As Japan lifts export restrictions on the three key materials necessary for semiconductor production to South Korea, there are expectations that South Korea's materials, parts, and equipment (SoBuJang) supply chain will significantly improve. Although the South Korean government has succeeded in domesticating some semiconductor core items that were highly dependent on Japan, a considerable portion of the global SoBuJang market is still monopolized by Japan. This is why a two-track strategy is needed: expanding collaboration with Japan on SoBuJang while strengthening the localization of key items such as semiconductors. Some experts emphasize the government's active support to reduce the gap with Japan in core industrial technologies, including SoBuJang, eco-friendly vehicles, and secondary batteries.

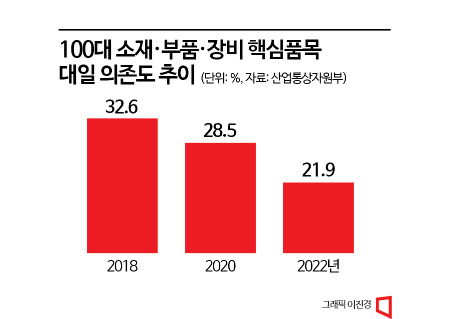

According to the Ministry of Trade, Industry and Energy and the Korea International Trade Association on the 17th, among the 100 core strategic SoBuJang technology items, the import dependence on Japanese products decreased by 10.7 percentage points from 32.6% in 2018, before the export restrictions, to 21.9% last year. The three major items subject to Japan's export restrictions starting in 2019 (photoresist, fluorinated polyimide, and hydrogen fluoride) also saw significant improvements in dependence on Japan. For photoresist, Japan's import dependence was 93.2% in 2018 but improved by 15.8 percentage points to 77.4% last year. Imports from Japan of hydrogen fluoride and fluorinated polyimide also decreased by 11.4 and 34.2 percentage points, respectively. This is thanks to the South Korean government's comprehensive support for corporate independence, including investing a budget of 248.5 billion won to strengthen SoBuJang R&D immediately after the export restrictions in 2019.

The problem is that many SoBuJang items are still monopolized by Japan. In the global electric vehicle (EV) battery pouch film market, Japanese companies such as Showa Denko and DNP held an 80% market share as of 2021, and microfilm ABF, necessary for semiconductor substrates, is 100% dependent on Japanese companies. This highlights the limitations in domesticating SoBuJang items where Japan holds absolute superiority just four years after the export restrictions began. For example, although South Korean companies like Kolon Industries started mass production of polyimide right after Japan's export restrictions, their technology level has not yet reached the point of fully replacing Japanese materials. Now that the barriers to exchanges between the two countries have been lifted, it is necessary to pursue not only technological exchanges in SoBuJang with Japan but also securing supply chains. Joo Hyun, president of the Korea Institute for Industrial Economics & Trade (KIET), said, "It is becoming increasingly difficult worldwide to fully guarantee supply chains between countries," adding, "Regardless of Japan's lifting of export restrictions, continuous efforts to strengthen technological independence in SoBuJang items are necessary."

Persistent Technology Gap Between Korea and Japan in Core Industries

In addition to SoBuJang, closing the technology gap between the two countries in core industrial fields such as autonomous vehicles and intelligent robots remains a challenge. The reason why closing the technology gap in core industries is important is that securing a technological super-gap requires competitiveness supported by industries like SoBuJang and foundational industries. South Korea possesses world-class technology in some semiconductor fields such as displays and memory devices, but still lags behind Japan in many industries.

According to the most recent indicator showing the technology gap between the two countries, the 'Industrial Technology Level Survey' by the Korea Evaluation Institute of Industrial Technology (KEIT), as of 2021, South Korea's technology level was 86.7% compared to the top technology country (the United States at 100), which is 4.5 percentage points lower than Japan's 91.2%. Among the 25 core industrial technology fields, the gap between the two countries is even larger in 19 major fields excluding design and energy sectors. While South Korea holds the top technology in three fields?eco-friendly smart shipbuilding, marine plants, future displays, and knowledge services?Japan still leads South Korea in 16 fields including advanced materials, intelligent robots, and secondary batteries.

The gap in foundational industries between the two countries is similarly significant. Foundational industries refer to the manufacturing base industries such as casting, mold, plastic processing, welding/joining, surface treatment, and heat treatment. Japan holds the top technology in nine of these areas, while South Korea does not hold the top technology in any. Looking at the technology gap period, the gap between the U.S. and Japan in foundational industries is 0.1 years, whereas South Korea's gap is 1.3 years, indicating a wider disparity. Experts expect that the lifting of SoBuJang regulations will serve as an opportunity for more active technological strengthening. Park Jae-geun, president of the Korean Semiconductor Display Technology Society, said, "By reducing large-scale imports aimed at cutting down Japan's administrative tasks, we will be able to start R&D on core products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)