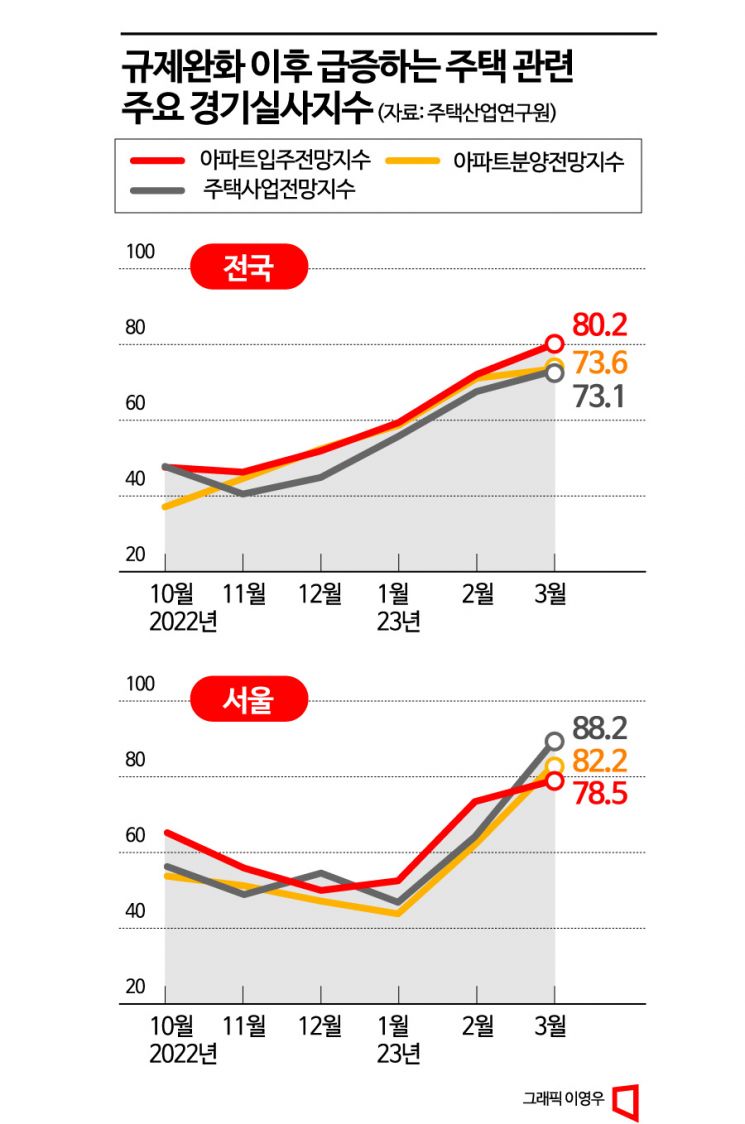

As the government has consecutively introduced real estate deregulation policies, major indicators related to the housing market have shown positive signs. The apartment sales outlook index has more than doubled in five months, and both the housing business outlook index and the apartment move-in outlook index have also risen consecutively.

According to the Korea Housing Industry Institute (KHII) on the 23rd, this month's apartment move-in outlook index was 80.2, an increase of 8.1 points from last month’s 72.1. This means that after the housing outlook worsened last November and dropped to 46.3, it has nearly doubled in four months. If this figure exceeds 100, it indicates that a higher proportion of companies expect the move-in outlook to improve, while a figure below 100 means the opposite.

It is not only the move-in outlook index that has improved. This month, the nationwide housing business outlook index was recorded at 73.1, up 5.5 points from 67.6 in the previous month. This index also fell to 40.5 last November but has recently shown an upward trend, surging 32.6 points in four months. Similarly, the nationwide apartment sales outlook index recorded 76.3 this month, more than doubling compared to 37.1 in October last year.

Regionally, Seoul’s upward trend was particularly prominent. Seoul’s housing business outlook index surged 41.3 points in two months, from 46.9 in January to 88.2 this month. During the same period, the apartment sales outlook index rose 38.3 points from 43.9 to 82.2, and the apartment move-in outlook index also increased by 26 points from 52.5 to 78.5.

This upward trend is analyzed to be the result of the government’s large-scale real estate deregulation efforts since the end of last year. With the complete lifting of regulated areas, easing of resale restrictions, and relaxation of regulations on multiple homeowners, strong deregulation policies have been poured out, raising expectations for a soft landing in the housing market. In fact, according to the Seoul Real Estate Information Plaza, the number of apartment sales transactions in Seoul hit a record low of 559 in October last year but rebounded to 2,389 last month.

Reduced loan burdens are also cited as a background factor. The KHII explained, “Recent moves by banks to lower interest rates and the easing of loan regulations for non-homeowners seem to have had an impact,” adding, “Furthermore, the abolition of the price ceiling on interim payment loan guarantees and special supply prices, as well as the expansion of HUG PF loan guarantees, are policies actively implemented on both the demand and supply sides to ensure a soft landing in the real estate market.”

However, unlike the metropolitan area, some local housing markets still show signs of stagnation. Regarding apartment move-in outlooks, non-metropolitan areas such as Gangwon (60.0→52.0), Daejeon-Chungcheong (66.5→59.7), Gwangju-Jeolla (61.6→59.3), and Daegu-Busan-Gyeongsang (64.9→62.7) all experienced declines compared to the previous month. During the same period, the housing business outlook index fell by 7.4 and 5.8 points in Ulsan and Gangwon, respectively, and the apartment sales outlook index dropped by 16.1 and 8.6 points in Gyeongnam and Gwangju. This appears to reflect the rapid cooling and slow recovery of the sales market in small and medium-sized local cities.

Meanwhile, actual performance against the outlook is also optimistic. According to KHII, last month’s nationwide apartment sales performance index was 69.5, up 37.7 points from 31.8 in September last year. Like the sales outlook, this index is compiled based on surveys of sales performance from sales operators. During the same period, the apartment move-in performance index rose 20 points from 48.5 to 68.5, and the housing business performance index increased 26.4 points from 52.0 to 78.4.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)