Samsung Electronics Semiconductor Division and Hynix Projected to Post 3 to 4 Trillion Won Loss

Operating Profits of 6 out of Top 10 Revenue Companies Significantly Decline

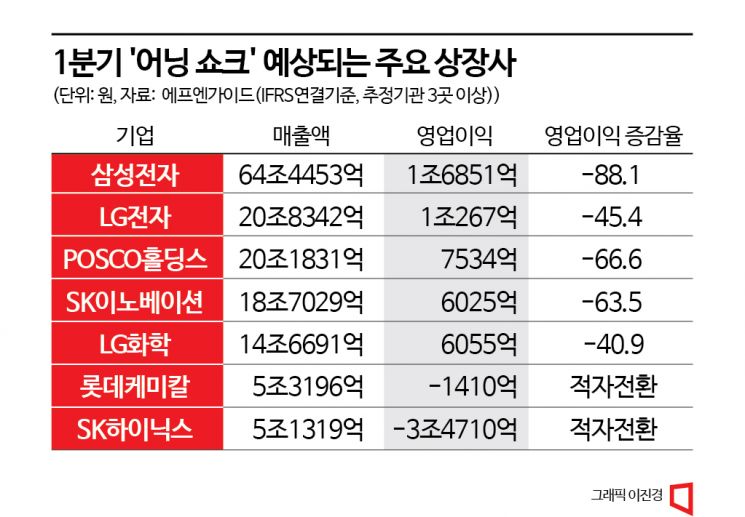

Due to high-intensity tightening and economic recession, major listed companies in South Korea are expected to record an 'earnings shock' in the first quarter of this year. In particular, the operating profits of flagship conglomerates leading the Korean economy, such as Samsung Electronics and SK Hynix, have fallen to a level of 'big shock' decline. The earnings outlook for the second quarter is also not optimistic. Although the U.S. interest rate hike cycle is nearing its end, concerns about economic recession are unlikely to dissipate easily due to financial sector instability triggered by the Silicon Valley Bank (SVB) and Credit Suisse (CS) incidents, as well as persistently high inflation levels.

First Quarter Operating Profit at 26 Trillion Won, Half of Last Year’s Same Period

According to FnGuide, a financial information provider, the total operating profit (forecast) for 199 KOSPI and KOSDAQ listed companies with earnings estimates from three or more institutions in the first quarter of this year was 26.1033 trillion won. This is about half of the 50.659 trillion won recorded in the first quarter of last year. Among the 199 listed companies with aggregated earnings forecasts, about 45%, or 89 companies, are expected to see a decline in operating profit. The second quarter earnings are expected to be even worse. The total operating profit forecast for the second quarter is only 21.3125 trillion won, which is less than half of the 44.4322 trillion won recorded in the same period last year.

The sharp decline in total operating profits of listed companies was largely influenced by the poor performance of major conglomerates ranked at the top of domestic sales. Among the 199 listed companies, six out of the top 10 in first-quarter sales are expected to see a significant drop in operating profit compared to the same period last year. Samsung Electronics (-88.1%), POSCO Holdings (-66.6%), SK Innovation (-63.5%), LG Electronics (-45.4%), LG Chem (-40.9%), and HD Hyundai (-24.2%) showed large decreases. Although Korea Electric Power Corporation (KEPCO) reduced its deficit, it is still expected to record losses in the 5 trillion won range.

Analysis Emerges on Samsung Electronics’ First Quarter Operating Loss Turnaround

Samsung Electronics’ operating profit, which was in the 14 trillion won range in the first quarter of last year, is estimated to be only 1.685 trillion won in the first quarter of this year. This represents a shrinkage to about one-tenth in one year. It is the first time in 14 years since the global financial crisis that Samsung Electronics’ quarterly operating profit has fallen below 2 trillion won, with 593 billion won recorded in the first quarter of 2009. Moreover, this is the average of existing earnings estimates. As the earnings announcement date scheduled for the end of this month approaches, the outlook is becoming more pessimistic.

Some even predict a gloomy scenario where Samsung Electronics’ operating profit falls below 1 trillion won or even turns into a loss. Among the securities reports added in the last three days, Shinhan Investment Corp. forecasted Samsung Electronics’ first-quarter operating profit at 768 billion won, Shin Young Securities at 320 billion won, and Ebest Investment & Securities at 100 billion won. Daol Investment & Securities was the only one to predict a loss (-68 billion won) among the current forecasts. There was no disagreement that the semiconductor division would fall into a large-scale loss in the high 3 trillion to low 4 trillion won range. Kim Yang-jae, a researcher at Daol Investment & Securities, said, "Due to memory inventory valuation losses, the semiconductor division’s operating loss is estimated to reach 4.1 trillion won," adding, "Operating losses are expected to decrease somewhat from the second quarter."

