Over 100,000 People Caught... Half Are Aged 50 and Above

Forgery of Medical Certificates and Excessive Hospital Surgery Charges Persist

#2. Mr. B preselected locations with habitual traffic congestion or bottlenecks where vehicle flow was slow and lane changes were restricted by solid lines as crime scenes. He then deliberately caused multiple staged accidents by changing lanes without slowing down or taking evasive actions, even though accidents could have been prevented by vehicles changing lanes.

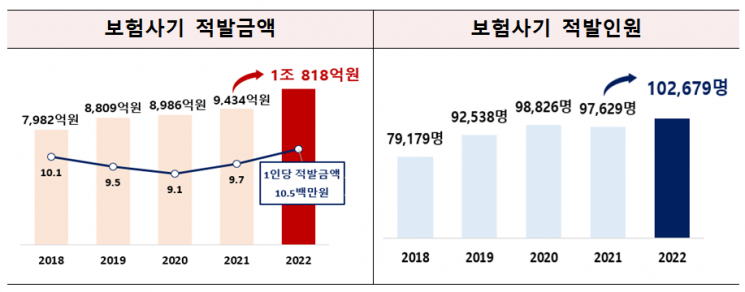

Last year, the amount of insurance fraud detected exceeded 1 trillion won for the first time ever, and the number of people caught surpassed 100,000. The proportion of fabricated accident details, such as falsified medical certificates and excessive claims for hospitalization and surgery fees, still accounted for more than half.

According to the Financial Supervisory Service on the 23rd, the amount of insurance fraud detected last year was 1.0818 trillion won. This is a record high, increasing by 14.7% (138.4 billion won) compared to the previous year. The number of people caught also rose by 5.2% (5,050 people) to 102,679. The average amount detected per person was 10.5 million won, continuing the trend of high-value fraud.

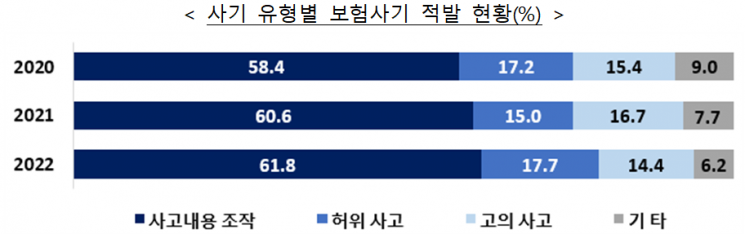

Among types of fraud, fabricated accident details accounted for the largest share at 61.8% (668.1 billion won), followed by false accidents at 17.7% (191.4 billion won), and intentional accidents at 14.4% (153.3 billion won).

Within fabricated accident details, falsification of medical certificates and excessive claims for hospitalization and surgery fees made up the largest portion at 36.9% (246.8 billion won). The growth rate was also steep, increasing by 34.5% (63.3 billion won) compared to the previous year.

Most insurance fraud occurred in non-life insurance. The amount detected in non-life insurance alone reached 1.0237 trillion won (94.6%). Life insurance accounted for only 58.1 billion won (5.4%). The significant increase in fraud related to false (excessive) hospitalization, diagnosis, disability, and injury/disease insurance products led to the large rise in non-life insurance fraud detection.

By age group, nearly half of those caught were aged 50 or older. Those in their 50s accounted for the largest share at 24.0% (24,631 people), and the proportion of elderly aged 60 and above increased by 2.4 percentage points from the previous year to 22.2%. Meanwhile, the share of those in their teens and twenties, which had been increasing recently, slightly decreased to 17.3% from 21.0% the previous year.

By occupation, company employees accounted for 19.1%, unemployed/daily workers 11.1%, full-time homemakers 10.6%, and students 4.9%. The proportion of related professionals such as insurance planners, medical personnel, and automobile repair workers was 4.3% (4,428 people), slightly down by 0.1 percentage points from the previous year.

The Financial Supervisory Service stated, "We will strengthen investigations and detections of organized insurance fraud in cooperation with investigative authorities, the National Health Insurance Service, and the Health Insurance Review & Assessment Service. Additionally, we plan to continuously enhance systems and work practices to prevent insurance fraud, as well as prevention education and promotional activities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)