The Third Largest Decline in History... 'First in 10 Years Since 2014'

Tax Burden Expected to Be Lower Than '2020 Level' Target

This year, the publicly announced prices of apartment complexes will drop by more than 18% compared to last year. After two consecutive years of double-digit increases, the publicly announced prices of apartment complexes turned downward for the first time in 10 years due to a decline in actual transaction prices and a decrease in the realization rate last year.

Additionally, with the government's real estate tax reform, including the reduction of the fair market value ratio, the burden of holding taxes is expected to decrease by more than 20% on average compared to 2020. However, the government states that it cannot guarantee that the tax burden will decrease as much next year as it did this year.

The Ministry of Land, Infrastructure and Transport announced on the 22nd that it has released the "2023 Publicly Announced Prices of Apartment Complexes" and that owners can view them starting from the 23rd, with opinions being collected until the 11th of next month.

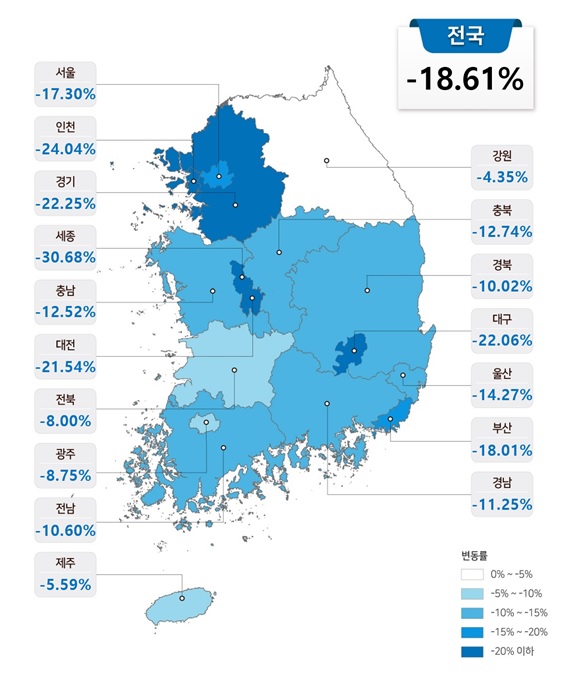

According to the Ministry, the nationwide average change rate of publicly announced apartment complex prices this year is -18.61%. Considering that the prices rose by 17.20% last year, this essentially returns to the 2021 level. This is the largest drop since the system was introduced and the third largest decline in history (2009: -4.6%, 2013: -4.1%). The publicly announced prices had increased by around 5% annually from 2017 to 2020 under the previous administration, then surged by 17-19% during 2021-2022 as housing prices soared.

By region, the highest decline rates were in Sejong (-30.68%), Incheon (-24.04%), Gyeonggi (-22.25%), and Daegu (-22.06%). Among these, Sejong was the only one among 17 cities and provinces to see a decrease in publicly announced prices last year, marking two consecutive years of negative growth. Incheon and Gyeonggi fell sharply after rising by 29.32% and 23.17% respectively last year. Seoul saw a 17.30% decline this year but it was below the average.

The median publicly announced price this year is 169 million KRW, down 23 million KRW from last year's 192 million KRW. By region, Seoul was 364 million KRW, Sejong 271 million KRW, and Gyeonggi 221 million KRW.

With the decline in publicly announced prices, the number of apartment complexes subject to the special tax rate, those priced at 900 million KRW or less, is expected to increase by 650,000 households to 14.43 million households compared to the previous year. The Ministry of Land expects that health insurance premiums for regional subscribers will also decrease by an average of 3,839 KRW per household compared to the same month last year.

2023 Apartment Officially Announced Prices by Region / Image Courtesy of the Ministry of Land, Infrastructure and Transport

2023 Apartment Officially Announced Prices by Region / Image Courtesy of the Ministry of Land, Infrastructure and Transport

The government applied an average realization rate 2.5 percentage points lower than last year's 71.5%. Considering the sharp interest rate hikes and prolonged transaction freezes due to falling housing prices, the realization rate was lowered to the 2020 level in November last year.

The fair market value ratio for property tax was lowered from 60% to 45%. For example, if the publicly announced price is 1 billion KRW, 450 million KRW becomes the taxable standard. The Ministry of the Interior and Safety has also announced plans to lower it even further. However, since the decline in publicly announced prices was larger than the government expected and the holding tax burden is lower than the initially set "2020 level," the ratio may only be adjusted slightly. The fair market value ratio for comprehensive real estate tax was initially lowered from 95% to 60%, but it is reported that the government is considering raising it back to 80%.

In fact, a simulation by the Ministry of Land applying a fair market value ratio of 45% for property tax and 60% for comprehensive real estate tax estimated that the holding tax for an owner of a house priced at 390 million KRW would be 454,000 KRW. This is a decrease of 28.4% compared to 2020 and 28.9% compared to last year. A single homeowner with a publicly announced price of 800 million KRW will pay property tax of 1,252,000 KRW, which is 29.5% less than in 2020. For a house priced at 1.25 billion KRW that is subject to comprehensive real estate tax, the total holding tax is calculated at 2,802,000 KRW (property tax 2,741,000 KRW, comprehensive real estate tax 61,000 KRW), a 24.8% decrease compared to 2020.

The realization rate for next year is also uncertain. A Ministry of Land official said, "The realization rate will be decided comprehensively based on long-term plans, market conditions, and macroeconomic situations," adding, "The issue of holding tax burden is something that the Ministry of Economy and Finance and the Ministry of the Interior and Safety need to consider deeply, and there is no set figure yet regarding whether to continue the current policy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)