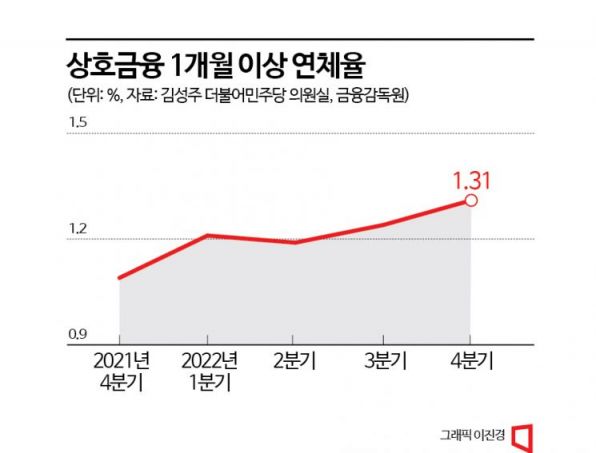

Mutual Finance Delinquency Rate at 1.31% in Q4 Last Year

Recent Trend of Expanding Loan Opportunities for Vulnerable Borrowers

Delinquency Rate Expected to Continue Rising

The delinquency rate in the secondary financial sector, mainly used by borrowers with lower credit ratings compared to the primary financial sector, is noticeably rising. In the case of mutual finance, loan amounts increased continuously last year, along with a rise in delinquency rates. In the financial sector, mutual finance typically has higher loan interest rates than primary financial institutions like commercial banks, and since the likelihood of interest rates dropping this year is considered low, delinquency rates are expected to continue increasing.

According to quarterly data on loans overdue by more than one month in the mutual finance sector (including credit unions, NongHyup, SuHyup, ChukHyup, and the Korea Forest Service) received by Rep. Kim Sung-joo of the Democratic Party from the Financial Supervisory Service on the 21st, the delinquency rate for mutual finance loans was 1.31% as of the fourth quarter of last year. This is an increase of 0.22 percentage points compared to 1.09% in the fourth quarter of 2022.

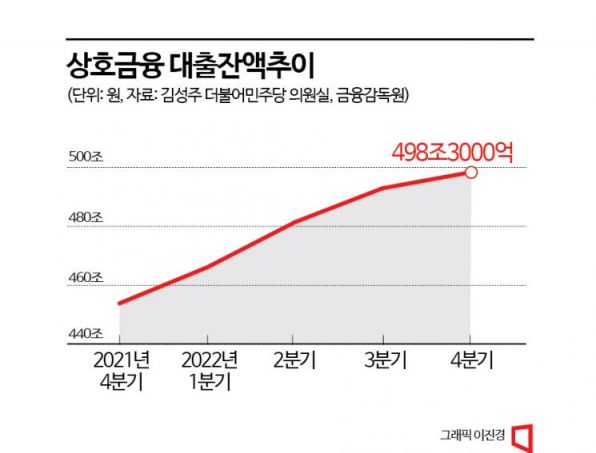

During the COVID-19 period, government financial support and low loan interest rates steadily lowered delinquency rates. However, delinquency rates began to rise from the third quarter of last year when loan interest rates started to increase significantly. In the mutual finance sector, loan balances also steadily increased last year. As of the end of December, the total was KRW 498.3 trillion, up KRW 44.4 trillion over the year.

The financial sector views the rise in mutual finance delinquencies as mainly occurring among multiple debtors (people who have loans from three or more financial institutions). A mutual finance official said, "Borrowers in the secondary financial sector are customers who previously dealt with primary financial institutions but moved due to limits or interest rates not being suitable," adding, "Recently, government policies have been expanding loan opportunities for vulnerable borrowers, including multiple debtors, so delinquencies in the secondary financial sector are trending upward."

As delinquency rates rise, the size of loan loss provisions in the mutual finance sector is also increasing. As of December last year, loan loss provisions stood at KRW 12.2 trillion, an increase of KRW 1.7 trillion over one year. However, considering that delinquency rates are expected to rise further, the financial sector does not view this as a reassuring level. A senior official from the Financial Supervisory Service stated, "When the economy worsens, the first to be hit in terms of delinquency rates are the secondary financial sector borrowers with low credit ratings," emphasizing, "It is important to strengthen soundness."

Meanwhile, credit card loan delinquency rates are also rising. According to the Financial Supervisory Service, the delinquency rate for credit card loans at the end of last year was 2.98%, up 0.38 percentage points from 2.60% at the end of 2021. The amount used for credit card loans was KRW 103.8 trillion, down KRW 3.4 trillion during the same period. However, among these, the amount used for short-term credit card loans (cash services), which are used by people needing urgent funds, increased by KRW 2.3 trillion over one year to KRW 57.4 trillion. The delinquency rate for savings banks also rose from 2.50% at the end of 2021 to the low-to-mid 3% range as of the end of last December.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)