Improvement in Business Conditions Following Growth in IT and Automotive OLED Markets

Beneficiaries Include Duksan Neolux, LX Semicon, and PNH Tech

The investment cycle for organic light-emitting diode (OLED) has returned. Just 3 to 4 years ago, the OLED industry faced a sharp decline in profitability due to the influx of low-cost panels from China, leading to widespread layoffs. Now, companies are rushing to make new investments as OLED demand, once limited to smartphones, expands into IT and automotive markets. Experts advise that this is an opportune time to buy OLED-related stocks at low prices, which have suffered from continuous losses and sluggish stock performance during the worst market downturn.

According to securities firms and industry sources on the 22nd, OLED companies such as Samsung Display and LG Display are planning investments in 8.7-generation OLED to replace the existing 6-generation OLED. The 8.7-generation displays are mainly used in IT devices such as tablets and laptops. Samsung Display is expected to place equipment orders as early as the second quarter of this year and expand production lines around 2024 to 2025. LG Display and China's Beijing Oriental Electronics (BOE) are also reportedly planning new 8.7-generation line investments in line with the growth of the IT OLED market.

The display industry is rushing to expand 8.7-generation OLED lines as OLED demand expands into IT and automotive sectors. The IT OLED market is considered to have significant growth potential due to its currently low penetration rate. In particular, with Apple's first OLED iPad expected to launch in 2024, the OLED iPad is anticipated to be a trigger for expanding the IT panel market. Mass production of OLED for MacBook is expected to begin in earnest in 2026. Kiwoom Securities researcher Kim Sowon said, “The shipment volume of OLED iPads in 2024 is projected to be 8 to 10 million units, with LG Display accounting for about 60 to 70% and Samsung Display about 30 to 40% of the OLED panels.”

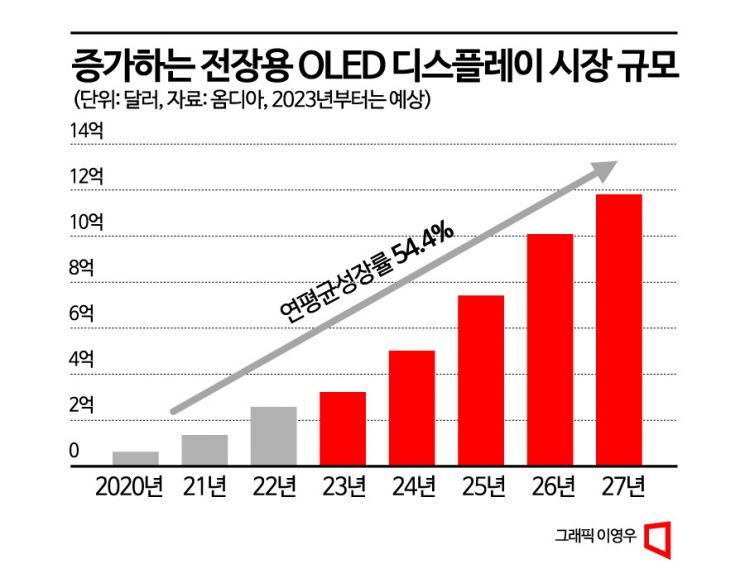

The automotive OLED display market is also growing rapidly. Automotive displays are located inside and outside vehicles to enhance the convenience of drivers and passengers. They are also used as entertainment devices that can consume driving assistance tools or content, increasing their utility. According to market research firm Omdia, the automotive OLED display market size is expected to grow from $56.15 million in 2020 to $1.2 billion in 2027, recording an average annual growth rate of 54%.

Securities firms expect the full bloom of the IT and automotive OLED markets to lead to a strong stock performance in the display sector. They especially recommend paying attention to material suppliers. Representative companies include Duksan Neolux, LX Semicon, and PNH Tech. Duksan Neolux is the biggest beneficiary of the application of new material structures in IT OLED panels, while LX Semicon is expected to benefit from the expansion of its client's iPhone market share. Hana Securities researcher Kim Hyunsoo analyzed, “When the OLED iPad market, which has an average panel area more than four times that of smartphones, penetrates, it is expected to increase annual sales by more than 25 billion KRW from the early stages of the OLED iPad.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)