Samsung Electronics Sold Net 44.2 Billion KRW, SK Hynix 350.5 Billion KRW This Month

Samsung Electronics and SK Hynix Sales and Operating Profit Expected to Plunge in Q1

Foreign investors are selling off domestic semiconductor stocks. This is interpreted as a result of weakened investment sentiment due to concerns over memory semiconductor inventory and the rising won-dollar exchange rate.

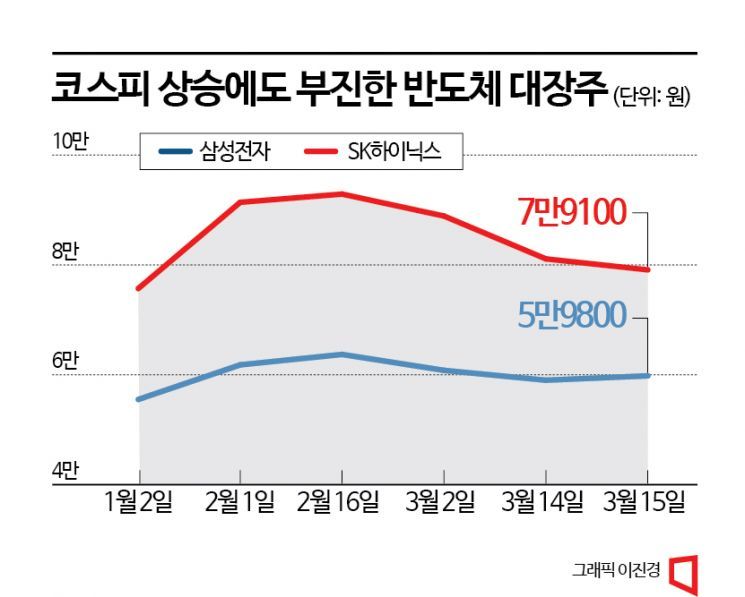

According to the Korea Exchange on the 16th, foreign investors have net sold Samsung Electronics worth 44.2 billion KRW from March 1 to 15. During the same period, they sold SK Hynix stocks worth 350.5 billion KRW. As a result, Samsung Electronics' stock price has fallen again. After rebounding past 60,000 KRW from the year-start closing price of 55,500 KRW, the 60,000 KRW level was broken again on this day. Although it slightly rebounded on the 15th, it closed at 59,800 KRW. Similarly, SK Hynix also surpassed 90,000 KRW from 75,700 KRW during the same period but turned downward. The closing price on the 15th was 79,100 KRW, breaking below the 80,000 KRW level.

There are two main reasons why foreigners are dumping Samsung Electronics and SK Hynix stocks: delayed recovery in the memory semiconductor market and the rising won-dollar exchange rate. First, the slowdown in the semiconductor market has caused inventory to increase more than expected, negatively impacting earnings. According to the three major memory semiconductor companies (Samsung Electronics, SK Hynix, Micron), memory semiconductor inventory assets in Q4 last year reached 56 trillion KRW, a 12% increase from the previous quarter. The global sales inventory turnover rate dropped 36% from the previous quarter to about 0.5 times. Memory semiconductor prices in Q1 this year are expected to fall by 20% compared to the previous quarter.

Experts expect that due to tightening policies and economic slowdown, memory semiconductor companies' earnings in Q1 this year will also fall short of expectations. This is because the recovery speed of global IT demand and Korean semiconductor exports has weakened since the second half of last year. Seong-yeon Seo, a researcher at Shin Young Securities, analyzed, "The worsening Korean semiconductor shipments, inventory cycle, and inventory-to-shipment ratio since January reflect this," adding, "Recently, memory semiconductor stock prices have shown a sluggish trend due to lowered earnings expectations for the first half of the year and the possibility of delayed recovery in the memory market."

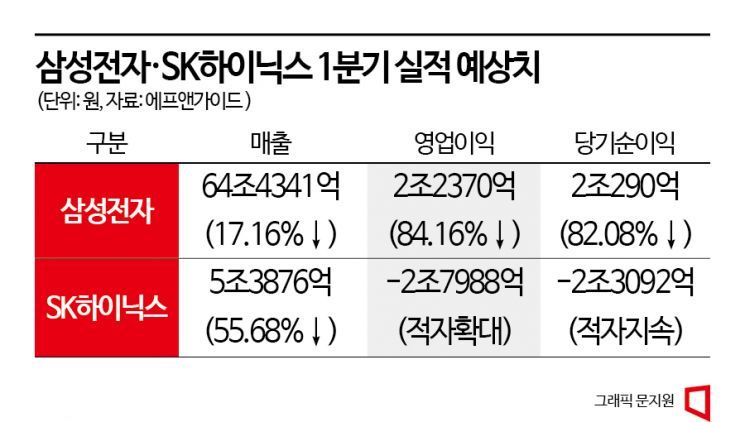

According to FnGuide, Samsung Electronics' operating profit estimate for Q1 this year is 2.237 trillion KRW, down 84.16% from the same period last year. Sales and net profit are expected to be 64.4341 trillion KRW (-17.16%) and 2.029 trillion KRW (-82.08%), respectively.

SK Hynix is expected to see a larger deficit. The estimated operating loss and net loss for Q1 are 2.7988 trillion KRW and 2.3092 trillion KRW, respectively. Sales are projected to decrease by 55.68% from the same period last year to 5.3876 trillion KRW.

Moreover, some suggest that the semiconductor market recovery may be delayed longer than expected. Seung-woo Lee, a researcher at Eugene Investment & Securities, explained, "It will not be easy for Q2 earnings to improve compared to Q1," adding, "This is because semiconductor inventory is at an excessive level, and from Q2, Samsung Electronics' Mobile Experience (MX) division's margins are also likely to decline."

The biggest current issue is the level of semiconductor inventory. To reduce inventory, production must be cut, and inventory valuation losses must be reflected. The researcher pointed out, "If production is reduced, fixed cost burdens will increase, potentially raising the cost per chip," adding, "Ultimately, it is a difficult situation where companies must cross a deep valley of deficits."

Equally burdensome is the rising won-dollar exchange rate. The won-dollar exchange rate, which had fallen to 1,301.00 KRW on the 3rd, rose to 1,323.00 KRW on the 10th. Although it plunged the next day, it closed at 1,311.50 KRW on the 14th. On the 15th, it jumped further to 1,319 KRW.

The timing when foreigners switched to a 'sell' stance on Samsung Electronics coincides with the period when the won-dollar exchange rate rose. From February 3 (1,229.4 KRW), when the won-dollar exchange rate began to rise, to February 17 (1,299.5 KRW), when it hit the highest intraday level in two months (1,305.0 KRW) and closed, foreigners showed cumulative net selling until the 14th. When the won-dollar exchange rate rises, even if profits are made from stock trading, there is a possibility of foreign exchange losses, which inevitably dampens foreign investors' sentiment.

However, there is also a view that now is the right time to increase semiconductor exposure. Gil-hyun Baek, a researcher at Yuanta Securities, explained, "The increase in inventory assets in Q1 has significantly slowed, and it is expected to enter a peak phase," adding, "Along with sales and inventory turnover rates, the sector's stock price is expected to bottom out, so focus should be on the direction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)