Major domestic conglomerates that expanded production facilities to improve production efficiency and create future growth engines are confirmed to be underutilizing their production capacity amid the global economic slowdown.

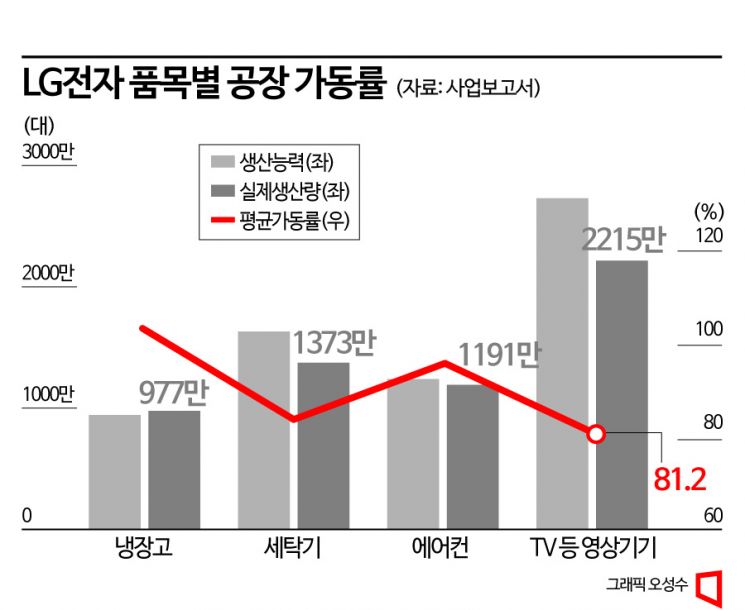

LG Electronics, which became the world's number one home appliance company by surpassing Whirlpool with record-high sales, lowered the factory operating rates for all its products. According to LG Electronics' 2022 business report posted on the Financial Supervisory Service's electronic disclosure system on the 21st, the only product in the Home Appliance & Air Solution (H&A) division with an average annual operating rate exceeding 100% last year was refrigerators (103.6%). However, this was lower than 126.1% in 2022. The factory operating rate for washing machines dropped from 106.8% to 84.3%, and for air conditioners from 110.4% to 96.2%.

The operating rate refers to the ratio indicating how much factory equipment is being operated. If a factory capable of producing 100 units per day produces only 80 units, the operating rate is 80%. Although 100 units per day is considered the maximum, if actual production exceeds this, the operating rate can surpass 100%. An operating rate above 100% means more products were made than the basic production capacity.

LG Electronics invested 860 billion KRW last year to enhance production capacity in the H&A division and plans to invest an additional 979.3 billion KRW this year. Despite continuous capital input for production efficiency, factory operating rates are declining due to the global economic slowdown. As raw material prices rise, increasing the cost of manufacturing products, it has become more important to reduce operating rates to reduce inventory rather than maintaining existing production volumes and increasing stock. The sharp rise in raw material prices worldwide last year directly impacted the increase in product manufacturing costs.

The average price of steel, an essential raw material for home appliance production, rose by 22.8% last year. Resin also increased by 21.7%, and copper showed a 42.6% rise. The Home Entertainment (HE) division, which includes TV product lines, also saw its average operating rate drop from 96.6% in 2021 to 81.2% in 2022.

The situation is similar for other LG electrical and electronic affiliates. The average operating rate of LG Innotek's main product, camera module production facilities, was only 56.9% last year, barely exceeding 50%. The expansion of production capacity from 584.05 million units in 2021 to 769.12 million units in 2022 led to the decline in operating rate. This means that the expanded facilities funded by capital investment were not fully utilized.

LG Display, which executed 5.2 trillion KRW in facility investments last year, reduced display panel production from 8.12 million units in 2021 to 6.39 million units in 2022 (converted to 8th generation lines) at its plants in Gumi, Paju, and Guangzhou, China. This year, reflecting market and financial conditions, it plans to reduce investment compared to last year.

Samsung Electronics is responding by reducing operating rates in most business units except semiconductors, which require 24-hour three-shift factory operations. The operating rate of mobile device factories, including smartphones, shrank by more than 10 percentage points from 81.5% in 2021 to 69% last year. The operating rate for video device factories, including TVs, also declined from 81.4% in 2021 to 75.0% last year. This is largely due to increased production capacity not being matched by production performance.

Following the electronic set industry, semiconductor companies will soon face inevitable declines in operating rates. Global market research firm TrendForce expects SK Hynix's DRAM factories, which have maintained a 100% operating rate, to reduce it to the 80% range in the second quarter. Kim Young-geon, a researcher at Mirae Asset Securities, stated, "We are experiencing a larger-than-expected supply surplus in the first quarter, so a significant decline in operating rates will begin in the second quarter," adding, "Following the leading companies' operating rate adjustments, there is a possibility of a simultaneous decline in operating rates across the semiconductor industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)