Active Net Buying of US Bank Stocks After SVB Crisis... 3x Leverage Investments Too

"Bank Stock Volatility to Increase After March FOMC... Growing Concerns Over Losses"

At the March Federal Open Market Committee (FOMC) meeting, Jerome Powell, Chair of the Federal Reserve (Fed), raised interest rates by 25 basis points (1bp = 0.01 percentage points) despite liquidity crises at U.S. banks, increasing volatility in bank stocks. Since he stated that the rate hike stance would be maintained, concerns about banks' liquidity crises are not expected to subside easily. Prior to this, Seohak Gaemi investors aggressively bought bank stocks, hoping for a shift in the Fed's interest rate policy, regardless of news about bank failures.

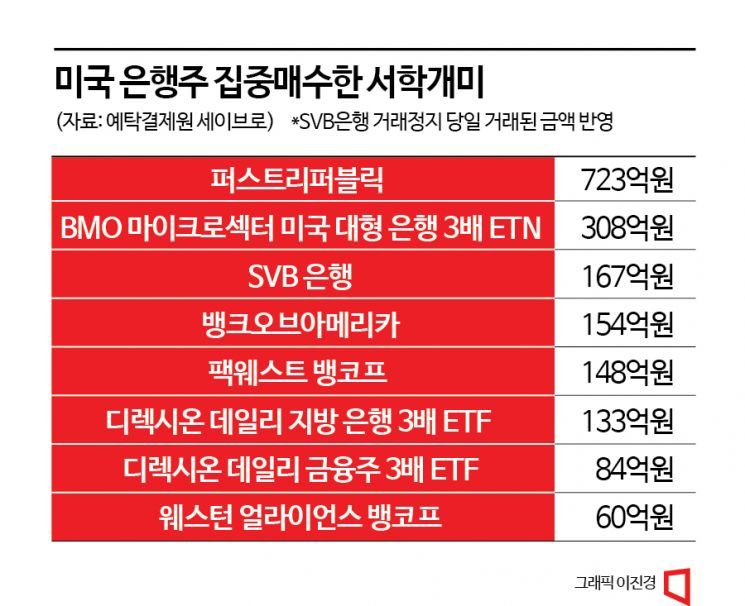

According to the Korea Securities Depository's securities portal system, SEIBRO, overseas stock investors purchased 72.3 billion KRW worth of First Republic Bank shares from March 13, when the Silicon Valley Bank (SVB) bankruptcy crisis emerged, through March 22. This was the third-largest net purchase amount among overseas stock investors. Moreover, among the top 1 to 20 most purchased stocks by overseas investors were Bank of America (BOA) at 15.4 billion KRW, PacWest at 14.8 billion KRW, and Western Alliance Bancorp at 6 billion KRW. Following the SVB bankruptcy on March 10 and UBS's acquisition of Credit Suisse (CS), bank stocks plummeted, prompting investors to flock in anticipation of a rebound.

Seohak Gaemi investors, aiming for a quick profit, also boldly purchased leveraged products that could incur triple losses if stock prices fell. They net bought 30.8 billion KRW worth of the ‘BMO Microsector U.S. Big Banks 3x ETN,’ which invests in major U.S. banks such as Bank of America, Charles Schwab, and Truist Financial. They also purchased significant amounts of the ‘Direxion Daily Regional Banks 3x ETF’ (13.3 billion KRW) and the ‘Direxion Daily Financial Bull 3x ETF’ (8.4 billion KRW).

The dominant analysis is that domestic investors were able to buy U.S. bank stocks in a short period due to expectations that the Fed would take a dovish stance at the March FOMC. The market anticipated that the Fed might decide to hold rates steady or adjust the dot plot, given the increasing number of banks facing capital adequacy concerns. However, at the March FOMC, Chair Powell stated, "Rate cuts are impossible this year, and rate hikes will continue," sharply dampening investors' expectations. Lee Kyung-min, a researcher at Daishin Securities, said, "Chair Powell tried to calm fears about the banking system but failed to provide a clear solution. Before more banking issues arise, he raised rates further to achieve the 2% inflation target, causing disappointment."

With expectations for rate cuts disappearing, volatility in bank stocks is expected to increase. U.S. Treasury Secretary Janet Yellen's statement that she is not considering comprehensive insurance for bank deposits also negatively affected investor sentiment. Seo Sang-young, a researcher at Mirae Asset Securities, explained, "Bank stocks quickly declined after Chair Powell stated there would be no rate cuts. Although he claimed the banking system remains robust and proceeded with rate hikes, his mention that credit conditions are deteriorating due to this incident will burden bank stock prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)