Global Monetary Policies 'Every Country for Itself'

Vietnam and Costa Rica Cut Rates... South Korea and Canada Hold Steady

High Interest Rates Increase Economic Burden... Decoupling Accelerates

SVB Bankruptcy Adds Pressure on Hikes

Emerging Markets Fear Capital Outflow Boomerang

Countries that had followed the United States, an economic powerhouse, in raising benchmark interest rates have begun to slow the pace of hikes. This contrasts with last year when many rushed to "catch up" with U.S. rate hikes to narrow domestic-foreign interest rate differentials and curb high inflation amid the U.S.'s aggressive tightening. To reduce the economic burden caused by high interest rates, several countries including South Korea have started to either freeze or lower their rates. Following soaring inflation, fears of a liquidity crisis hitting the U.S. and Europe are being reflected in a decoupling of interest rates between the U.S. and other countries.

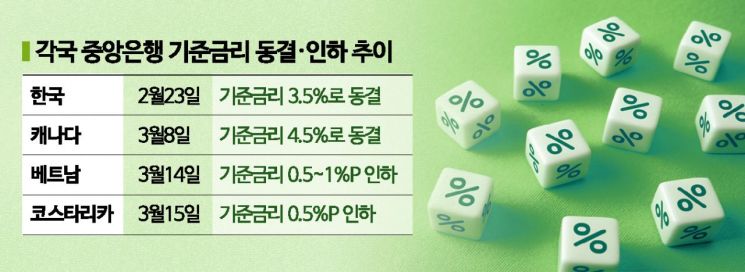

According to major foreign media on the 24th, the State Bank of Vietnam cut its benchmark interest rate by 0.5 to 1 percentage point on the 14th. This was the first rate cut by the central bank in 2 years and 5 months since October 2020. The rediscount rate, which is the rate applied when the central bank lends to commercial banks, was lowered from 4.5% to 3.5%, and the overnight interbank lending rate was reduced from 7% to 6%.

Costa Rica, a member of the Organisation for Economic Co-operation and Development (OECD), also lowered its benchmark interest rate by 0.5 percentage points to 8.5% this month. This is the first rate cut among South American countries experiencing soaring inflation (7.9% annual consumer price inflation in 2022, the highest in 14 years).

Some countries are keeping their rates steady. Among the Group of Seven (G7), the Bank of Canada was the first to officially halt rate hikes by freezing its benchmark interest rate at 4.5% this month.

South Korea, which had raised rates for a year straight, froze its benchmark interest rate at 3.5% last month. The prevailing forecast is that the current rate level will be maintained next month as well. This path differs from that of the Bank of England (BOE) and the Swiss National Bank (SNB), which continued tightening by raising rates by 0.25 and 0.5 percentage points respectively following the U.S. rate hike of 0.25 percentage points on the 22nd (local time).

Countries choosing to decouple from the U.S. had initially tried to keep up with U.S. rate hikes to curb inflation caused by liquidity unleashed during the COVID-19 pandemic last year. However, due to differing economic strengths and the increasing burden of interest repayments and financing costs on households and businesses constraining growth, they have opted for a different path from the U.S.

According to the International Monetary Fund (IMF), emerging markets' economic growth averaged 4.8% from 2012 to 2018 before the COVID-19 pandemic, but is expected to decline to 4.0% this year and 4.2% next year.

The recent collapse of Silicon Valley Bank (SVB) in the U.S. earlier this month has also made the Federal Reserve's (Fed) rate hikes more burdensome, which is cited as another reason for decoupling from the U.S. Fed Chair Jerome Powell viewed the SVB failure as an issue limited to some banks, but many countries are gripped by fears of contagion to the global financial system.

There are even forecasts that more emerging countries will cut benchmark interest rates within this year. The U.S. investment bank JP Morgan predicts that five countries?Hungary, Chile, Peru, the Czech Republic, and Colombia?will lower rates in the second or third quarter.

However, this "every country for itself" style of monetary policy raises warnings that it could backfire and pose risks to each country. The International Finance Center stated, "If market instability caused by the recent SVB incident is alleviated through effective government responses, the advanced economies' rate hike trend due to persistent high inflation may re-emerge," adding, "Emerging countries will find it increasingly difficult to go against major countries' monetary policies due to concerns about capital outflows and currency instability, and there is a risk that high policy rates will increase economic burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)