Bank of Korea's Q4 Last Year 'Financial Stability Report'

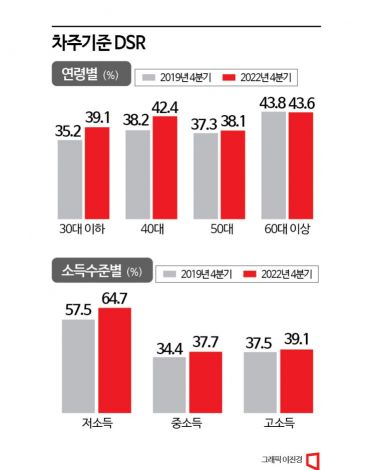

DSR Increase Larger for Under 30s and 40s Over Past 3 Years

DSR Rises More for Low-Income Groups

The younger and lower-income groups have seen a significant increase in debt burden over the past three years. This is due to a sharp rise in their total debt service ratio (DSR). DSR refers to the ratio of principal and interest repayments to the borrower's income.

According to the 'Financial Stability Report' released by the Bank of Korea on the 23rd, compared to the fourth quarter of 2019, the DSR in the fourth quarter of last year increased by 3.9 percentage points for those aged 30 and under (35.2% → 39.1%) and by 4.2 percentage points for those in their 40s (38.2% → 42.4%). In contrast, the 50s age group saw only a 0.8 percentage point increase (37.3% → 38.1%), and the 60s age group experienced a 0.2 percentage point decrease (43.8% → 43.6%).

During the same period, the DSR for low-income households rose by 7.2 percentage points (57.5% → 64.7%), a larger increase than that of middle-income households (34.4% → 37.7%) and high-income households (37.5% → 39.1%).

It was also found that loans are concentrated among borrowers with high DSRs. As of the fourth quarter of last year, borrowers with a DSR exceeding 70% accounted for 1.5 out of every 10 borrowers (15.3%), but their share of total loans was 41.9%. Among vulnerable borrowers, 6 out of 10 (61.3%) had a DSR over 40%.

Since financial authorities strengthened DSR regulations last year, positive effects have also emerged. The DSR of new borrowers in the fourth quarter of last year was 17.3%, down from 23.8% in the fourth quarter of 2020, before the DSR regulations were tightened. During the same period, the DSR of borrowers who took out additional loans also decreased (62.6% → 61.3%). In particular, the DSR of new unsecured loan borrowers dropped from 38.0% to 29.3%.

The average DSR of household loan borrowers in the fourth quarter of last year was 40.6%. The Bank of Korea stated, "While there is no cause for concern about a sudden surge in debt repayment burdens across households, the household debt ratio is considerably high compared to major countries," and added, "Considering the large loan balances of borrowers with high DSRs and the heavy burden on vulnerable borrowers, it is necessary to ensure the proper implementation of DSR regulations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)