Event for Customers Trading to Celebrate New Listing

Mirae Asset Global Investments announced on the 23rd that it will newly list two maturity-matching ETFs on the Korea Exchange. With this new product launch, Mirae Asset Global Investments now has a total lineup of four maturity-matching ETFs.

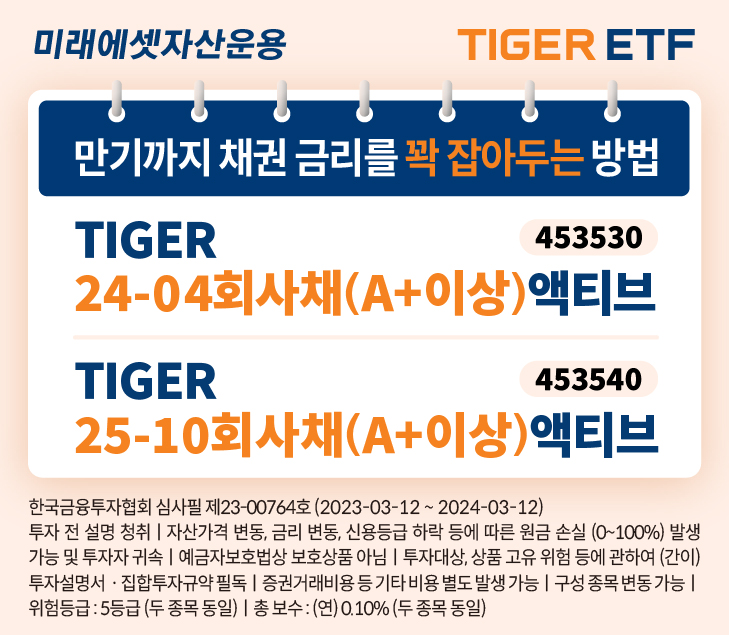

The newly listed ETFs are ‘TIGER 24-04 Corporate Bonds (A+ or higher) Active (453530)’ and ‘TIGER 25-10 Corporate Bonds (A+ or higher) Active (453540)’. The maturities of these ETFs are April 2024 and October 2025, respectively, primarily investing in corporate bonds rated A+ or higher. The expected maturity yields are approximately 4.1% and 4.2%, respectively (as of February 28).

Maturity-matching ETFs are products that can realize the targeted yield if held until maturity regardless of market interest rate fluctuations. Additional purchases are possible until maturity, and if interest rates rise compared to the initial listing, investors can buy at the higher maturity yield level. Even if new investors make additional purchases, bonds are incorporated at the market maturity yield level at the time of setting, so it does not significantly affect the yield of existing investors. During periods of declining interest rates after listing, investors can gain profits through early sales.

Investing through pension accounts offers various tax benefits. When trading through ISA (Intermediary type), personal pension, or retirement pension (DC/IRP) accounts, taxation is deferred until withdrawal, and tax credits can also be received. Additionally, unlike individual bond investments that mainly require transactions through securities firms, these ETFs can be easily bought and sold like stocks.

Last year, Mirae Asset Global Investments launched two maturity-matching ETFs: ‘TIGER 24-10 Corporate Bonds (A+ or higher) Active ETF (447820)’ and ‘TIGER 23-12 Government and Public Bonds Active ETF (447780)’. As of the 21st (source: Dataguide), the cumulative net individual purchase volume of the ‘TIGER 24-10 Corporate Bonds (A+ or higher) Active ETF’ since listing is 119.5 billion KRW, ranking first among 10 maturity bond ETFs listed domestically.

Mirae Asset Global Investments is also holding a new listing commemorative event for customers trading the two newly launched ETFs. The event will be held at KB Securities (3/23~4/21) and Shinhan Investment Corp. (3/27~4/24), where customers meeting certain conditions will receive cultural gift certificates. Detailed information can be found on each securities firm's website.

Jung Seung-ho, manager of the ETF Management Division at Mirae Asset Global Investments, said, “The ‘TIGER 24-10 Corporate Bonds (A+ or higher) Active ETF’ launched last year has received great interest from individual investors, and there is high demand for ETFs with various maturities. Compared to individual bond investments, maturity-matching ETFs have many advantages in terms of liquidity, fees, and diversification, so we expect maturity-matching ETFs to grow further in the future.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)