The collapse of the U.S. Silicon Valley Bank (SVB) and the liquidity crisis at Credit Suisse (CS) have shaken the international financial system, causing turmoil in asset markets as well.

As confidence in the U.S. dollar has partially eroded, foreign currency deposits have sharply declined, while alternative assets such as gold (silver) and cryptocurrencies have surged.

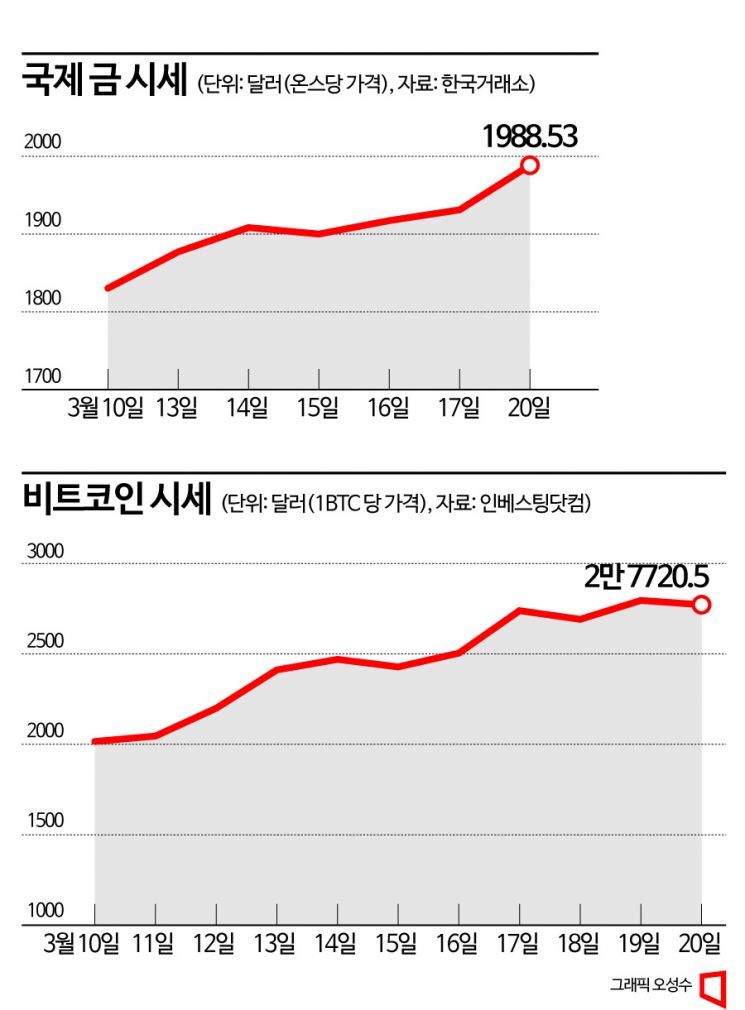

According to the Korea Exchange (KRX) on the 24th, the international gold price closed at $1,988.53 per ounce on the 20th. This represents an 8.6% ($158.16) increase compared to $1,830.37 on the 10th, when the SVB crisis began in earnest.

The international gold price had plunged to the $1,600 per ounce range last October due to aggressive interest rate hikes by the U.S. Federal Reserve (Fed), but it has been on the rise as the strong dollar trend has eased. After hovering around $1,800, gold prices surged sharply following the SVB crisis.

As gold prices soared, related profit-taking and investments continued. From the 1st to the 20th of this month, the balance of gold banking accounts (gold passbooks) at three major domestic banks (KB Kookmin, Shinhan, and Woori) was recorded at 534.8 billion KRW. This is an increase of 18 billion KRW compared to the end of the previous month (516.8 billion KRW). A financial sector official explained, "Considering that the number of gold banking accounts and the weight (kg) are on a declining trend, it appears that existing holders are realizing profits," adding, "This means that the rise in gold prices has more than offset the volume of profit-taking."

Besides gold banking, gold exchange-traded funds (ETFs) are also attracting attention. According to the Korea Exchange and the Korea Financial Telecommunications & Clearings Institute, the gold ETF ‘KODEX Gold Futures (H)’ has attracted 11.6 billion KRW in funds in just about ten days (as of the 20th).

Bitcoin, the representative cryptocurrency, is also gaining attention as an alternative asset. As of the 20th, the price of Bitcoin was $27,720.5, up about 37.5% compared to ten days earlier.

On the other hand, the U.S. dollar, which is also regarded as a representative safe-haven asset along with gold, is fluctuating. The won-dollar exchange rate was 1,324.20 KRW at the close on the 10th, but it dropped to 1,301.80 KRW on the 13th, right after the SVB crisis became known. On the 23rd, it plunged by 29.4 KRW to close at 1,278.3 KRW.

The dollar deposit balance at the four major domestic banks (KB Kookmin, Shinhan, Hana, and Woori) also decreased by $1.1 billion (1.9%) over 20 days to $55 billion. Compared to the end of January ($61.1 billion), it has decreased by $6.1 billion (9.9%).

The sharp rise in gold prices is due to concerns about the global financial system. The bank run and collapse of SVB led to the bankruptcy of New York’s Signature Bank, intervention by the U.S. government and the Fed, and the liquidity crisis and acquisition of the global investment bank CS, increasing uncertainty in the global financial system and highlighting gold’s value as an alternative asset.

The rise in cryptocurrency prices is similar. Although cryptocurrencies are not yet considered safe-haven assets due to their characteristics, the accelerating instability of the international financial system has drawn attention to cryptocurrencies’ role as ‘alternative currencies.’

A representative from a commercial bank said, "Since the SVB crisis, the won-dollar exchange rate has fluctuated around the 1,300 KRW level, and commodity prices are returning to normal trajectories, leading investors’ interest to shift toward alternative assets," but regarding investments in gold and others, added, "However, since the Fed is likely to ease the pace of tightening to stabilize financial markets, and gold prices have also reached a peak, caution is needed in investing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)