Pension Fund Expected to Deplete by 2055, Health Insurance Reserves by 2028

Urgent Reforms Needed to Ensure System Sustainability and Reduce Future Burden

Macron Government Pushes Pension Reform at Political Risk

Concerns have been raised that the National Pension and Health Insurance, both facing financial crises threatening their sustainability, must be reformed promptly.

The Korea Economic Research Institute (hereinafter KERI) stated on the 27th that, referring to the pension reform of the Macron government in France, courageous decisions and strong driving force from the government and political circles are necessary for pension and health insurance reform in South Korea.

The Ministry of Health and Welfare recently announced the results of the 5th financial projection of the National Pension, stating that the point of deficit will be in 2041 and the fund exhaustion point in 2055. Compared to the 4th projection in 2018, the deficit point has been moved forward by one year and the fund exhaustion point by two years. KERI claims that the rapid acceleration of low birth rates and aging population, combined with successive governments hesitating to reform the pension system, has brought forward the depletion of the National Pension fund.

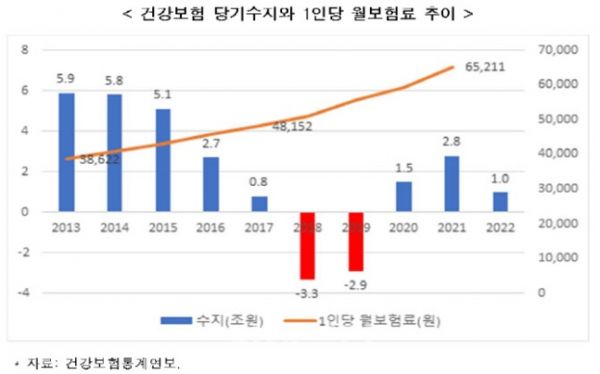

According to related statistical yearbooks, Health Insurance had a surplus ranging from 2.7 trillion to 5.9 trillion KRW annually between 2013 and 2016, but began to deteriorate from 2017, recording deficits of 3.3 trillion KRW and 2.9 trillion KRW in 2018 and 2019, respectively. In September last year, the National Health Insurance Service also projected that deficits would begin in 2023 and that the current reserve fund of about 20 trillion KRW would be depleted by 2028.

Researcher Lim Dong-won of KERI emphasized, "If pension and health insurance are not reformed in some way, the system will collapse," adding, "We must reform the system considering the changing population and economic conditions and move forward."

KERI focused on France’s pension reform plan. To secure the financial soundness of the pension fund, the Macron government’s reform plan, which was effectively passed by the parliament following the rejection of a no-confidence motion against the prime minister, extends the retirement age from the current 62 to 64, increases the insurance contribution period from 42 to 43 years, and slightly raises the minimum pension floor. President Macron took the unprecedented step of legislating the pension reform without a vote in the lower house, which led the opposition party to submit a no-confidence motion against the prime minister and labor unions to hold large-scale protests, putting his political career at risk. However, maintaining the current system would result in a pension deficit of 13.5 billion euros (approximately 18.8 trillion KRW) by 2030.

Researcher Lim pointed out, "The longer pension reform is delayed, the greater the burden on future generations, clearly worsening intergenerational inequality," and criticized, "Compared to France, which showed courageous decisions and strong driving force for pension reform, our government and political circles are only stalling for time."

He continued, "The longer pension and health insurance reforms are delayed, the more their financial deficits will be covered by government subsidies, significantly increasing taxpayers’ tax burdens," and argued, "In the short term, efforts should be made to improve financial balance by adjusting insurance rates and pension payment rates for each pension, and in the long term, the four major public pensions should be consolidated to resolve fairness issues between systems."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)