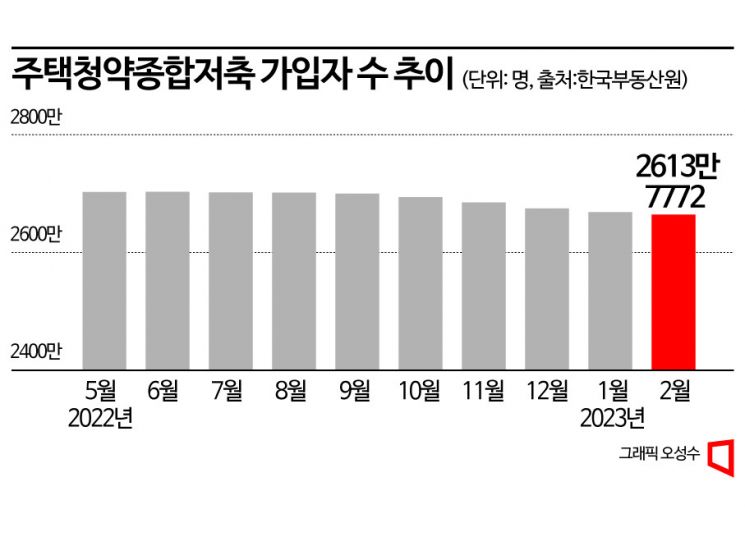

26,137,772 Comprehensive Savings Subscribers at the End of February

100,000 Left in One Month... Impact of Real Estate Market Slump

However, Decline Gradually Decreases Due to Subscription Regulation Easing

The number of subscribers to the housing subscription savings account, once an essential item for home ownership, has decreased for eight consecutive months. As the prices of pre-sale apartments soar but house prices fall, the 'lottery subscription' has disappeared, leading to a continued exodus. However, thanks to the relaxation of subscription regulations under the 1·3 measures, the decline in subscribers has slowed, and new subscribers are steadily joining.

According to the Korea Real Estate Board's Subscription Home as of the end of last month, the number of subscribers to the Housing Subscription Comprehensive Savings Account was 26,137,772. This is nearly 100,000 fewer than the previous month's 26,236,647. Thus, the number of subscription savings account holders has been declining for eight consecutive months since July last year, after reaching 27,031,911 in June.

The subscription savings account was considered essential during the real estate boom for home ownership. At that time, the pre-sale price was far below the market price, allowing winners to gain hundreds of millions of won in capital gains just by winning the lottery.

However, as the real estate market has stagnated due to the impact of high interest rates from the U.S., more people are canceling their subscription savings accounts. Apartment prices continue to fall, but pre-sale prices have soared due to rising raw material and labor costs, making it impossible to expect capital gains. According to the Housing & Urban Guarantee Corporation (HUG)'s 'Private Apartment Pre-sale Price Trends,' the average nationwide pre-sale price per 3.3㎡ was 15,715,000 won in January, a 51.66% increase from 10,362,000 won five years ago.

With pre-sale rights often carrying a negative premium, it is now possible to buy new apartments without a subscription savings account, eliminating the reason to hold onto low-interest subscription accounts. In particular, among low-score applicants with slim chances of winning, there is significant demand to switch to savings/deposit products that guarantee high interest rates.

However, as the government has significantly relaxed subscription regulations through the 1·3 measures, the decline in subscription savings account holders has clearly slowed. In November and December last year, 210,990 and 231,522 people left respectively, but last month saw a decrease of only 98,875.

Most importantly, the increase in lottery-based allocations rather than point-based ones has been effective. The government lifted the regulation on all of Seoul except Gangnam, Seocho, Songpa, and Yongsan districts. In non-regulated areas, 60% of units under 85㎡ and 100% of units over 85㎡ are allocated by lottery. As a result, young people with short subscription periods and low points, as well as those who already own homes, can now participate in subscriptions.

Moreover, with successful subscription cases centered in Seoul and the resolution of the transaction freeze, the market sentiment has changed, strengthening the psychology that one should keep their subscription savings account. For example, the first-priority competition rate for 'Yeongdeungpo Xi Dignity' in Yangpyeong-dong, Yeongdeungpo-gu, Seoul, which recently held a subscription, reached 198.76 to 1.

Ye Kyung-hee, senior researcher at Real Estate R114, explained, "The exodus of subscribers who have held accounts for a short time continues mainly in areas with poor subscription performance. However, with the recent increase in lottery-based allocations and the relaxation of resale restrictions, interest in subscription savings accounts is reviving in popular areas with demand for new apartments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)