting a tax accountant in the Gangnam area to receive tax education.

During the tax education session, Kim revealed, "I pay about 4.4 million KRW for medical insurance."

He added, "I’m not even sick. I don’t go to the hospital. But still, I pay 4.4 million KRW every month for medical insurance," emphasizing, "This is something I have to pay."

In response, the tax accountant showed a shocked expression, highlighted by the subtitle 'Shock,' and Chae Tae-in, who appeared alongside, asked, "Does that mean you have a lot of assets?"

The production team displayed an article via subtitles stating, "Health insurance premiums for employees earning over 110 million KRW per month are 4 million KRW."

Kim explained, "In the past, I was a beneficiary of livelihood protection, so I didn’t pay medical insurance. But as I started paying more taxes, from this year I also had to pay medical insurance, and the amount became unimaginable."

4 million KRW per month corresponds to the top 0.017%... 40% of median income exempt from health insurance premiums

The 2023 health insurance premium cap is set at 7,822,560 KRW, which is 515,460 KRW higher per month than last year. Since workplace subscribers share the cost equally with their companies, the actual maximum amount an individual pays is 3,911,280 KRW per month.

The maximum monthly salary amount for premium calculation translates to 110.33 million KRW.

Because workplace subscribers split the premium with their companies, the actual maximum premium paid by the subscriber is 3,911,280 KRW per month.

According to data titled 'Status of Subjects Paying the Maximum Monthly Salary Insurance Premium' submitted by the National Health Insurance Corporation to the office of National Assembly Health and Welfare Committee member Choi Hye-young on the 23rd, 3,326 high-income workplace subscribers paid the maximum premium as of January this year.

This accounts for approximately 0.017% of the total 19.59 million workplace subscribers as of December 2022, excluding dependents.

When considering the monthly health insurance premiums paid, these high-income workplace subscribers earning about 110 million KRW monthly are mostly owners of large or small-to-medium enterprises earning tens or hundreds of billions of KRW annually, executives, professional CEOs, or chaebols (conglomerate) heads.

On the other hand, the minimum health insurance premium is 19,780 KRW. However, those with income below 40% of the median income are designated as medical aid recipients and are not subject to health insurance enrollment, thus exempt from paying premiums.

Health insurance subscribers in the top 10% income bracket can receive a refund for any medical expenses exceeding 7.8 million KRW paid during 2023. Those in the bottom 10% income bracket can receive a refund for amounts exceeding 870,000 KRW.

For long-term care hospitals, separate standards apply from 2023. Patients in the top 10% income bracket must pay up to 10.14 million KRW themselves, while those in the bottom 10% pay up to 1.34 million KRW, with any excess refunded.

Meanwhile, as our society gradually enters an aging society, discussions on raising health insurance premium rates continue. Under current law, premiums can be increased up to 8%.

Using 2021 figures as examples, major countries’ insurance premium rates include Germany at 14.6% and France at 13.0%, fueling ongoing discourse on the statutory upper limit for health insurance premium increases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)