The situation at SK Hynix is even more severe. It is expected to record a loss of 3.471 trillion won in the first quarter alone. This exceeds the profit of 2.8596 trillion won earned in the first quarter of last year, meaning that quarterly operating profit has evaporated by more than 6 trillion won in one year. The latest report on SK Hynix even predicted a worse-than-expected loss in the 4 trillion won range. Seo Seung-yeon, a researcher at Shin Young Securities, said, "SK Hynix’s first-quarter operating loss is expected to be 4.2 trillion won, below market consensus," adding, "Due to the seasonal off-season and ongoing inventory adjustments by customers, memory shipments are expected to decrease more than anticipated."

The semiconductor market is expected to hit its worst in the second quarter. According to FnGuide, Samsung Electronics’ second-quarter operating profit forecast is even lower than the first quarter at 1.462 trillion won. Shinhan Investment Corp. predicted that Samsung Electronics would record operating profit in the 100 billion won range in the second quarter, effectively pushing it to the brink of a loss. SK Hynix is expected to continue losses throughout the year, with an estimated annual loss of around 12 trillion won.

From the third quarter onward, the semiconductor market is expected to gradually enter a recovery phase. The key factor is demand. It is analyzed that semiconductor companies, including Samsung Electronics, currently hold inventory assets two to three times the average level. Nevertheless, Samsung Electronics’ official policy direction is "no artificial production cuts." However, the market expects Samsung Electronics to implement some form of production cut to reduce the increased inventory. Do Hyun-woo, a researcher at NH Investment & Securities, explained, "According to some testing and component companies, semiconductor orders from Samsung Electronics in the first quarter have decreased by more than 30%, indicating that significant production cuts are already underway."

Absolute semiconductor demand is also expected to increase from the third quarter. Ko Young-min, a senior researcher at Shinhan Investment Corp., said, "The inflection point for absolute semiconductor demand will be in the third to fourth quarter of this year," adding, "IT set demand, which had declined after COVID-19, is returning to normal, and near the macroeconomic inflection point, the recovery speed of IT set and semiconductor demand could be stronger and faster than expected." Nam Dae-jong, a researcher at Ebest Investment & Securities, also said, "The bottom for memory semiconductor prices is expected to form between the end of the second quarter and early third quarter," adding, "The supply glut is expected to peak out in the first quarter, and supply-demand conditions are expected to improve in the second half of the year."

Automobile and Secondary Battery Sectors Offset Semiconductor Slump

Due to Samsung Electronics’ poor performance, a seismic shift in the rankings of listed companies’ earnings is expected in the first quarter of this year. While semiconductors are faltering, the automobile industry has been booming across the North American and European markets. According to the Ministry of Trade, Industry and Energy, automobile exports in January and February reached 10.581 billion dollars, a 34% increase compared to the same period last year. In particular, the export amount in February (5.6 billion dollars) was the highest monthly figure ever recorded. The securities industry forecasts Hyundai Motor’s first-quarter operating profit to increase by 32.1% year-on-year to 2.5481 trillion won. Kia is also expected to record operating profit of 2.0278 trillion won, up 26.2% from the same period last year. Both figures far exceed Samsung Electronics’ earnings. Hyundai Mobis, a key parts affiliate of Hyundai Motor, also achieved 560 billion won in operating profit in the first quarter, with a growth rate of 44.6%.

The outlook for the secondary battery sector, considered a representative growth industry, is also bright. LG Energy Solution is estimated to post 451.6 billion won in operating profit in the first quarter, a 74.4% increase compared to the same period last year. Supported by earnings growth, LG Energy Solution’s stock price reached 575,000 won (closing price on March 23), up about 40% since the beginning of the year. Samsung SDI’s first-quarter operating profit is also forecasted to increase by 22.7% year-on-year to 395.6 billion won. Additionally, EcoPro BM, the 'KOSDAQ leader' whose stock price recently soared, is expected to record first-quarter operating profit of 113.2 billion won, three times last year’s 41.1 billion won. Anna Lee, a researcher at Yuanta Securities, commented on the sharply rising secondary battery-related stocks, saying, "Although a short-term correction is possible due to the steep price increase, the large order volume and strong growth potential mean the correction period will not be long or severe."

The shipbuilding industry, which had suffered long-term losses, is also expected to smile in the first quarter of this year. Hyundai Heavy Industries and Samsung Heavy Industries are likely to return to profitability in the first quarter, while Hyundai Mipo Dockyard and Daewoo Shipbuilding & Marine Engineering are expected to reduce their losses compared to the first quarter of last year. Furthermore, with the continuation of high interest rates, Shinhan Financial Group (1.9378 trillion won) and KB Financial Group (1.8887 trillion won) are also expected to rank high in operating profit due to net interest margin income.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)