Retail Industry Increasing Dividends Led by Record Performance

Mostly Silent on Calls to Improve 'Dark' Dividends

Emart Cuts the First Tape on Dividend Procedure Improvement

The distribution industry is increasing dividends to enhance shareholder value, riding on last year's record-high performance. However, most companies remain silent on demands to improve the so-called 'blind dividends,' where investors do not even know the amount of dividends before investing. Nevertheless, as Emart plans to amend its articles of incorporation at this month's regular shareholders' meeting to separate the record date for voting rights and the dividend payment date, it is expected that more companies will follow suit in improving dividend procedures in the future.

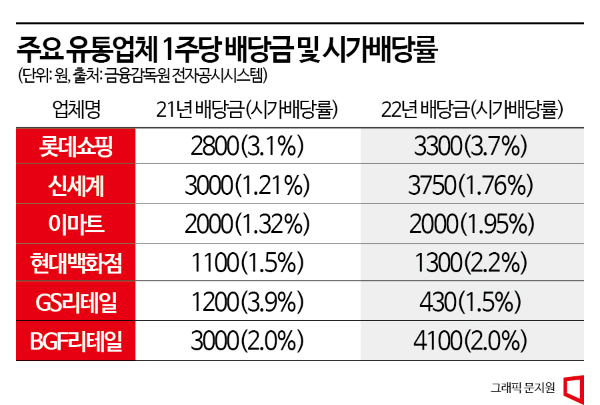

According to the Financial Supervisory Service's electronic disclosure system on the 15th, Lotte Shopping's dividend for last year's settlement was 3,300 KRW per common share, a 17.9% increase from 2,800 KRW a year earlier. During the same period, the total dividend amount rose from 79.2 billion KRW to 93.3 billion KRW, and the dividend yield increased by 0.6 percentage points from 3.1% to 3.7%. The dividend yield is an indicator showing the dividend amount relative to the stock price on the dividend record date. Since the dividend yield varies depending on the reference stock price, if the stock price falls, the dividend yield rises, and a higher dividend yield generally indicates a higher dividend payout tendency of the company. In the stock market, companies with a dividend yield of 5% or more are typically classified as high-dividend stocks.

Despite high inflation and a decline in consumer sentiment due to the economic downturn last year, Lotte Shopping posted solid results by maintaining operating profit. Department stores recovered to pre-COVID-19 levels, and marts turned profitable, contributing to improved performance. In particular, department stores increased both sales and operating profit, laying the foundation for dividend payments. Last year, department store sales rose 11.9% to 3.232 trillion KRW, and operating profit increased 42.9% to 498 billion KRW. This is the first time in three years since 2019, before COVID-19, that annual department store sales exceeded 3 trillion KRW.

Besides Lotte Shopping, major distribution companies are also enhancing shareholder value by implementing dividend increase policies based on last year's record performance. Shinsegae raised its dividend from 3,000 KRW per common share in 2021 to 3,750 KRW last year, a 25.0% increase, and Hyundai Department Store increased its dividend from 1,100 KRW to 1,300 KRW, an 18.2% rise. Shinsegae Department Store recorded record-high sales and operating profit for two consecutive years, including last year, while Hyundai Department Store achieved its best-ever performance with sales of 5.0141 trillion KRW, more than 40% higher than the previous year.

The convenience store industry's dividend policies show mixed trends. BGF Retail, which operates CU, set last year's dividend at 4,100 KRW per share, a 36.7% increase from 3,000 KRW a year earlier. However, GS Retail, which operates GS25, lowered its dividend from 1,200 KRW in 2021 to 430 KRW. The dividend yield also dropped by 2.4 percentage points from 3.9% to 1.5%, and the total dividend amount decreased from 122.6 billion KRW to 43.9 billion KRW. A GS Retail official explained, "We have a policy to distribute 40% of controlling interest consolidated net income as dividends, but since the base amount for the dividend policy decreased, the absolute amount inevitably declined," adding, "However, the payout ratio was expanded to about 100%."

Although the distribution industry is strengthening shareholder-friendly policies by expanding dividends, it still appears inactive in improving the so-called blind dividends. Domestic listed companies have been criticized for the 'blind dividend' practice, where shareholders entitled to dividends are determined first at the end of the year, and the dividend amount is finalized at the shareholders' meeting held the following year. In response, financial authorities announced in January a plan to improve dividend procedures so that investors can confirm dividend amounts before deciding whether to invest. Specifically, the dividend record date, which determines the shareholders entitled to dividends, will be moved to after the dividend amount is finalized. However, most major distribution companies did not propose amendments to separate the voting rights record date and the dividend record date at this year's regular shareholders' meetings.

However, Emart has taken the lead in resolving blind dividends in the distribution industry by improving dividend procedures. Emart announced through a disclosure that it will propose an amendment to the articles of incorporation related to the dividend record date at the shareholders' meeting scheduled for the 29th of this month. The amendment aims to change the articles so that the board of directors sets the dividend record date after the dividend amount is finalized. The revised articles of incorporation will apply from the next dividend payment.

Last month, Emart also announced a shareholder return policy adjusting the dividend payout ratio from 15% to 20% of annual operating profit based on separate financial statements. Additionally, even if the return amount falls short, the minimum dividend per share is fixed at 2,000 KRW to ensure stable dividend income for shareholders. Emart reviews its dividend policy every three years, and this policy will continue for three years until 2025, after which it will be reviewed again. Emart explained, "This return policy was established to increase long-term predictability of shareholder returns while ensuring stable dividends." Meanwhile, Emart's dividend last year remained the same as the previous year at 2,000 KRW per share, but the dividend yield rose by 0.63 percentage points from 1.32% to 1.95%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)