Price Surge as Bitcoin Seen as Safe Haven Amid SVB·CS Crisis

Rapid Rise from $19,000 to $27,000 Range

Bitcoin Gains Attention as Alternative Amid Weakening Trust in Banking System

As the financial market is shaken by the bankruptcy of the U.S. Silicon Valley Bank (SVB) and the liquidity crisis of Swiss investment bank Credit Suisse (CS), the virtual asset market is unexpectedly enjoying a ripple effect. Due to financial risks, the coin market is being recognized as a safe haven. If financial risks do not disappear, this trend is expected to continue.

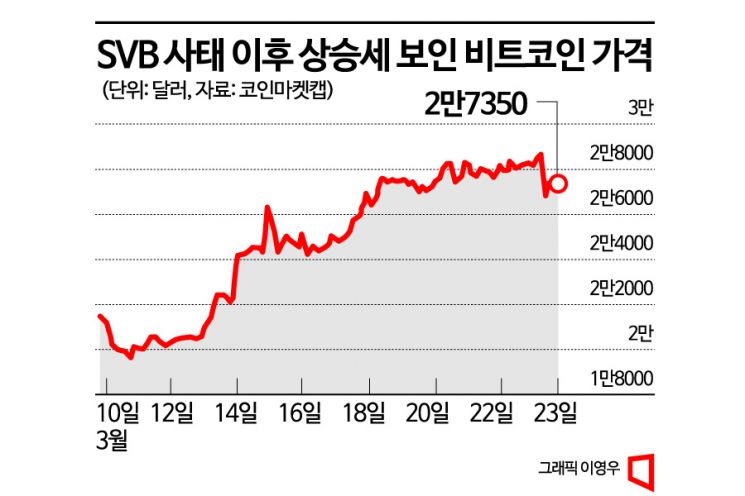

According to CoinMarketCap, a global virtual asset market status relay site, since the SVB bankruptcy crisis intensified on the 10th of this month, the price of Bitcoin has started to rise. The price, which was in the $19,000 range, rose to $27,350 (approximately 35.04 million KRW) as of 2:05 PM on that day. During this period, the price of Bitcoin surged by more than 40%. The previous day, it even exceeded $28,700. However, on the day of the March Federal Open Market Committee (FOMC) regular meeting, the Federal Reserve (Fed) raised the benchmark interest rate by 0.25 percentage points, and Fed Chair Jerome Powell stated that he does not expect a rate cut this year, causing a decline that day.

The recent sharp rise in Bitcoin prices is because the virtual asset market has been recognized as a safe haven among investors. As risks such as bankruptcy and liquidity crises emerged in the banking sector and trust was shaken, funds flowed into the coin market. The virtual asset specialized media CoinDesk evaluated, "As traditional finance faces turmoil, Bitcoin has emerged as a safe haven."

According to economic media CNBC, on the 23rd (local time), Oliver Lynch, CEO of Bittrex Global, said, "This (virtual asset) rally can be explained by investors being scared due to the collapse of the banking system." CNBC also reported that Bitcoin supporters have claimed that Bitcoin is a kind of digital gold, an inflation hedge, and a safe asset to invest in times of turmoil.

After the SVB and CS incidents, virtual asset trading increased, and the amount of Bitcoin held by exchanges also rose sharply. According to data from virtual asset data provider CryptoQuant, the number of Bitcoins held by exchanges was counted at 2,142,550 on the 10th of this month but increased to 2,208,659 on the 20th. Additionally, the number of virtual asset transfers also increased significantly. According to blockchain company Lotoda, the number of transfers on the Web 3.0 digital asset wallet platform 'Bithumb Burrito Wallet' from the 6th to the 12th of this month increased more than fourfold compared to the previous week. Especially on the 10th, when the news of SVB's bankruptcy was announced, the number of transfers increased more than ninefold compared to the weekly average.

However, there are voices suggesting that interest in the virtual asset market as a safe haven may decrease somewhat as recent financial risks ease. UBS acquired CS, and 11 major U.S. banks, including JP Morgan, have deposited a total of $30 billion to support liquidity for First Republic and are considering additional support.

Experts, however, predict that interest in the virtual asset market as a safe haven will be maintained for the time being. Professor Hwang Seok-jin of Dongguk University Graduate School of International Information Security explained, "Although financial risks are easing, they are still ongoing, so there is a high possibility that investment funds will flow into the virtual asset market," adding, "It seems that it will take a little more time for the overall financial market to stabilize." Lee Mi-seon, head of the research center at Bithumb Economic Research Institute, explained, "Although the possibility of a chain bank run (massive withdrawal of deposits) has been somewhat blocked after the SVB bankruptcy, Bitcoin's role as an alternative to the weakening trust in the banking system has been highlighted," and added, "Bitcoin demand in the U.S. is estimated to have continued even after SVB."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)