[Impact and Outlook of China's Reopening] "China Can't Save the World"

Chinese Government Shifts Growth Strategy from Investment to Domestic Consumption

The international community's attention is focused on the impact that China's "reopening (resumption of economic activities)" will have on the global economy, which is facing a risk of stagnation. Expectations are high that the lifting of lockdown measures that lasted for three years will drive a rebound in growth rates, but some predict that it may remain a "party for them alone." Since the recovery is likely to be driven by domestic consumption rather than government or corporate spending, the effect on the global economy is expected to be more limited than before.

From Investment to Domestic Consumption... Limited Effects of China's Reopening

The core of the economic policy direction announced by the Chinese government at the National People's Congress is the expansion of domestic demand. Former Premier Li Keqiang clearly stated a growth strategy centered on domestic consumption, saying, "We will focus on expanding domestic demand and prioritize the recovery of consumption to increase the income of urban and rural residents." The government aims to shift the driving force of economic recovery from past government spending and corporate investment to consumption. Foreign media are also paying attention to China's changed growth strategy. In the aftermath of the 2008 financial crisis, China revived its economy based on government stimulus measures and large-scale corporate investment, benefiting foreign companies as well. However, government and corporate debt have been increasing, and the real estate market has contracted. The Wall Street Journal (WSJ) analyzed that the national infrastructure China needs has already been built, making it difficult to continue a government-led growth strategy. WSJ stated, "China's economic rebound will mainly be centered on the domestic service industry," and "we should no longer expect China to save the world."

The UK think tank Centre for Economics and Business Research (CEBR) forecasted, "China's growth rate is expected to reach 5% this year, but today's China is very different from the China that previously supported the world." Considering the current uncertainties surrounding the housing and financial markets, consumption spending will be cautious, and growth will be internally focused, limiting the ripple effects on the rest of the world. Frederick Neumann, HSBC's Chief Asia Economist, predicted, "Although a strong economic recovery in China is expected, the nature of this rebound means that the growth spillover effects to other parts of the world will be much weaker this time."

Will Chinese Consumption Revive?

Coupled with post-COVID-19 pent-up demand, as the Chinese government shifts the growth focus toward domestic consumption, consumer spending within China is expected to expand. Face-to-face services such as travel, culture, and transportation are rebounding, and sales of related products like mobile phones and cosmetics are recovering. However, it is expected to take time before this is confirmed through visible economic indicators. According to China's National Bureau of Statistics, the Consumer Price Index (CPI) in February rose 1.0% year-on-year, falling short of market expectations (1.9%) and the previous month's increase (2.1%). Consumers are still hesitant to open their wallets, so it is difficult to say that domestic demand has definitively revived yet.

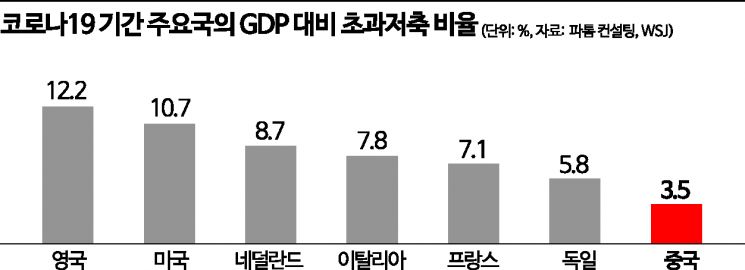

The cooling real estate market, stagnant employment market, and low household consumption capacity are cited as causes. China's excess savings rate relative to GDP is about 3.5%, which is lower than that of the UK (12.2%), the US (10.7%), the Netherlands (8.7%), Italy (7.8%), France (7.1%), and Germany (5.8%). During the COVID-19 period, government financial support to households was smaller than in other advanced countries, and a fragile employment market and real estate downturn reduced disposable income. Logan Wright, China Research Director at the research firm Rhodium Group, predicted, "China's consumption recovery will be shallow and short-lived," adding, "After showing rapid growth around the second quarter, the recovery in consumer spending will quickly slow down." Additionally, signals of "Peak China" have been detected, such as the population decline last year for the first time in 61 years, indicating growth limits. US-China tensions and the resulting anti-China supply chain restructuring in the international community also pose burdens on China's economy.

Still Trusting China... 5% Growth Rate

Although forecasts on the economic effects of China's reopening are mixed, there is considerable analysis that China is the only pillar to rely on amid global recession concerns. Former Premier Li Keqiang set this year's economic growth target at 5% at the National People's Congress (NPC) opening on the 5th. This is the lowest target since 1991 (4.5%), but considering the current conditions of economic slowdown in the US and Europe, it is a fairly high level. Many experts forecast 6% growth. Considering that foreign direct investment in China increased by 9% year-on-year to $189.1 billion last year, China is still regarded as an attractive market. Earlier, the International Monetary Fund (IMF) projected China's GDP growth at 5.2% this year. Compared to the US (1.4%) and the Eurozone (0.7%), the growth trend is clear.

Expectations for the effects of China's reopening are already widespread in the commodity markets. The US Energy Information Administration (EIA) forecasted that China's average daily oil consumption will increase from 15.12 million barrels last year to 15.85 million barrels this year and 16.22 million barrels next year. Due to China's reopening, global total oil consumption this year is also expected to exceed last year's level of 99.36 million barrels per day, reaching 104.7 million barrels per day.

However, if the global inflation, which has just calmed down due to rising commodity prices, reignites, there is a variable that high-intensity tightening policies may continue and dampen the economy. Goldman Sachs warned, "One of the reopening risks is that strong growth could cause inflation to rise surprisingly by the end of this year," adding, "The reopening of the economy could increase inflationary shocks, leading central banks to raise interest rates more than currently expected by the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)