Mid-Year Economic Outlook Announcement

Global Economic Growth Rate at 2.6%...Upward Revision by 0.4%P

"Global Demand Expected to Expand with China's Full Reopening"

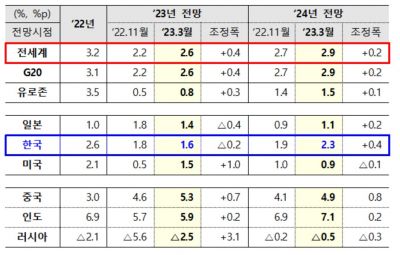

The Organisation for Economic Co-operation and Development (OECD) has lowered its growth forecast for the South Korean economy to 1.6% this year, while adjusting next year’s growth forecast to 2.3%, as it expects South Korea to benefit from China’s growth rebound. Meanwhile, the global economy is expected to grow at a higher rate than previously projected.

The OECD releases economic outlooks twice a year (May-June and November-December) for the global economy, member countries, and G20 nations. In March and September, it publishes interim economic outlooks focusing only on the global economy and G20 countries.

Korean Economic Growth Forecast: 1.6% in 2023, 2.3% in 2024

On the 17th, the OECD, through its interim economic outlook, revised South Korea’s 2023 economic growth forecast down by 0.2 percentage points from its November projection last year to 1.6%. This aligns with the forecasts from the government (December last year) and the Bank of Korea (February this year).

The growth forecast for next year was revised upward by 0.4 percentage points to 2.3%. The OECD expects South Korea, along with Australia, to benefit from China’s growth rebound, which is anticipated to mitigate the negative impact of tight financial conditions.

An official from the Ministry of Economy and Finance explained, "Although the OECD lowered South Korea’s economic growth forecast by 0.2 percentage points for this year, it raised the forecast by 0.4 percentage points for next year, effectively increasing the overall growth outlook by 0.2 percentage points. It projects that from the second half of this year, the Korean economy will benefit from China’s economic rebound, and this benefit will be fully reflected in the 2024 growth rate."

South Korea’s inflation rate for 2023 was revised down by 0.3 percentage points from the November forecast to 3.6%, while the 2024 inflation rate was revised up by 0.1 percentage points to 2.4%.

"Global Economy to Recover Gradually, Inflation to Ease Progressively" Forecast

The OECD projects that the global economy will recover gradually over 2023?2024, with inflation easing progressively.

Global economic growth is forecast at 2.6% in 2023 and 2.9% in 2024, which are upward revisions of 0.4 and 0.2 percentage points respectively from the November projections last year.

The OECD expects the United States to experience slowing growth due to easing demand pressures from monetary tightening. Accordingly, the growth forecast for this year was raised from 0.5% to 1.5%, but next year’s forecast was lowered from 1.0% to 0.9%.

The Eurozone is expected to grow by 0.8% this year and 1.5% next year, supported by stable energy prices. China’s economy is projected to grow by 5.3% this year and 4.9% next year.

The OECD noted that falling energy and food prices have increased purchasing power, improving economic activity and business and consumer sentiment. It also expects global demand for goods and services to expand due to China’s full reopening. In particular, neighboring Asian countries such as South Korea are expected to be the biggest beneficiaries of China’s tourism resumption.

Furthermore, while demand may be supported by easing household savings rates following the pandemic, the OECD warned that tighter financial conditions?manifested in the banking sector due to sharp interest rate hikes?are likely to affect the overall economy, including private investment.

"Inflation Gradually Stabilizing... However, Downside Risks Slightly Prevail"

The OECD forecasts the average inflation rate for G20 countries at 5.9% in 2023 and 4.5% in 2024, lowering previous forecasts by 0.1 and 0.9 percentage points respectively. This reflects expectations that inflation will gradually stabilize due to global growth slowdown, stable energy and food prices, and the effects of monetary tightening in major economies.

However, the OECD assessed that the improved outlook for the global economy still rests on a "fragile" foundation. While upside and downside risks are currently balanced, downside risks remain somewhat dominant. Geopolitical uncertainties such as the Russia-Ukraine war, resulting food security issues in emerging markets, and worsening supply chain fragmentation could negatively impact growth and inflation.

Other risk factors include increased burdens on households and businesses from rapid interest rate hikes, financial instability exemplified by the Silicon Valley Bank (SVB) collapse, and steep declines in housing prices. The OECD pointed out that, as seen in the SVB incident, sharp fluctuations in market interest rates and bond prices could expose financial institutions’ business models to higher maturity risks. It also expressed concerns about rising debt and fiscal deficits in emerging markets due to global interest rate increases.

"Monetary Tightening Should Continue Until Clear Signs of Inflation Easing Appear"

The OECD recommended continuing monetary tightening, targeted fiscal policies for vulnerable groups, resuming structural reform efforts, and joint responses to the climate crisis as future policy directions. It emphasized that monetary tightening should persist until clear signs of easing inflation pressures emerge, noting that additional interest rate hikes remain necessary in most countries including the United States and the Eurozone.

Additionally, the OECD advised using fiscal policies that selectively support vulnerable groups to alleviate burdens from high energy and food prices. It also urged resuming structural reform efforts to enhance productivity and ease supply constraints, including boosting corporate dynamism, reducing cross-border trade barriers, promoting human exchanges, and creating flexible and inclusive labor markets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)